Close to 1 in 3 Surveyed Hedge Funds Plan Crypto Investments – PwC

Close to one out of three – or 29% – of hedge funds that are not yet invested in digital assets say they are looking to invest or are in late-stage planning for investments in the space, a new survey by consulting giant PwC has revealed.

The survey was conducted in the 1st quarter of 2022 on a sample of 77 specialist crypto hedge fund managers, in collaboration with Elwood Asset Management (now a part of CoinShares).

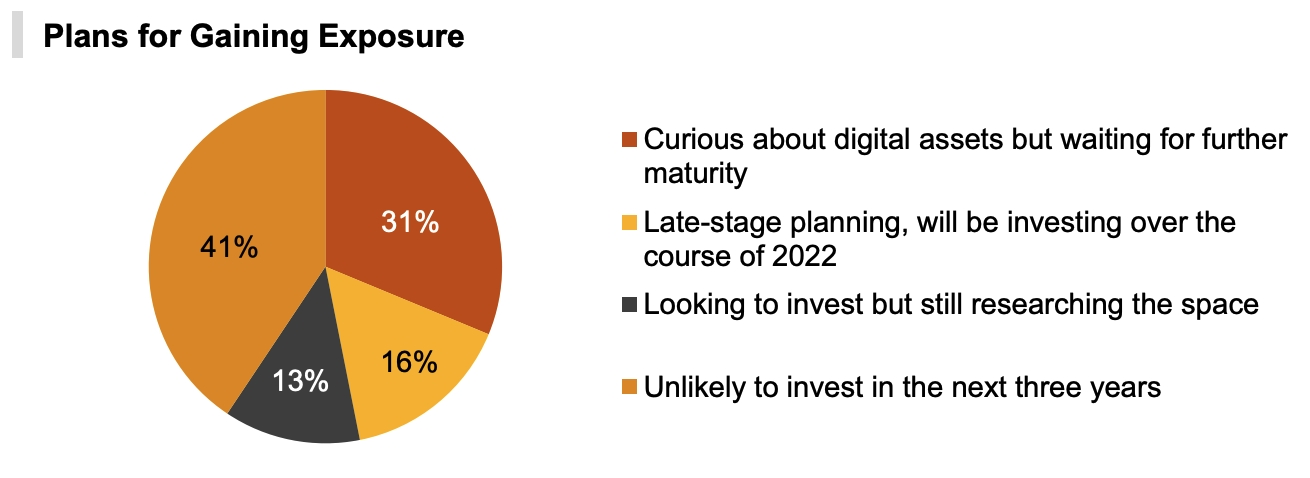

According to the survey results, published in PwC’s Global Crypto Hedge Fund Report for 2022, the share of hedge funds that are looking to the crypto market for their future investments has risen from 26% last year to 29% this year. The majority of the funds looking towards the crypto market said they are now in “late-stage planning” for the investment, the survey found.

At the same time, the survey also found that 41% of uninvested hedge funds are unlikely to invest in the next three years, while 31% said they are “curious” about digital assets, but prefer to wait for the market to mature more.

Among the funds that were not invested, the top reason for staying away from crypto was “regulatory and tax uncertainty,” the PwC report said. That was followed by “client reaction” or “reputational risk” as the second-biggest concern for the crypto-skeptical funds.

One in three funds already invested

Meanwhile, the report said that one in three surveyed hedge funds has already invested in digital assets. The number is up significantly from last year’s report when only one in five funds said they had investments in crypto.

Among the funds that have already invested, an average of 4% of assets under management are now invested in crypto, an increase from 3% a year ago. Still, for the funds with more than USD 5bn in total assets under management, the allocation to crypto was smaller, with all of these funds allocating less than 1%, the survey found.

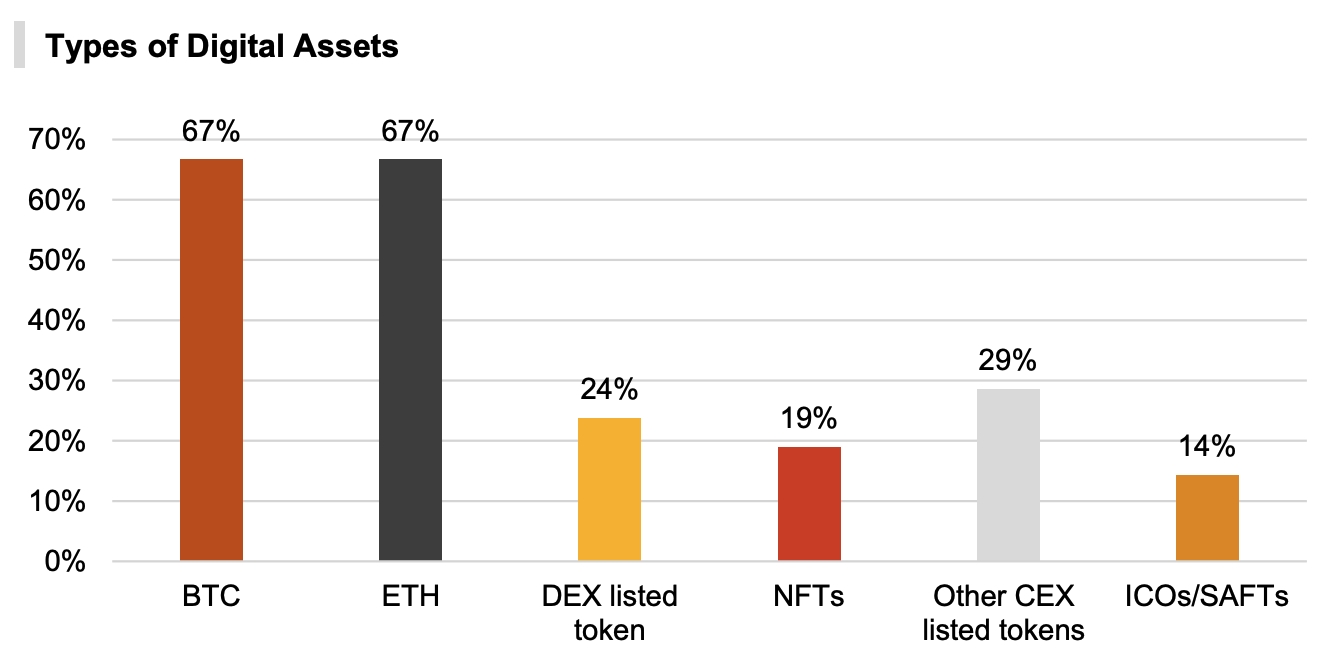

Asked about which digital assets they invest in, two-thirds of the respondents who were invested in the market mentioned either bitcoin (BTC) or ethereum (ETH) as one of their investments, while only 29% mentioned other cryptoassets listed on a centralized exchange.

At the same time, 19% of hedge funds active in the crypto market said that they have exposure to non-fungible tokens (NFTs).

67% of funds looking to increase exposure

Notably, two-thirds of the funds that are already invested in the crypto market said they plan to increase their exposure to the nascent asset class this year. The figure marks a decrease from last year’s survey when 86% of the funds said the same.

Of the funds looking to allocate more capital to digital assets, 57% currently have less than 1% of their assets under management allocated to these assets. A third of the respondents looking for more exposure have between 2% and 5% of their assets under management already allocated to crypto, the survey found.

Fund managers remain bullish

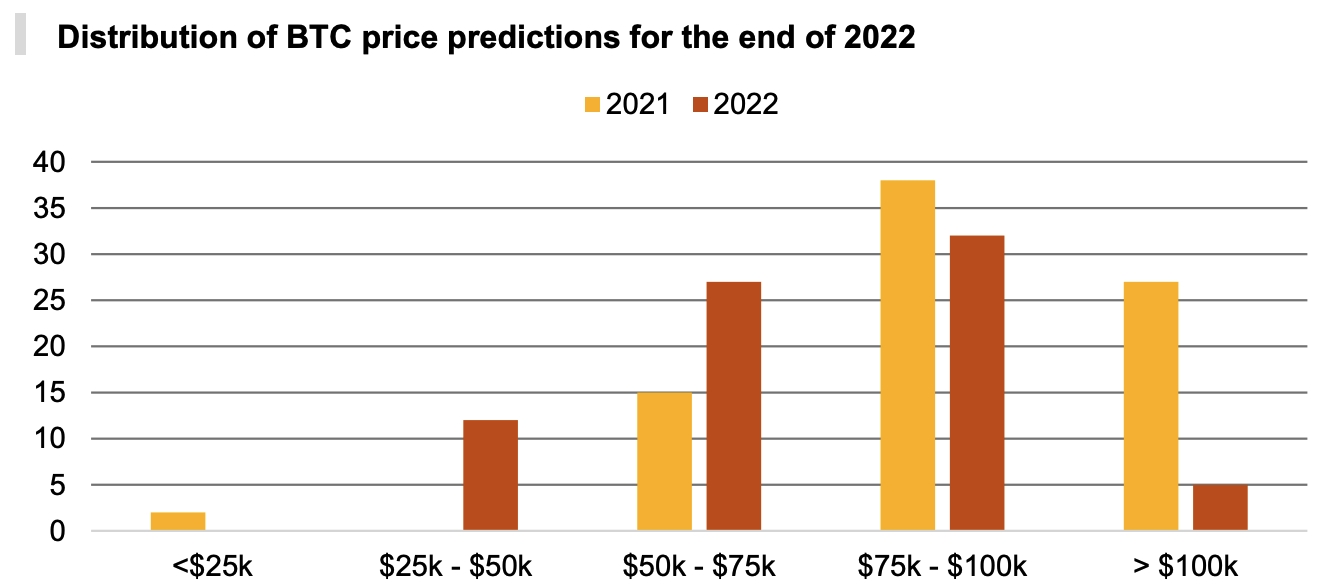

Lastly, the survey also revealed that as of April 2022 when responses were given, most hedge fund managers were still bullish on the price of bitcoin.

All respondents predicted that the bitcoin price would end the year above USD 40,000, which was the current price around the closure of the survey. The median price prediction for this year ended at USD 75,000, while around 5% of respondents said that bitcoin would end the year above USD 100,000.

____

Learn more:

– Just 18% of Respondents Do Not Expect Bitcoin to Become Legal Tender in 3 Years – Survey

– Accenture Sees Strong Demand for Digital Assets Among Asian Investors, but Hesitancy Among Advisory Firms

– DAOs, Token Holders Could Face New Tax Liabilities, PwC Report Warns

– NFTs Will Become ‘Critical Pieces’ of Sports Industry – PwC

– Global Insurers Start Investing in Crypto Amid Risk-On Investment Approach

– 40% of Surveyed Lower-income Individuals Want to Use Bitcoin – Not to Make Money