Circle Prepares for Crypto Mass Adoption as USD Coin Trading Volume up 954%

Major crypto financial services firm behind the USD Coin (USDC) stablecoin, Circle , intensifies competition in the stablecoin market as the company estimates mass crypto adoption in 2-3 years. In the meantime, USDC trading volume has already jumped 954% this year.

Circle’s 2020 will be all about stablecoins, specifically USDC, which is a much-discussed product of collaboration between Circle and major crypto exchange Coinbase, aka the CENTRE industry consortium. Next year, the company will focus on new global payment, custody, and wallet APIs (application programming interfaces) for stablecoins, which should be offered as services to businesses and developers.

“Stablecoins, third generation blockchains, and deep global policy engagement suggest to us that the mass market phase of crypto currency adoption is approaching over the next two to three years,” write co-founders Sean Neville and Jeremy Allaire.

And it seems that the company is preparing for this phase seriously, as the USDC trading volume has skyrocketed this year.

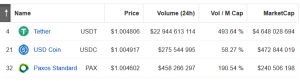

We took a look at the trading volumes for the top 3 stablecoins by market capitalization (USDT, USDC, and PAX) – specifically the average daily volume in January and December (1st-17th) for each of the three. This is what we’ve got:

| Daily Average (in million USD) | USDT | USDC | PAX |

|---|---|---|---|

| January | 2,739 | 13 | 65 |

| December | 15,916 | 137 | 202 |

| Change | 481% | 954% | 211% |

However, despite USDC saw the biggest increase in trading volume and is the second biggest stablecoin by market capitalization, PAX trading volume is still larger at the end of 2019.

But the competition in the stablecoin business is far from over.

Circle also plans to bring its USDC, Pay, Invest, and Trade to the front and center in 2020, and provide the services through APIs, which the platform believes “will accelerate the adoption of stablecoins and USDC.”

To accomplish this, Circle has taken several steps recently as outlined in their blog post:

- sold the Circle Trade OTC business to cryptocurrency exchange Kraken;

- sold and spun out the exchange Poloniex into a standalone company, in order to focus on the stablecoin and “practical U.S. regulatory reality”;

- ended the standalone Circle Pay application, though the underlying platform technologies will be part of our new stablecoin platform services.

Finally, the platform also announced that Neville will exit his co-CEO management position, but will maintain the connection with the company as an independent director on the Circle Board of Directors. Moreover, Coinbase and Circle opened doors to new USDC issuers in June.

However, some experts raise questions about the future of stablecoins, arguing that “it is highly likely that fiat-based stablecoins will become redundant” and “stablecoins could find themselves killed off by harsh regulatory environments in major countries.” There’s also the longer term threat of digital currencies issued by central banks, which could compete directly with stablecoins in terms of providing non-volatile digital assets and fiat-crypto onramps

___

Learn more: EU Confirms its Firm Stance on All Stablecoins, Not Facebook’s Libra Only