Considering Adding Bitcoin to Your Portfolio? Answer These 3 Questions First

Instead of jumping straight onto the bitcoin (BTC) bandwagon, traditional investors should ask themselves three “critical questions,” and make sure they can answer each of them satisfactorily, crypto investment firm Bitwise Asset Management urged in their new report.

According to the report, titled The Case for Bitcoin in an Institutional Portfolio, investors who are thinking about allocating a part of their portfolio to bitcoin first need to ask themselves the following questions:

- What is the minimum acceptable holding period for a bitcoin allocation?

- What is the best rebalancing frequency for a bitcoin allocation?

- How much bitcoin should you add to a portfolio?

1. The minimum acceptable holding period

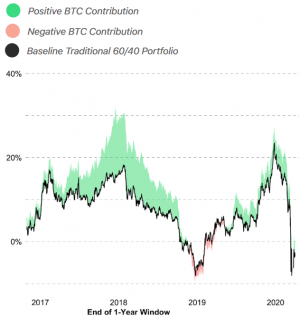

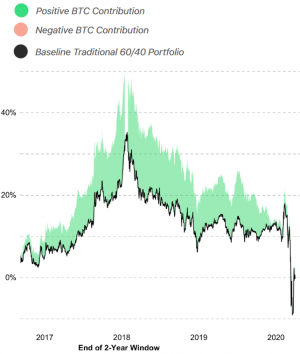

With regards to the minimum holding period for the bitcoin allocation, Bitwise noted that an “asymmetrically positive” impact on overall portfolio returns can be achieved by allocating to bitcoin over just a one year holding period.

When moving to a holding period of two years or more, however, Bitwise said that adding bitcoin to a portfolio means that “the frequency of positive contributions [to the portfolio] quickly approaches 100%.”

2. Rebalancing frequency

One the second question regarding the rebalancing of the bitcoin allocation in an investment portfolio, the report made it clear that without proper rebalancing, “even a small allocation to bitcoin can grow to dominate a portfolio’s risk/return characteristics.”

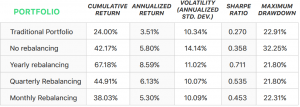

Given the necessity of performing regular rebalancing, the report, therefore, looked at four different intervals for doing so, namely no rebalancing, monthly rebalancing, quarterly rebalancing, and yearly rebalancing.

With bitcoin’s historically massive returns in mind, however, it should come as no surprise that the less an investor rebalances away from bitcoin, the greater the returns of the portfolio will be. However, such a strategy also leads to higher volatility and drawdowns for the investor, the report said.

Consequently, Bitwise noted that “Adding any rebalancing strategy, however – monthly, quarterly, or annually – dramatically lowers the volatility impact. This leads to substantially higher Sharpe ratios [risk-adjusted return] for strategies with rebalancing in place.”

3. How much

Finally, on the third and perhaps most important question that investors should ask themselves about how much bitcoin should be added to a portfolio, Bitwise said that judging strictly from past returns, the answer is “the more bitcoin the better.” However, adding more bitcoin also increases the volatility of the portfolio and increases the chance of experiencing large drawdowns, the report warned.

To determine an optimal allocation to bitcoin, the report calculated the Sharpe Ratio – known as a measure of risk-adjusted returns – for different allocations ranging from 0% to 10%, and found that there is a non-linear rise in the Sharpe Ratio as more bitcoin is added to the portfolio.

As a result, “the incremental benefit of adding more bitcoin to a portfolio diminishes once allocations go beyond the 3-4% range,” the report concluded.

___

Learn more:

Here is How Your Portfolio Would’ve Performed w/ 1%, 5% and 10% in BTC

Family Offices Likely to Invest in Bitcoin; Don’t Count on Banks