ETH/BTC Ready to Break Higher? Not So Fast, Some Analysts Say

A much-discussed chart among crypto traders in recent days has been the ethereum (ETH)/bitcoin (BTC) chart, with many claiming it looks primed for a sharp move higher. However, some are still betting on an opposite outcome, with investor demand also indicating stronger appetite for bitcoin.

The potential break-out for ETH has gotten a fresh round of attention following strong outperformance of ETH over BTC during the past week. At 11:57 UTC on Tuesday, ETH was up 11% over the past 7 days, while BTC was up 2.5% over the same time period.

The notable difference in performance came at a time when the stock market has tumbled over renewed coronavirus fears, with the US S&P 500 futures currently down by about 2.9% from its all-time high on Monday last week.

And as has been pointed out by many in recent weeks, bitcoin is still behaving more like a risk asset that fluctuates with the stock market, than a safe haven hedge like gold. This relationship has once again been demonstrated in recent days, some crypto traders have argued.

Gm. $BTC and equities are down but $ETH is holding well. Probably nothing..

— CoinMamba (@coinmamba) November 30, 2021

The ETH/BTC chart has also been pointed to by Raoul Pal, founder & CEO of Real Vision, who said recently that he sees it as “the most important chart in digital asset markets right now.”

“A break higher will lead to more risk seeking into year end,” Pal said, suggesting that we may be entering a new bullish period for altcoins.

However, as usual, not everyone agrees with the narrative that ethereum is about to break higher relative to bitcoin. According to the popular crypto trading educator and Crypto-TA.nl founder Crypto_Ed, the ETH/BTC chart is not breaking out yet, and instead may be looking at a move lower.

“I see many tweeting ETHBTC chart looks so good….. All I see is a rising wedge with bearish divergence and it looks more like it’s gonna break down,” he said, adding that the same also holds true when looking at the same chart with a longer time frame.

So many comments I should look at higher TF…

— Ed_NL (@Crypto_Ed_NL) November 29, 2021

Well, that's what I taught ~2000 students in past years: "always start at the highest possible TF"

Daily TF: symmetrical triangle, usually in an ABCDE.

E doesn't need to go completely to the bottom but will do a pull back pic.twitter.com/ZpyeI3bGDo

Similar takes were also shared by other traders.

Futs a bit heavy as well, tough conditions thought we were looking better earlier

— depression BTC (@depression2019) November 30, 2021

Growing capital flows

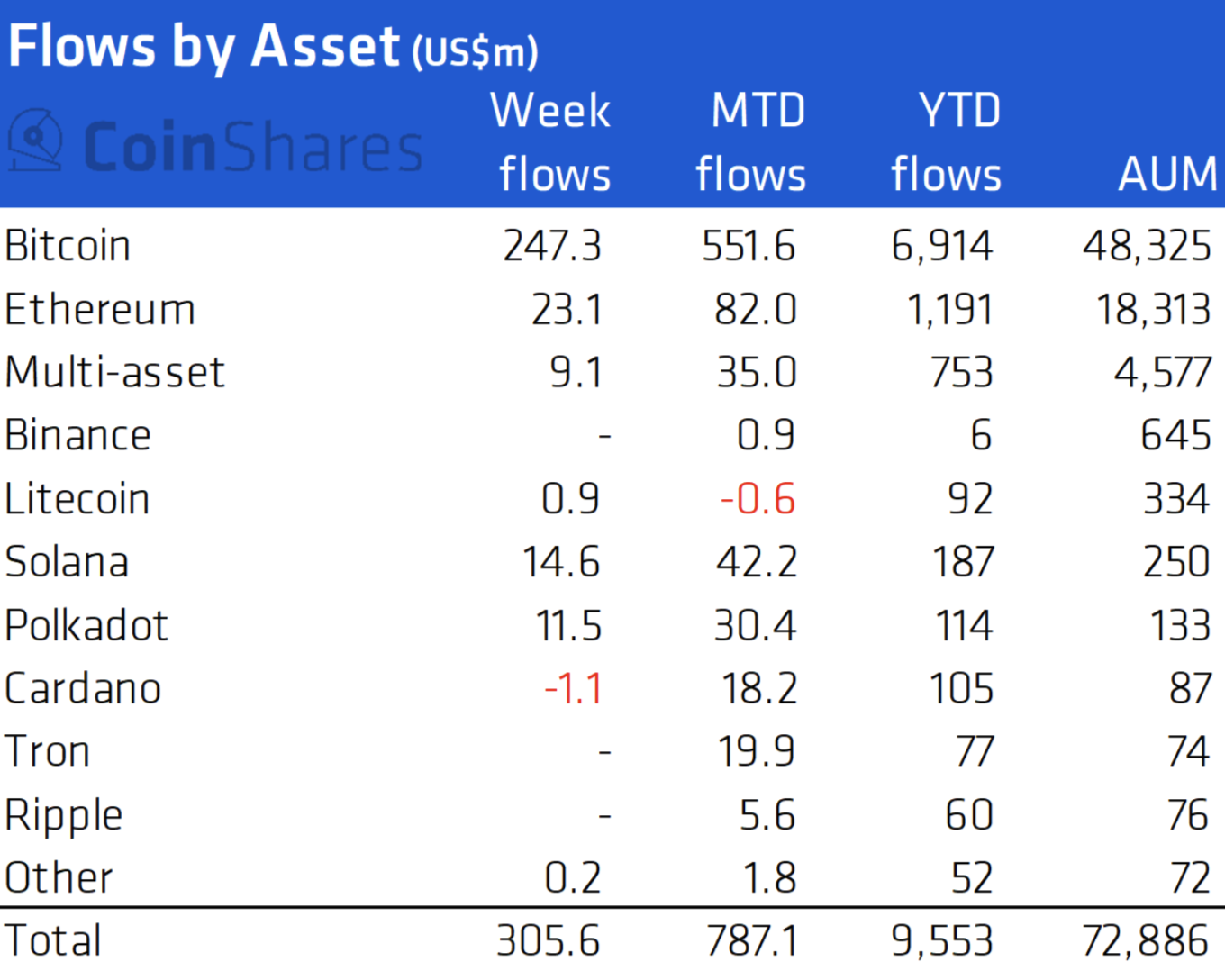

According to last week’s Digital Asset Fund Flows report from CoinShares, bitcoin appears to be enjoying greater momentum than ethereum in terms of capital flows into regulated investment vehicles.

As reported, last week, BTC saw the largest inflows in 5 weeks totaling USD 247m (compared with USD 114m a week earlier) following the launch of another investment product in Europe, they added. ETH saw inflows totaling USD 23m last week, compared with around USD 13m a week earlier.

3/ demand – we track weekly investment flows via our @CoinSharesCo report

— Meltem Demirors (@Melt_Dem) November 29, 2021

in the last 11 weeks, we've seen $2.7B of inflows into bitcoin ETPs alone. demand continues unabated, and w $5.5T of dry powder on the sidelines, there's plenty of capacityhttps://t.co/Ivu9apdYqv

Moreover, Marcus Sotiriou, a sales trader at the UK-based digital asset broker GlobalBlock, is also demonstrating a bullish stance towards bitcoin.

“Bitcoin appears to be forming a falling wedge pattern which is historically bullish and has a higher probability of breaking to the upside than the downside,” the trader wrote in an emailed comment, adding:

“If the down trending line of resistance is broken, bitcoin may be on its way to retest the all-time-high as the technical target is around that region.”

At 11:57 UTC, BTC traded at USD 57,600, up 1.4% over the past 24 hours. At the same time, ETH stood at USD 4,581, up 6.3% over the same time period.

____

Learn more:

– Selling Hits Crypto Market Again as New COVID Variant Spooks Traders

– Most Cryptos Correlated with Stocks, Not with Gold – Analysts

– Vitalik Buterin Proposes New EIP to Tackle Ethereum’s Sky-High Gas Fees

– MicroStrategy Makes its Fourth-Largest Bet on Bitcoin

– Crypto Investment Trends in 2022: Brace for More Institutions and Meme Manias

– All-Time High Weekly Close for Bitcoin Boosts Sentiment as 2022 Nears