DeFi Moves: Maker, Ampleforth Hit Milestones, YFI Corrects ‘100x’ Gains

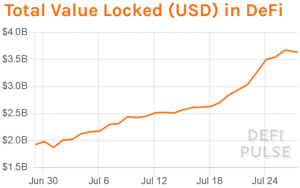

After a wild ride higher in recent months, tokens in the decentralized finance (DeFi) space are taking a breather today, while the growth in total USD value locked in DeFi protocols is also on pause after more than 10 days of uninterrupted growth.

In terms of total value locked (TVL) – one of the metrics for measuring the success of a DeFi platform – the recent growth has consolidated somewhat after reaching a top of USD 3.67 billion on Sunday.

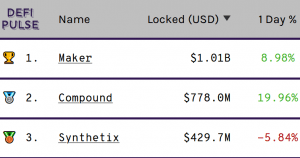

Perhaps most notable recently has been the growth of the Maker (MKR) platform, which just today became the first DeFi protocol to reach USD 1 billion in total value locked.

Maker is a platform that allows users to lock up various digital assets as collateral to borrow decentralized stablecoin DAI.

Another new development in the DeFi space is that the ampleforth (AMPL) token, which until recently was largely unknown in the crypto community, now ranks as one of the most valuable DeFi token by market capitalization.

Judging from DeFi Market Cap’s ranking, AMPL has the highest market capitalization if we exclude DAI locked up on the lending and savings platform Compound. Judging from Coinmarketcap’s ranking, however, AMPL ranks second, behind Chainlink (LINK), which isn’t included as a DeFi token on the former ranking site.

AMPL chart:

Lastly, another less-known DeFi protocol is yearn.finance and its YFI token, which according to popular crypto trader Luke Martin may have made the “fastest 100x in the history of crypto,” after a 6-day rally from USD 34.50 to USD 3,052.

As of press time on Monday (08:45 UTC), however, the token is again down to USD 2,787, after having traded as high as USD 4,799 on the Poloniex exchange on Saturday.

Poloniex is currently the main centralized exchange where YFI is traded, accounting for nearly 70% of trading volume in the token over the past 24 hours (USD 762,352).

Despite the gains and bullish sentiment surrounding DeFi projects, however, some industry players are starting to worry that the space is moving in an overly complex direction. Startup investor Qiao Wang said that he is “worried that DeFi is moving towards a direction of complexity/obscurity which will scare people away.”

“Fine if the goal is the build games for a small inner circle, but if the goal is to bank the unbanked, better build simple products and speak a language normal [people] understand,” Wang added.

__

Learn more: DeFi Punches Above Its Weight As it Targets Bitcoin’s Thunder