Crypto Expert Willy Woo Predicts Bitcoin Bottom is Close Using On-Chain Data – Here’s What You Need to Know

The popular Bitcoin (BTC) and crypto on-chain analyst Willy Woo has predicted that the bottom of the current Bitcoin bear market is close, given the share of the BTC supply that is considered “underwater.”

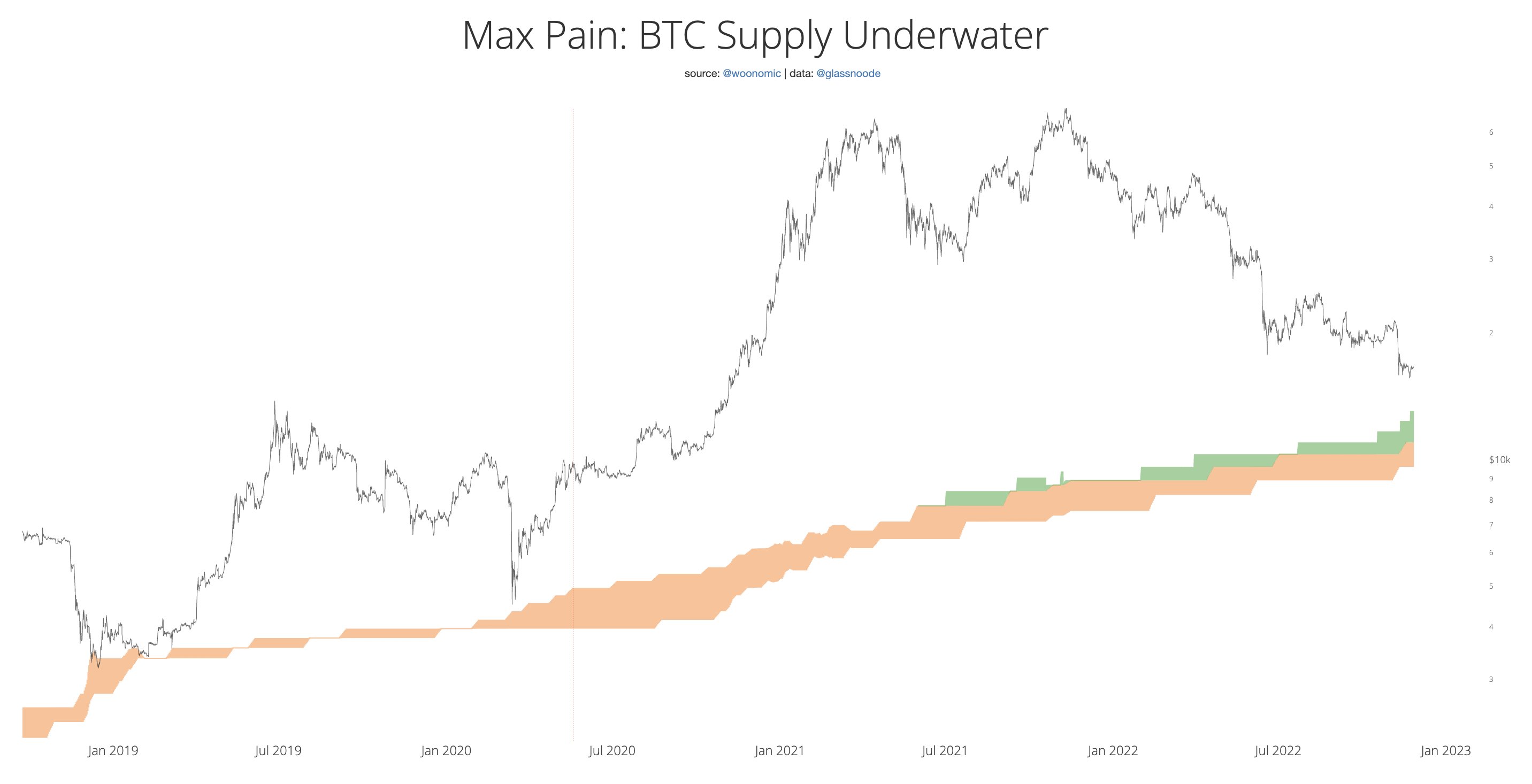

Using his so-called “Max Pain” model, Woo said on Twitter this weekend that a macro cycle bottom for bitcoin historically has been seen when 58% to 61% of the BTC supply is underwater, or held by investors sitting on an unrealized loss.

Judging from Woo’s model, that level is now getting close.

#Bitcoin bottom is getting close under the Max Pain model.

— Willy Woo (@woonomic) November 26, 2022

Historically BTC price reaches macro cycle bottoms when 58%-61% of coins are underwater (orange).

Green shading adjusts for the coins locked up inside GBTC Trust. pic.twitter.com/haIcKlQ3M3

Asked by a commenter where exactly the model predicts the bottom to be, Woo admitted that the price could still fall further, saying the upper part of the shaded area of his model is at $13,000 “and rising quickly.”

“Not all bottoms have hit, but for those that didn’t, they got close,” he added.

Willy Woo’s “Max Pain” model correctly predicted the bottom of the bitcoin bear markets in late 2018 and in 2015. In the bear market of 2011 – during bitcoin’s early years – the price got fairly close to the model’s predicted bottom price, but did not hit it.

Failed predictions this year

Back in March this year, Woo predicted a “decoupling” between bitcoin and stocks, given his view that bitcoin fundamentals continue to point in a bullish direction despite “macro headwinds.”

With spot demand for BTC continuing to climb, and a return to more demand for bitcoin futures, the market is now “fully reset” and “accumulation has already happened,” Woo wrote on Twitter at the time.

So far, Woo’s prediction about a bullish decoupling for bitcoin has – unfortunately – not come to fruition.