Digital Currency Group’s Q1 2023 Revenue Jumps, CFO Michael Kraines Resigns – Here’s the Latest

Barry Silbert’s crypto conglomerate Digital Currency Group (DCG) saw its revenue rise 63% in the first quarter compared to the prior quarter, but it was still down on a year-over-year basis.

For the first quarter this year, DCG’s revenue totaled $180 million, up a respectable 63% from the prior quarter, the company said in an update this week.

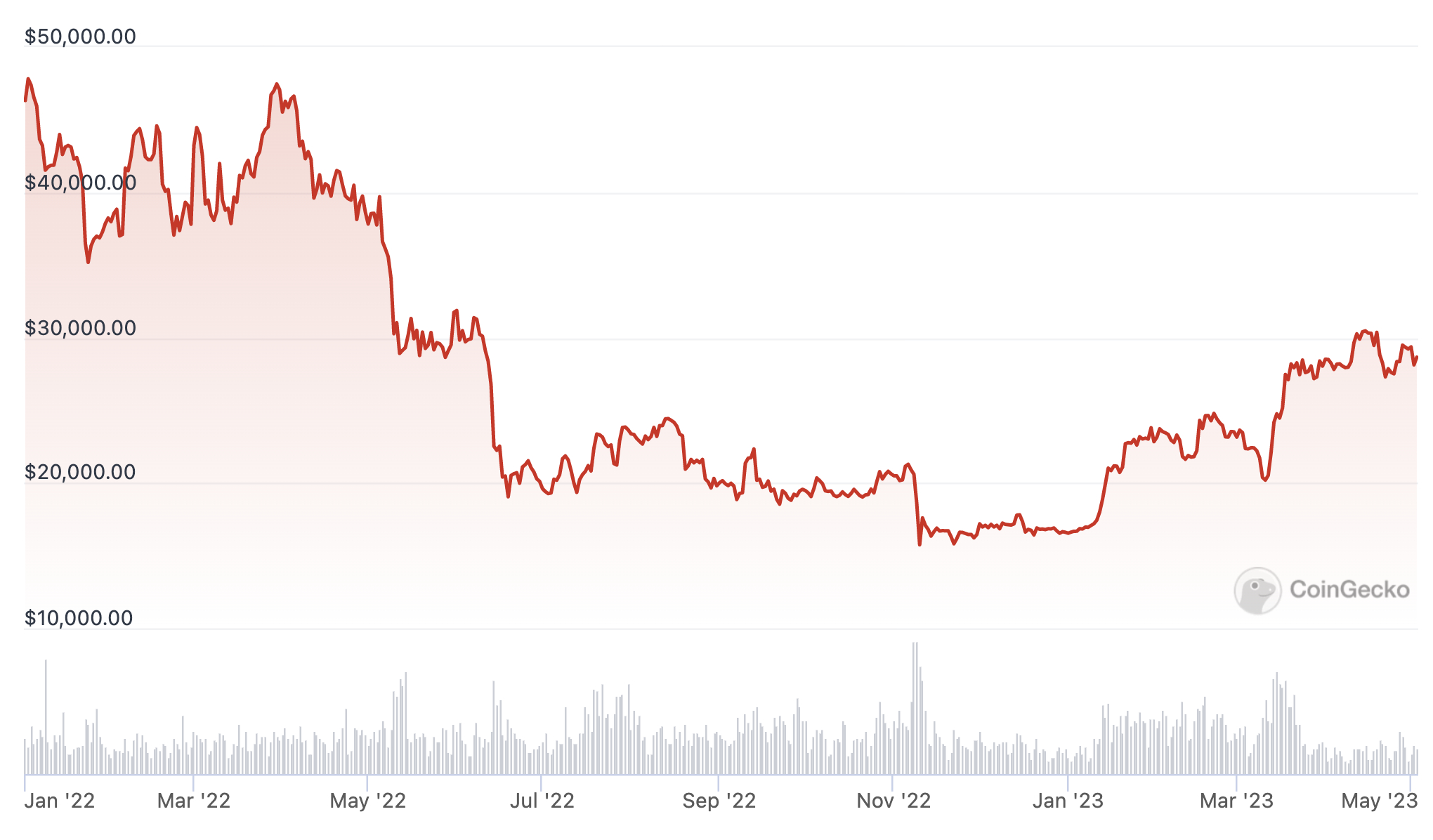

However, that’s still down 46% compared to the first quarter of last year, which was a time when the entire crypto market traded at much higher prices than today.

As of the end of Q1 2022, Bitcoin (BTC) traded at around $45,000, approximately 60% above the current price of around $28,000.

In its update, DCG also said that it has repaid a $350 million senior secured term loan during the quarter.

Commenting on its performance this year, DCG said in a letter to shareholders that its financial performance so far this year is “reflective of the market.”

CFO leaving

Meanwhile, the firm on Tuesday also announced that its chief financial officer Michael Kraines stepped down last month, and that President Mark Murphy and Chief Strategy Officer Simon Koster will take over his duties until a permanent replacement can be found.

A veteran from the world of traditional finance, Michael Kraines assumed the position as CFO in March of 2021, saying at the time that he looked forward to “accelerating its growth and positive impact on the industry.”

The firm said that the headhunting firm Heidrick & Struggles had been engaged to help find a replacement for Kraines.

Genesis difficulties

DCG has been in the news both this year and last year due to financial difficulties faced by crypto lending and trading firm Genesis Global, which is owned by DCG.

Late last year, the difficulties led to the suspension of redemptions from Genesis, causing problems for other players in the crypto industry such as the US-based exchange Gemini, which relied on Genesis for its interest-paying “Earn” program.

After efforts to work out a deal with Barry Silbert turned out to be unsuccessful, Gemini co-founder Cameron Winklevoss went as far as to publicly call for the DCG board to sack Barry Silbert as CEO.

Genesis filed for Chapter 11 bankruptcy in the US in January this year.