Crypto Question Placement on New Tax Return ‘Signals IRS Action’

The United States Internal Revenue Service (IRS) has released a new draft for filing the 2020 tax returns, with several significant changes – primarily placing the crypto transaction question on the first page of the return.

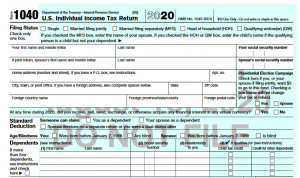

Form 1040, US Individual Income Tax Return, will ask citizens filing their tax return a question that reads: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” However, a major change here is in the placement of the question.

As reported by Forbes’ senior contributor, Kelly Phillips Erb, this new draft is similar to the 2019 tax return form except for the fact that tax information in the 2019 version was available in the form of a checkbox on Schedule 1 – used to report income / adjustments to income that can’t be entered directly on the front page of form 1040.

And this came with a number of issues, such as “taxpayers who don’t have to file Schedule 1 for any other purpose may not be aware that they need to file Schedule 1 to answer to this question if it applies to them,” wrote the author.

The IRS’s determination to place the form on the front page of Form 1040 shows its move to make its initially unclear position on the taxation of cryptocurrency gains clearer.

As Kelly Phillips Erb noted, the move by the IRS comes with a conviction that taxpayers are not correctly reporting cryptocurrency transactions. From the IRS tax data spanning 2013 to 2015, the number of bitcoin-related tax reports did not show consistency. While 807 bitcoin-related transactions were filed in 2013, the number retraced back to 802 in 2015, after hitting 893 in 2014.

“I think the new placement of the virtual currency question signals – even more than before – that the IRS is taking action,” said the author.

Important to note is that this is a draft, and the final version of the form may look differently.

The question of cryptocurrency taxation resonated across countries. With the Russian government about a year away from enacting its comprehensive crypto tax laws, Cryptonews.com reported back in July that crypto owners including traders, miners, and custodians had a short time window before Russian taxmen came calling for them to declare their profits.

Meanwhile, also in July, the crypto taxation enforcement in the Republic of South Korea had sparked outrage as crypto traders threatened to quit amid a 20% payable crypto tax. Mira Kim, a South Korea-based blockchain consultant, told Cryptonews.com that “a lot of people really seem to think that it’s not fair, that the bar has been set too high.”

____

Learn more:

Good News For Crypto Traders in the U.S. as IRS Extends Tax Deadline

IRS Says No Taxes on Gaming Cash, Crypto Regulation Remains Hazy

Britain’s Tax Agency Cracking Down on Crypto Tax Evasion

Spanish Tax Agency to Step up Bitcoin and Altcoins Monitoring Efforts