BTC Investments Boom, SEC Chair vs. Crypto ‘Wild West’ + More News

Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

_____

Investments News

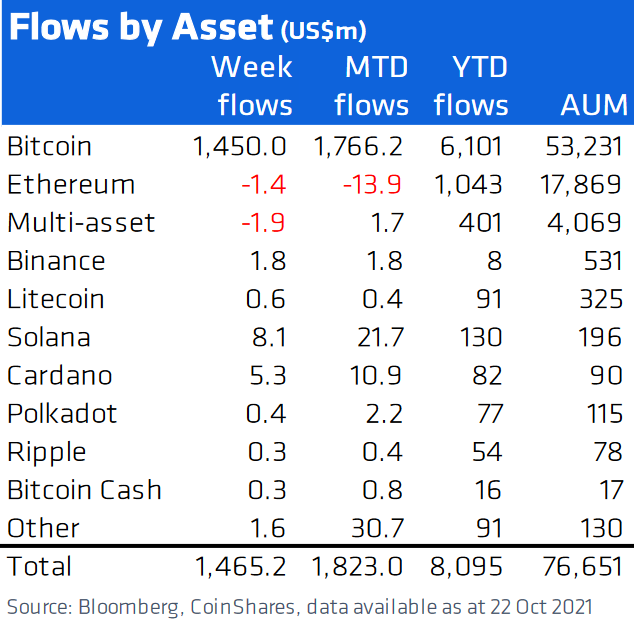

- Digital asset investment products saw inflows last week totaling USD 1.47bn, the largest on record by a significant margin, per CoinShares data. The previous weekly record was seen earlier this year in February with inflows totaling USD 640m. Bitcoin (BTC) saw 99% of the inflows totaling USD 1.45bn last week after BTC futures ETFs debuted last week in the US. Inflows into BTC products were also seen in other regions totaling USD 138m, although there was evidence of profit-taking with some older investment products seeing outflows, CoinShares said. Ethereum (ETH) saw outflows for a 3rd consecutive week, they added, noting that they believe it “is minor profit-taking as the price closes-in on all-time-highs.”

- The NEAR (NEAR) ecosystem announced USD 800m in funding initiatives targeted at accelerating growth of the ecosystem. They said they will be focusing on decentralized finance (DeFi) teams.

- Unique Network, a non-fungible token (NFT) chain for Polkadot (DOT) and Kusama (KSM), said they have raised USD 11.3m in the second round of its pre-sale, bringing its total raised to USD 16m. The investment round was led by Outlier Ventures, among other investors.

- SkyBridge Capital’s Anthony Scaramucci claims that his BTC stash is now worth more than USD 1bn.

Anthony Scaramucci tells CNBC’s @_HadleyGamble that his once $270 million Bitcoin purchase is now worth over $1 billion. pic.twitter.com/b7wnP6VWOm

— CNBC Middle East (@CNBCMiddleEast) October 25, 2021

Regulation news

- “The crypto field has been a catalyst for change. It has pressed up against what we think about money, about ledgers, about finance, and so forth,” US Securities and Exchange Commission (SEC) Chairman Gary Gensler told Yahoo! Finance, stressing that his goal is investor protection in a “Wild West” of crypto. He also said that most of the crypto asset space has not come under an investor protection remit and thus investors are not protected the way they are when they go into the stock or bond markets.

SEC Chair Gary Gensler w/ @bcheungz this morning…

— Nate Geraci (@NateGeraci) October 25, 2021

Based on these comments, tough to envision a spot bitcoin ETF being approved until crypto space is brought "within the regulatory perimeter".

Gensler continues emphasizing need for investor protection under their purview. pic.twitter.com/SMB1RRWKSa

- The US Commodity Futures Trading Commission (CFTC) is investigating whether betting platform Polymarket is letting customers improperly trade swaps or binary options and if it should be registered with the agency, Bloomberg reported. The company has stated that they are committed to complying with laws and regulations.

Payments news

- Citigroup CEO Jane Fraser told Yahoo! Finance that the banking giant is building the infrastructure for retail real-time payments, but they are doing “so cautiously because the space is moving so quickly.” “There’s still a lot of questions about how the space evolves around regulatory clarity, around some of the scalability, around resiliency, certainly around some transparency, and making sure that there are the appropriate guardrails in the system, particularly for our retail clients,” the CEO said.

"It’s clear that digital assets will be a part of the financial services and financial markets, the future of them," @Citi CEO Jane Fraser says, later adding: "Real-time payments will be here in the near term, and digital currencies may be part of that future." pic.twitter.com/jKUi01vLxu

— Yahoo Finance (@YahooFinance) October 25, 2021

Adoption news

- BlockFi, a crypto financial services company, and Neuberger Berman, a private, independent, employee-owned investment manager, announced a partnership to develop and distribute a series of cryptoasset management products and strategies. These products and strategies will be housed in a separate entity called BlockFi nb LLC, they added.

- Frances Haugen, the former Facebook product manager and whistleblower, practices the strategy of holding cryptocurrency to hold herself up financially, The New York Times reported. The outlet didn’t specify what type of cryptocurrency Haugen purchased.

- Digital banking solutions provider Q2 and crypto company NYDIG have announced that Five Star Bank (NY) and UNIFY Financial Credit Union as the first financial institutions in the US to enable their banking clients and members to buy, sell and hold bitcoin, powered by NYDIG. These institutions can now provide bitcoin services to their customers and members while helping to overcome barriers such as wallets and key management.

Security news

- Millions of email addresses associated with the crypto market data website CoinMarketCap (CMC) have been compromised, data security breach website haveibeenpwned.com reported. The data aggregator has stated that they believe “the leak did not come from CoinMarketCap servers” and that there “is no trace of any security breach of our servers.”

Legal news

- Decentralized finance (DeFi) company Terra Finance is suing the SEC to contest the subpoenas issued by the SEC following a dialogue concerning Mirror Protocol, a DeFi protocol built on Terra, which allows users to trade “synthetic” assets that track the price movements of real assets, such as shares of Netflix or Tesla. The lawsuit also claims the SEC violated its own rules and hired an outside private process service company to deliver the subpoena at a crowded conference as a means to “publicly intimidate and embarrass.”

NFTs news

- Social network Reddit is intending to build a non-fungible token (NFT) platform for buying and selling crypto collectibles, according to a job posting. They noted a “a new and exciting, rapidly growing team that aims to build the largest creator economy on the internet, powered by independent creators, digital goods and NFTs.”

Charity news

- Crypto.com has announced it is making a USD 1m direct donation to the nonprofit organization Water.org to support its mission of offering access to clean water worldwide and will launch initiatives to encourage more than 10m users worldwide to support the cause.