Ethereum Staking Sees Accelerating Growth Ahead of Merge

Staking of Ethereum’s native ETH tokens is accelerating ahead of ‘the Merge,’ with more than 9% of the entire supply of ETH now locked in staking protocols. Meanwhile, exchanges are being depleted of their ETH supply, as more investors are taking their tokens into their own custody and staking them.

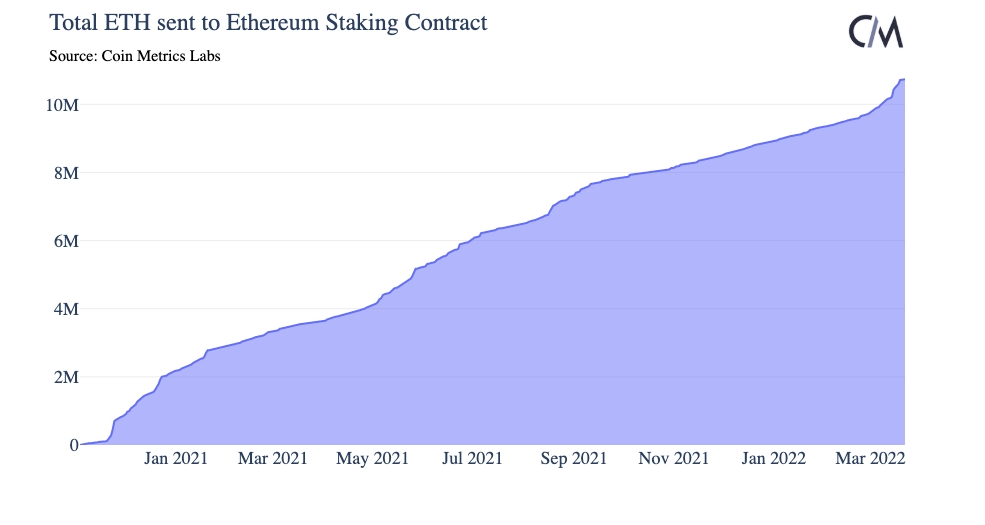

According to crypto analytics firm Coin Metrics, the total amount of ETH sent to staking protocols exceeded 10m for the first time on March 8. In total, the firm said that about 9% of all ETH is now locked in staking contracts.

Included in this figure are also third-party staking providers, which makes it possible to stake ETH without having ETH 32 (USD 102,000) that Ethereum otherwise requires.

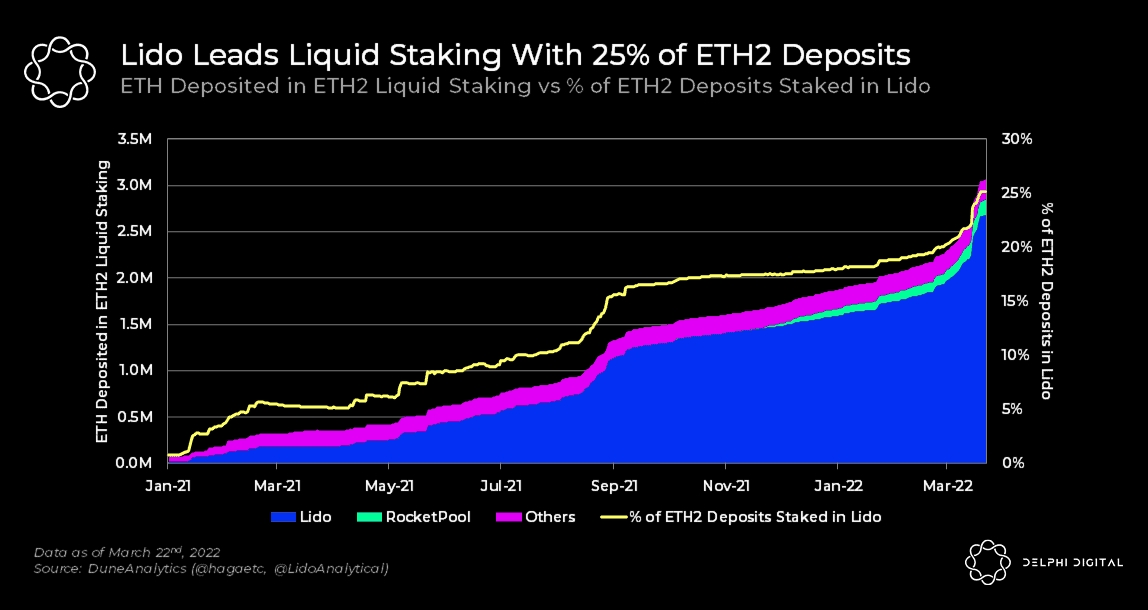

Lido has remained the dominant player among these staking providers, with the growth of ETH staked using Lido accelerating in March, according to data from analytics firm Delphi Digital.

The firm said in its newsletter on Tuesday that Lido is still responsible for over 25% of ETH staked. It added that the protocol last week saw its largest daily deposit ever, when ETH 197,000 were deposited.

Ethereum-native staking requires a user to put up ETH 32 for at least 1 year in order to receive annual staking rewards, making alternatives like Lido more attractive for regular users.

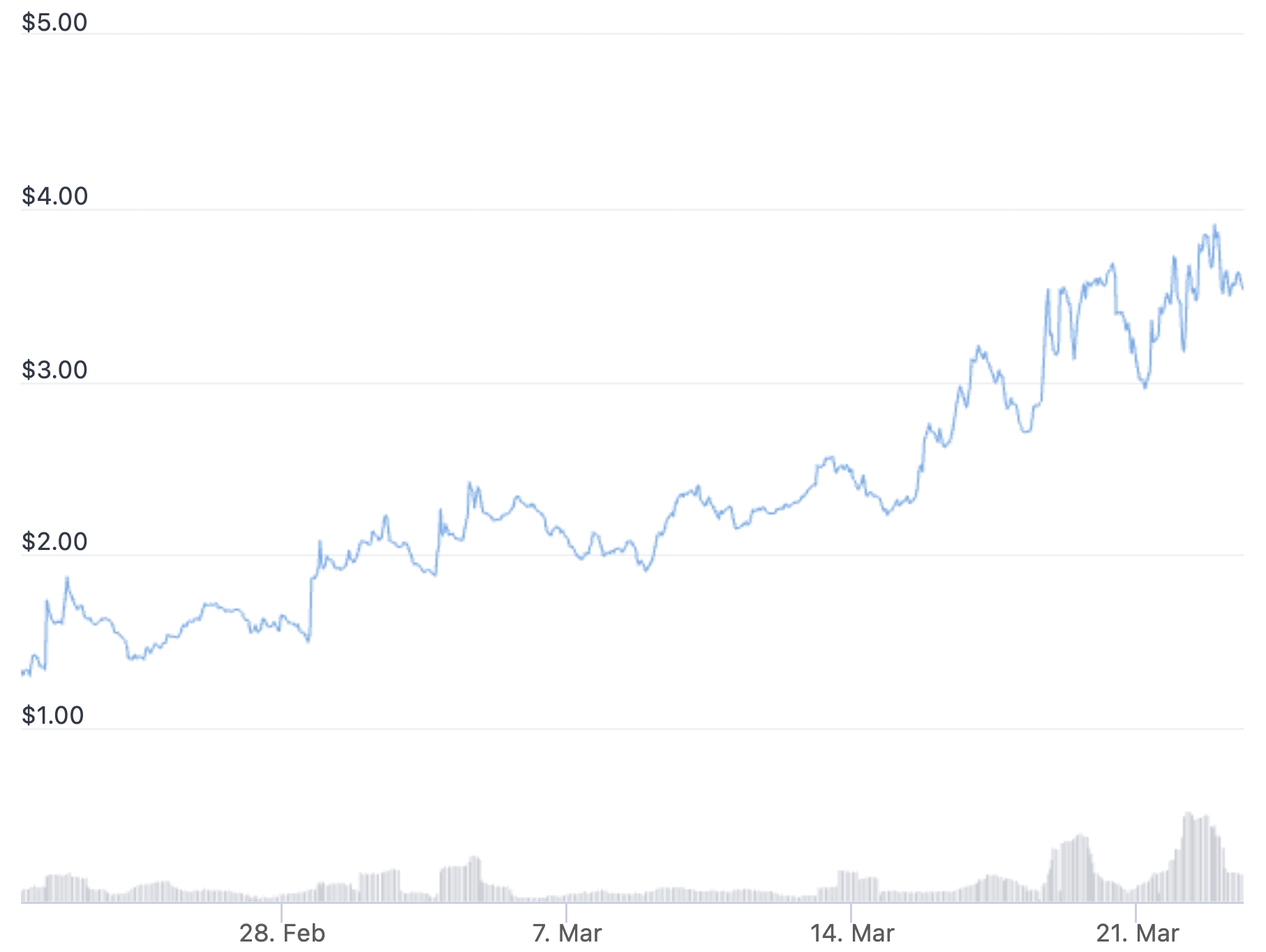

The inflow of tokens into Lido’s staking protocol has also led to a sharp price increase for the protocol’s governance token LDO, which on Thursday at 13:18 UTC was up by a strong 111% for the past 30 days, trading at USD 3.58.

LDO price past 30 days:

One step closer

The acceleration in staking is notable given that there still is no firm date (some expect it to happen in the second quarter this year) set for when the merge between the new proof-of-stake (PoS) blockchain and the current proof-of-work chain (PoW) – known as the Merge – will happen.

In the latest sign of progress, however, Ethereum developers last week said that Kiln – the final testnet before the Merge – had successfully completed the procedures necessary for the merge to happen.

The flow of more ETH tokens into staking contracts is likely a result of investors finding the yield that can be earned from staking ETH attractive, particularly in light of the low yields that are seen in the traditional financial system.

7% to 12% yield expected

For now, the yield that can be earned through the Lido staking protocol is 3.9%. Factoring in an inflation rate of 7.9% in the US, stakers thus end up with a real yield of negative 4%.

Once Ethereum completes its transition to PoS, however, the situation might improve, with Lucas Outumuro, Head of Research at blockchain analytics firm IntoTheBlock, saying staking rewards of between 7% and 12% can be expected.

“That being said, if Ethereum activity picks back up, staking [annual percentage rate] can go as high as 12% or even 15%,” Outumuro said in a Twitter thread published earlier this month.

Low ETH supply on exchanges

Meanwhile, IntoTheBlock also said in a report from Friday that ETH 180,000 was withdrawn from exchanges on March 15, marking the largest ever single-day outflow of ETH from exchanges.

Last time a similar event happened was in October 2021, which preceded a 15% increase in the price of ETH over the next 10 days, the firm said. It added that exchange outflows typically signal accumulation by investors who are looking to store their tokens safely for the long term.

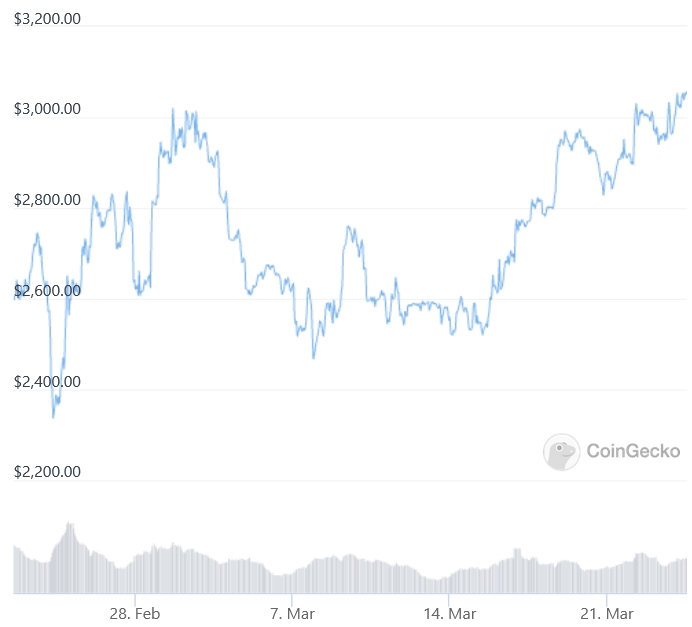

At the time of writing, the price of ETH was up 5% over the past 24 hours and it also rose almost 13% for the past 7 days, trading at around USD 3,175.

ETH price past 30 days:

______

Learn more:

– Staking in 2022: Ethereum’s Merge, Institutions, Layer-2, and Liquid Staking

– ‘Far More Bearish’ Survey Predicts Doubling of Ethereum Price This Year

– Hut 8’s ‘Ferrari of GPUs’ Ready for Ethereum’s PoS Move, Miner Open to M&A

– Layer 2 in 2022: Get Ready for Rollups, Bridges, New Apps, Life With Ethereum 2.0, and Layer 3

– ‘Fiat-Like’ Proof-of-Stake Chains Favor Centralization & Rich Players

– Proof-of-Disagreement: Bitcoin’s Work vs. Ethereum’s Planned Staking