ETH Can Flip Bitcoin, But It Can’t ‘Have Its Cake & Eat It Too’ – Arthur Hayes

Ethereum (ETH) can’t be a better store of value than bitcoin (BTC) while also being a widely used smart contract platform, according to former BitMEX CEO Arthur Hayes.

Writing in a blog post, Hayes considered the possibility of ethereum’s market capitalization overtaking bitcoin’s, warning that a high ETH price would make it difficult for Ethereum to fulfill its role as “the world’s best decentralized computer.”

His warnings come amid record-high transaction fees for Ethereum and an all-time high price of over USD 4,300, with the blockchain preparing a new fee schedule as well as an eventual move to a proof-of-stake consensus mechanism.

Sound money or a universal computer – pick one

While Hayes acknowledged that ethereum’s market capitalization (currently USD 459bn) could potentially “eclipse” bitcoin’s (USD 944bn), his blog argued that this would undermine its utility and popularity as a smart contract platform.

“The market values the focus of Ethereum on being the best smart contract protocol over it attempting to be a form of hard crypto money good collateral as well. Serving two masters is impossible,” he wrote.

Hayes also took particular aim at Ethereum Improvement Protocol 1559, arguing that introducing a deflationary monetary structure risks reducing the supply of ETH to impractically low levels.

“The supply of ether will decline in ether terms as the platform becomes more useful. If we are underestimating the impact of DeFi on human economic interactions, there is a future where there isn’t enough ether supply to allow the system to function,” he suggested.

Basically, Hayes’ argument is the following: if ETH becomes more popular as a smart contract platform, more ETH will have to be paid as fees. But with EIP 1559, ETH will actually become scarcer, making it harder to source the ETH necessary to pay for all the transactions the Ethereum blockchain needs to facilitate.

“The network will not produce enough ETH, via block rewards, to satisfy its use in the attainment of the Ethereum mission,” Hayes said.

In order to avoid network failure, Hayes predicts that EIP 1559 may end up being overturned via a fork, something which could cause the price of ethereum to collapse as investors (rather than users) feared the end of deflation.

As a result, he concluded,

“Ether cannot ever be the hardest form of crypto money while achieving its real mission to power the world’s decentralized computer.”

Not so simple

To some extent, Hayes’ warnings have already been borne out. High Ethereum fees have already pushed some users towards Binance Smart Chain and other networks in recent months, supporting the view that you can’t really have a constantly rising cryptoasset and an accessible or efficient platform.

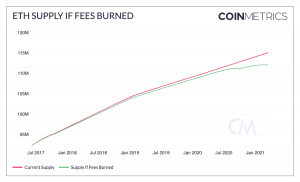

However, it’s possible that his prediction of a steep decline in the supply of ethereum (in the event of EIP 1559) may be overstated. In March, Coin Metrics published its Ethereum Gas Report, which included an estimate of the extent to which EIP 1559 will reduce ETH supply inflation.

The chart above shows a smaller supply (by ETH 3m) in the timeline where fees are burned (relative to a timeline where they aren’t), but it doesn’t show an actual decline in ethereum.

At the same time, Hayes’ argument doesn’t really account for Ethereum 2.0. This move to proof-of-stake and sharding aims to significantly increase Ethereum’s capacity and thereby reduce transaction fees.

Also, some other analysts would like to correct Hayes too.

Popular crypto analyst Hasu stressed: “Transactions on Ethereum have no fixed cost in ETH. They only have a cost in gas, a virtual unit. Miners/stakers have a fixed amount of gas to allocate in every block. Transactors bid for this gas in ETH.”

But to be fair to Hayes, he does admit that the Ethereum network could potentially become more valuable than Bitcoin. He just argues that it may be very difficult “because ether does not get to have its cake and eat it too.”

“Holders of USD don’t cry like babies on social media because companies that sell their products denominated in USD are worth more than the USD. So why are Bitcoin maxis so threatened by the inevitability that other cryptos that have an industrial use case will be worth more than Bitcoin?” Hayes asked, claiming that “Bitcoin is the hardest money ever created.”

At 10:05 UTC, BTC trades at USD 50,477 and is up by 1.5% in a day. The price is down by 20.5% in a month, trimming its annual gains to 444.5%. ETH changes hands at USD 3,959 and is up by almost 6% in a day. It rallied by 72% in a month and 1,886% in a year.

____

Learn more:

– Why Ethereum is Far From ‘Ultrasound Money’

– The Ethereum Economy is a House of Cards

– Bitcoin’s Correlation with Altcoins is Declining Again. What Does it Mean?

– Bitcoin Is More ‘Public’ Money than Central Bank-Issued Fiat Currencies

– Bitcoin Faces Hedge Test Amid Rising Inflation Concerns

– A Debt-Fuelled Economic Crisis & Bitcoin: What to Expect?

___

(Updated at 17:35 UTC with a comment from Hasu.)