Crypto Crowd Sentiment Surges as Bitcoin Bulls Bet the Bottom is In

Prior to the recent DoJ FUD (fear, uncertainty and doubt) and US equity market weakness-induced pullback in Bitcoin and broader cryptocurrency markets on Wednesday, the crypto trading crowd was having its second most bullish week in terms of sentiment in the past 14 months, crypto analytics firm Santiment revealed in a chart shared on Twitter on Thursday.

🤞 Traders are treating #Bitcoin's signs of life as a signal that a bigger breakout may be looming soon. The rebound back over $21k in January has resulted in the crowd showing the most optimism they've had in markets since July. https://t.co/LDI0WdmU6h pic.twitter.com/rHQyyfz53j

— Santiment (@santimentfeed) January 19, 2023

As of the 17th of January, Santiment’s Bitcoin Weight Social Sentiment (BWSS) index, which is released on a weekly basis, had jumped to 1.219. The jump coincides with Bitcoin’s recent rally back to the north of the $21,000 level for the first time since prior to the abrupt collapse of Sam Bankman-Fried’s FTX/Alameda crypto trading empire.

Santiment’s BWSS index will probably drop a little next week if Bitcoin is unable to recover back to the north of the $21,000 level. BTC/USD was last changing hands in the $20,700s. Prices are currently being held down by some much overdue profit-taking, with the 14-day Relative Strength Index (RSI) having recently rocketed to its most overbought level since early 2021.

But there is every chance that Santiment’s BWSS remains elevated close to multi-month highs, amid growing signs that Bitcoin’s bear market might be over.

Bitcoin Bulls Bet the Bear Market is Over

In 2022, Bitcoin bulls got caught out by a number of bear market traps – this is where, after a prolonged decline, the market teases bulls with a small rally, suckers them back in, and then proceeds to drop once again. Bitcoin bulls where caught wrongfooted as US and global inflation surged more than expected, prompting major central banks like the Fed to tighten financial conditions far more aggressively than expected.

Not only did 2022’s aggressive rate hikes force investors out of speculative assets like crypto and slam the breaks on global economic growth, but the shift in macro conditions triggered a painful deleveraging cycle within speculative corners of the crypto industry, beginning with the collapse of unsustainable ecosystems like Terra and highly levered hedge funds like Three Arrows Capital before culminating in November’s collapse of FTX.

But from a macro perspective, 2023 is set to be very different. The room for further rate hikes from the Fed appears to be minimal, with inflation already falling back towards the central bank’s target faster than expected and with US growth sliding. Financial markets have in recent months been upping their bets that the Fed will end up cutting interest rates towards the end of 2023 and into 2024.

Strategists think this could give crypto prices some respite in 2023, with the industry seemingly having cleared most of the speculative excess built up in 2020 and 2021. As a result, many strategists have taken the view that “this rally is different” from the bear market traps of 2022.

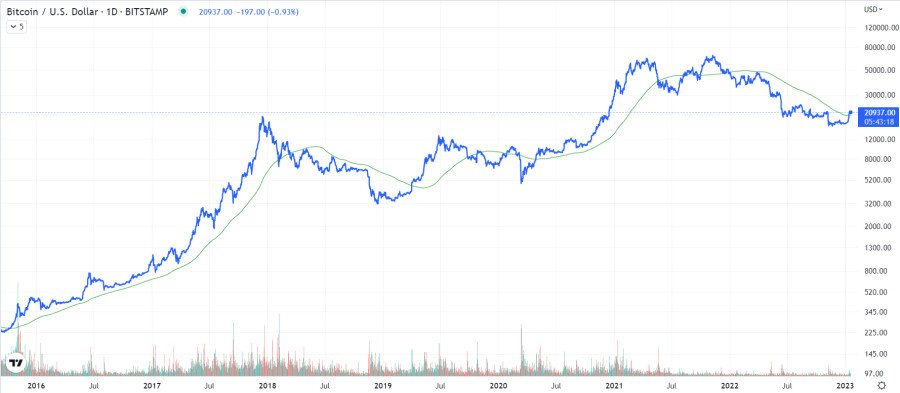

And numerous technical and on-chain indicators support this idea. Bitcoin is back above its 200-Day Moving Average and Realized Price – both are just under $20,000 and both are considered key psychological levels.

After a prolonged period in the red, Glassnode’s Net Unrealized Profit/Loss (NUPL) has recovered back into positive territory, essentially meaning that the average wallet on the Bitcoin network is back in profit. Typically, a recovery of the NUPL indicator back into positive territory after a prolonged spell in red signifies that a new bull market has begun.

Meanwhile, according to analysis from pseudonymous crypto-focused Twitter account @CryptoHornHairs, Bitcoin may be at the start of a bull market that could last another nearly 1000 days.

$BTC #Bitcoin

— HornHairs 🌊 (@CryptoHornHairs) January 12, 2023

2015-2017 bull market: 1064 days

2017-2018 bear market: 364 days

2018-2021 bull market: 1064 days

2021-*current* market low: 364 days

Days left until the top if we just carbon copy the cycle timeframe again: 1001 days pic.twitter.com/KoNZxJRuy5

Alternative.me’s Bitcoin Fear & Greed Index also recently recovered back above 50 and out of “Fear” territory for the first time since last April. A prolonged recovery above 50 (which hasn’t been seen just yet) has typically happened in tandem with a new Bitcoin bull market starting. As of the 19th of January, the index was at 45 and just back in “Fear”.

Altcoins to Consider

Cryptocurrency markets have been performing well since the start of 2023, but the longer-term bear market remains very much still in play. Investors might still want to consider diversifying their holdings with the discounted presale tokens of some promising, up-and-coming crypto projects. Here is a list of a few that analysts at Cryptonews.com think have the potential to perform well.

Fight Out (FGHT) – Presale on Now

The young move-to-earn crypto niche has shown a lot of promise, but early success stories like STEPN have significant limitations that have, so far, prevented them from conquering the mainstream. Fight Out, which touts itself as the future of move-to-earn, wants to change that in 2023. Fight Out is a brand new web3 fitness application and gym chain that rewards its users for working out, completing challenges and competing within a first-of-its-kind fitness metaverse.

While existing M2E applications such as STEPN only track steps and require expensive non-fungible token (NFT) buy-ins to take part, Fight Out takes a more holistic approach to tracking and rewarding its users for their exercise and activity, and doesn’t require any expensive buy-ins to take part. Fight Out seeks to combine the physical and web3 worlds.

The project aims to eventually acquire gyms across all of the world’s major cities, whilst simultaneously promoting an integrated web3 fitness experience. At the center of Fight Out’s digital ecosystem will be its smartphone application which, according to Fight Out’s whitepaper, is scheduled for launch in Q2 2023.

The Fight Out app will harness smartphone and wearable technology to measure and track physical performance. The app will have its own in-house tokenized economy, where users can earn rewards for completing M2E tasks, and can mint their own soul-bound token avatar, through which the user will be able to interact with the Fight Out metaverse.

FGHT is the token that powers the Fight Out metaverse ecosystem. Users will pay to enter competitions and leagues with FGHT, and winning will be paid out in FGHT.

FGHT can also be used in peer-to-peer fitness wagers. Fight Out’s FGHT tokens are currently selling for 60.06 per 1 USDT, and interested investors are encouraged to move fast to secure their tokens, with the pre-sale having already raised close to $3.05 million in just a few weeks. FGHT is the token that will power the Fight Out crypto ecosystem.

Calvaria (RIA) – Pre-sale Nearly Over

RIA, the token that will power afterlife fantasy-themed NFT battle card game Calvaria, is also currently in presale. The play-to-earn (P2E) crypto gaming start-up has raised close to $3.0 million in just a few months since the launch of its pre-sale. Only around 8% of its tokens remain up for grabs.

Calvaria seeks to bring crypto gaming into the mainstream by tapping into a huge, existing market – the market for physical battle card games (think viral sensations of the past like Pokemon and Yu-Gi-Oh). And with the crypto gaming space expected to grow from $4.6 billion in size in 2022 to $65.7 billion in size by 2027, according to an analysis by Markets and Markets, there is plenty of room for massive growth. Calvaria is set to launch its headline fantasy-themed card game “Duels of Eternity” in Q2 2023.

C+Charge (CCHG) – Presale Now On

The carbon credit industry is projected to be worth $2.4 trillion by 2027. Democratizing access to accrue these benefits is going to massive business in the years ahead and this is something crypto start-up C+Charge hopes to achieve. C+Charge is currently building a blockchain-based Peer-to-Peer (P2P) payment system for EV charging stations that will allow the drivers of electric vehicles (EVs) to earn carbon credits.

C+Charge aims to boost the role of carbon credits as a key incentive for the adoption of EVs. At present, large manufacturers of EVs like Tesla earn millions from selling carbon credits to polluters. C+Charge wants to democratize the carbon credit market by allowing more of these rewards to find themselves in the hands of the EV owners, rather than just the big businesses.

C+Charge has just started its pre-sale of the CCHG token that its platform will use to pay at EV charging stations. Tokens are currently selling for $0.013 each, though by the end of the presale, this will have risen by 80%. Investors interested in getting in early on a promising environmentally friendly cryptocurrency project should move fast, with the project having already raised over $320,000 in just a few weeks since the presale launch.

Investors should note that the remaining tokens could be scooped up quickly. A crypto whale recently scooped up over $99 worth of CCHG in one transaction, as can be verified here on BscScan.

Meta Masters Guild (MEMAG)

Meta Masters Guild is an up-and-coming web3 mobile gaming ecosystem that says its wants to create fun and addictive games that utilize non-fungible tokens (NFTs), allowing community members to earn rewards, as well as stake and trade. Game development is already underway, with the team set to launch their first title Meta Karts in the coming months.

The promising crypto gaming start-up is currently conducting a presale of its MEMAG tokens and has already raised a whopping $651,000 in just a few weeks. Tokens are currently selling for $0.007 each. According to some observers, this is a steal. Moreover, this price will have risen to $0.023 by the seventh stage of the presale, meaning early investors could be sat on paper gains of over 300% by the time the presale ends.

Visit Meta Masters Guild here.