Ethereum Now ‘Significantly Undervalued’ – Researchers

Despite a rebound of more than 100% since the crypto market crash on March 12, ethereum (ETH) remains “significantly undervalued,” and could be poised for further upside, crypto research firm Blockfyre believes.

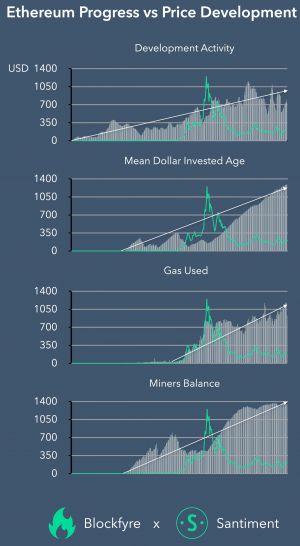

In a recent Twitter thread, the firm noted that while ETH prices have remained relatively stagnant since the end of 2018, high development activity and several on-chain metrics suggests that the price could soon go higher.

“Taken together, although the price decreased significantly from its January 2018 peak and is going sideways since EOY 2018, Ethereum’s progress and several further indicators are very promising for Ethereum,” the firm wrote, while pointing to gas used, an increasing investment holding period, and growing ETH balances held by miners as bullish for the price.

Meanwhile, ETH bull Ryan Sean Adams, founder of crypto investment company Mythos Capital, called ETH “doubly undervalued,” arguing that ETH price will first catch up with the actual usage of Ethereum, before it then continues to price in ETH as a store-of-value.

However, not everyone agreed with these views. Primitive Ventures partner Dovey Wan called it “a flawed logic,” and claimed that the increased usage of the network is largely the result of “ponzi/casino games on Ethereum,” which she said is mostly settled in stablecoins rather than in ETH. Instead, “actual settlement demand” for ETH is what will eventually drive up prices, as it did during the 2017 bull run.

Dovey Wan’s argument that only actual demand for ETH can drive up prices also partly contradicts the research from Blockfyre, which points to increased gas usage as one of the key reasons for why ETH is undervalued.

As of press time on Wednesday (09:52 UTC), ETH was nearly unchanged over the past 24 hours, after rebounding early Wednesday from overnight selling pressure. Over the past 7 days, however, the price remains down by 4%, currently trading at USD 204. ETH is up by 4% in a month and down by 25% in a year.

__

Learn more:

Ethereum 1.0 Has ‘A Major Role’ To Play Before Merging With ETH 2.0

The ‘ETH Is Used 440x More Than Bitcoin’ Claim Is Not So Simple

New Ethereum 2.0 Calculator: Stake ETH 1 and Earn 279% in 10 Years

How Ethereum Could Help The Global Economy Recover From A Recession

Ethereum 2.0: The Original Ethereum Will be Gradually Phased Out