Ethereum Price Calm But is Short Squeeze About to Push ETH to $2k?

As the Ethereum Merge nears, there has been increased interest in the second-largest cryptocurrency by market cap.

Ether has been outperforming Bitcoin over the past week as news of the Merge triggers bulls that have been liquidating short positions – the Ethereum futures market has been increasingly active as investors hedge against the risk of the Merge.

Ethereum short squeeze as the Merge nears

There has been a difference in sentiment between the top two largest cryptocurrencies, Bitcoin and Ethereum. The difference comes from the Merge news, a process expected to happen within the week.

The Ethereum development team has been working on the Merge since the network’s inception, and this work is finally becoming a reality. The Merge is a process that will transition Ethereum from a Proof-of-Work (Pow) consensus to a Proof-of-Stake (PoS) consensus.

As the Ethereum community anticipates the Merge, the ETH funding rates have been notably negative for more than a month because investors hedge their risk exposure to Ether by choosing short perpetual futures.

Investors are turning towards the futures market to adjust their risk exposure as the Merge nears. A report by Kaiko revealed that the perpetual futures for Ether now trade at more than seven times the volumes of the spot market, which is also a four-times gain since November last year.

The short-term trading activities of the traders have left the market prime for a potential short squeeze, which has happened in previous times when the funding has been on the sharp negative side.

If the Ethereum Merge is successful, it is expected that the short futures positions will be closed, and the funding will return to the positive side. This could give Ether the support needed for accelerating the price after the Merge.

Ether headed for $2,000?

Ether has been on a notable gain. However, the anxiety following the Merge seems to weaken the bulls, as bears have been in control for the past 24 hours. During this time, Ether has plunged by 8% to trade at $1,609, according to data from CoinGecko.

During the past week, Ether has recorded increased volatility, with the token trading between the $1,500 and $1,700 range. The positive developments surrounding the Merge, including the countdown ticker launched by Google, seem to be doing little to convince investors to rally buying support for the token.

The Ethereum daily chart shows that the token is already in a bearish zone. While bulls are attempting to take over the market and reclaim the critical resistance level at $1,700, the selling pressure seems overwhelming, and Ether could soon lose its hold above the $1,600 levels.

If the effort of the bulls is weak to propel Ether towards new highs, it is expected that a plunge towards $1,550 will be witnessed soon. If the bears persist during the Merge, further dips towards the $1,300 to $1,400 range will be witnessed, after which the prices will consolidate as the Ethereum community awaits to see if the Merge will be successful.

If the Merge is a success, a bullish sentiment could overwhelm the market, and bulls will be in full control to reclaim the $2k levels. However, failure to break these levels post-Merge could result in Ether continuing with the bearish sentiment witnessed during the past few months.

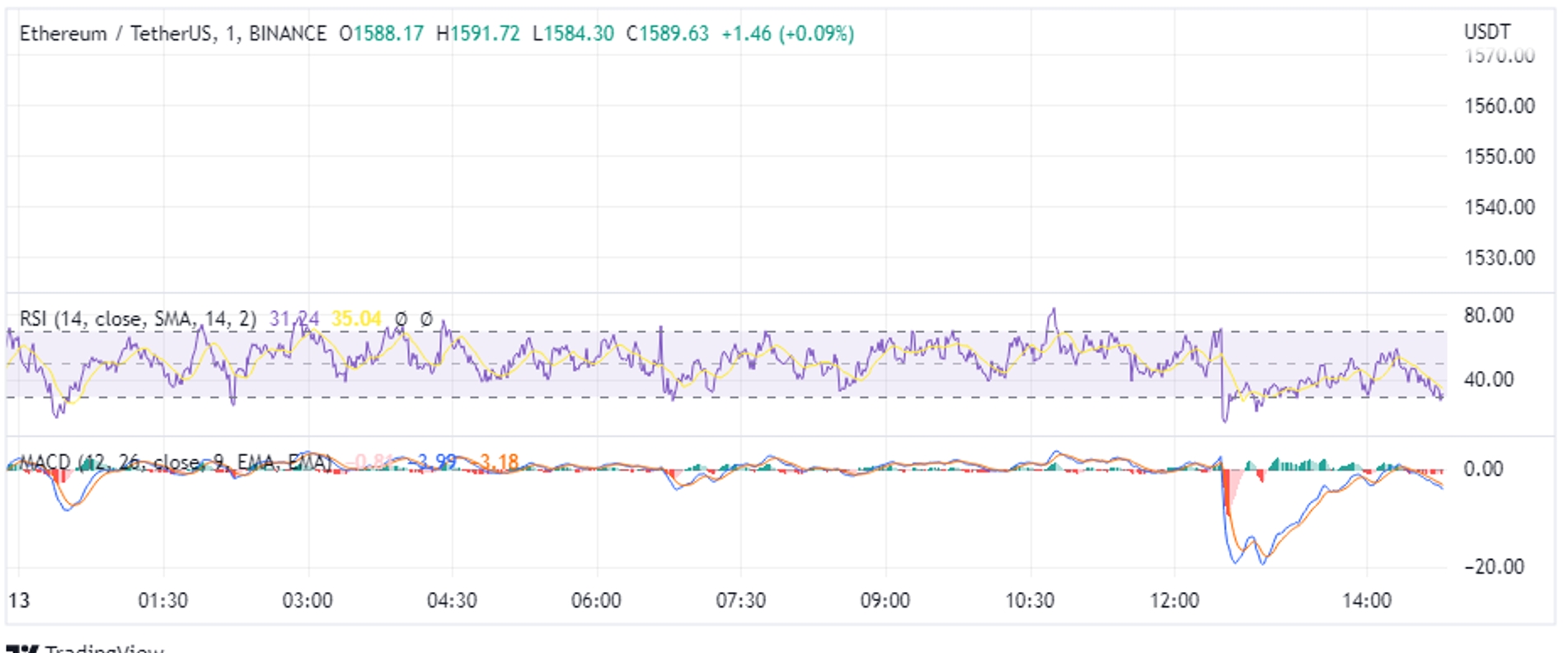

The Ether Relative Strength Index (RSI) stands at the 35% range, showing that sellers are behind the token’s failure to reclaim higher levels as the date for the Merge nears.

However, with ETH slowly headed towards the oversold levels, there is a possibility that the selling pressure will be worn out, and the prices will either consolidate or head to higher levels.

Additionally, the Moving Average Convergence Divergence (MACD) has gone below the signal line, which also makes for another case of more people flocking to the market to buy Ethereum anticipating notable gains from the Merge.

It is important to closely observe the ETH daily chart during the next few days leading up to the Merge. The bears seem resistant to defending the resistance zone, while more investors are shifting towards the futures market and avoiding the spot market to hedge against Merge jitters.

Nevertheless, a strong bullish case for Ether of the Merge goes on without hiccups. The Ethereum community believes the Merge will lower energy consumption by 99% and make ETH a better store of value, which could translate to notable gains.