Paxos Standard Token (PAX) is a regulated ERC-20 stablecoin, which maintains 1:1 parity with the U.S. dollar. It was issued by the Paxos Trust Company on September 14, 2018, and is regulated by the New York State Department of Financial Services (NYDFS).

What is Paxos Standard Token (PAX)?

Paxos Standard Token (PAX) is an ERC-20 token issued on Ethereum blockchain. As a regulated stablecoin collateralized by the U.S. dollar, it brings benefits of the blockchain technology and stability of fiat currencies together.

It results in a steady cryptocurrency which offers:

- Instant worldwide transactions

- Immutability

- Decentralized accounting

- 24/7 transactions

On top of that, every PAX token is fully backed by the equivalent amount of U.S. dollars, meaning it can also be redeemed for USD at any time. However, according to U.S. Law, Paxos Standard isn’t a security.

PAX Standard was established in the light of the infamous Tether controversy, where the leading market stablecoin has come under scrutiny for printing Tethers out of thin air during the early 2018 crypto market bull run. Paxos team has noticed the opportunity and made an extra effort to be as transparent as possible. Paxos issues and burns its tokens using an audited smart contract, inspected by smart contract auditor Nomic Labs. Withum, one of the top U.S. auditing companies, regularly verifies the reserves.

Who Is The Team Behind Paxos?

Paxos team consists of seasoned professionals from diverse backgrounds, including former Wall Street and Silicon Valley employees. The company is led by its co-founder and CEO Charles Cascarilla.

Paxos Vision

Paxos team sees a future in which blockchain isn’t a part of a major financial revolution, but an essential element of its evolution. In the big picture, the company wants to improve the economic ecosystem by developing a global frictionless network for simple, mobile and instant exchange of assets.

How Does Paxos Standard Token Work?

Paxos Standard is designed to have growing use cases. Today, it’s primary use case is to limit crypto asset volatility, remove friction from cross-border transactions, and become a reliable payment vehicle for crypto assets and other blockchain assets.

In the future, Paxos expects to be used for consumer payments and the stable store of value for people outside the U.S., especially in countries with unstable national currencies.

Here’s how tokenizing USD to PAX works:

1). A user sends USD to the token issuer’s bank account.

2). The issuer creates the equivalent amount of PAX using PAX smart contract.

3). The freshly minted PAX are delivered to the user while the USD is held in the bank account.

The same but reversed process is used to redeem PAX for USD. Every Paxos Standard token can be purchased and redeemed using Paxos.com. Upon PAX token redemption, the tokens are immediately burned and taken out of the circulation.

It’s worthy to note the company doesn’t charge any fees for both converting and redeeming PAX tokens. The minimal conversion amount starts at $100.

Paxos uses third-party auditors for proving they hold the corresponding amount of dollars. The monthly attestation reports can be found here.

Is Paxos Standard Token Different From Other Stablecoins?

The Paxos website emphasizes the following features of PAX:

- Regulation. Paxos is regulated by the New York State Department of Financial Services.

- Guaranteed cash deposits. Every collateralizing deposit is held at FDIC-insured U.S. banks.

- Audited. Every Paxos Standard bank account is overseen by U.S. auditing firm Withum.

- Security. Paxos employs additional transaction monitoring and surveillance partners for an extra layer of compliance.

- Daily purchase and redemption windows. PAX tokenization and redemption requests are processed in regular windows that facilitate free and frequent fund movement. Every operation is usually done within one business day

- No fees. Paxos Standard tokens are issued and redeemed without any extra charges.

These features make PAX like the other recently emerged stablecoins – USD Coin (USDC), TrueUSD (TUSD) and Gemini Dollar (GUSD). All of them are fully redeemable regulated ERC-20 tokens backed 1:1 which are backed by U.S. Dollars, uses Ethereum smart contracts to issue and burn tokens, and are overseen by the U.S. auditors and regulators. Besides, none of these platforms charge transaction/conversion fees (despite few exceptions).

The most significant difference between PAX and its rivals are different partner organizations and more efficient operations due to its “processing windows.”

All the fresh stablecoin projects are designed to decrown the longstanding market leader Tether (USDT). It employs a similar model but has refused to conduct regular audits and provide credible attestations. Yet, most USDT coins are issued on Omni protocol.

The only fundamentally different stablecoin within top 100 coins is DAI. This Maker’s project isn’t fiat-collateralized but still strives to retain value relative to USD.

Here’s a brief overview of four different types of stablecoin projects:

- Fiat-collateralized. These include all stablecoins pegged to reserved fiat value. All fiat-collateralized coins are centralized by design. Examples: Tether (USDT); TrueUSD (TUSD); Gemini Dollar (GUSD); Paxos Standard Token (PAX); Digix Gold (DGX); USD Coin (USDC).

- Crypto-collateralized. These are the stablecoins whose value is pegged to reserved crypto assets. Examples: Makercoin (MKR & DAI); Havven (nUSD & HAV).

- Algorithmic non-collateralized. Software-based economic models that seek to provide price stability without any collateralized assets. Example projects: Basis; Kowala; Fragments.

- Hybrid. The stablecoins which rely on a blend of the approaches listed above. Example projects: Carbon.

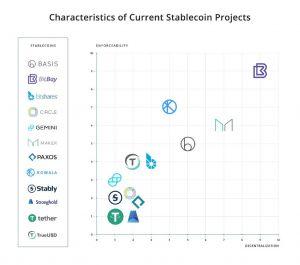

BitBay, another crypto stablecoin project, recently has shared an interesting crypto comparison matrix, which sheds some light on how the most popular stablecoin projects stack up. Although, the axes of “enforceability” and “decentralization” are vague.

Where to Get Paxos Standard Token?

Paxos keeps on landing new partnerships with popular exchanges. Some of them are:

Binance (paired with BTC, USDT, ETH, XRP, EOS, XLM, BNB).

Bittrex (paired with BTC, USDT).

DigiFinex (paired with USDT).

OKEx (paired with BTC, USDT).

ZB.COM (paired with BTC, USDT, ETH, ETC, LTC).

CoinBene (paired with USDT).

CPDAX (paired with BTC).

Hotbit (paired with BTC, USDT, ETH).

BCEX (paired with USDT).

Coinsuper (paired with USD, BTC).

Gate.io (paired with USDT).

UEX (paired with BTC, USDT).

Bitrue (paired with BTC, ETH, USDT, XRP).

Kucoin (paired with BTC, ETH).

Bit-Z (paired with BTC, ETH, USDT).

Upbit (paired with BTC).

ABCC (paired with BTC, USDT).

OKCoin International (paired with USD).

FCoin (paired with USDT).

Paxos Standard Tokens can also be exchanged using Paxos.com website.

Where to Store Paxos Standard Token?

PAX is an ERC-20 token issued on the Ethereum blockchain. Therefore, it can be stored in any Ethereum wallet. The most common ETH wallet options include MyEtherWallet, MetaMask, Mint or Jaxx. If this is your first time getting involved with Ethereum, you can find guidance in one of our quick Ethereum guides.

Current State of The Project

Paxos has entered the crypto “bear market” and became one of the fastest growing stablecoins. Its team continuously works on new partnerships. Some of the latest announcements include PAX listing on Binance and partnerships with companies like Bitpay and Global Bitcoin Payment Service, and others.

In the future, Paxos expects to become the crypto market leading coin.

Similar Projects

If you enjoyed learning about PAX, you might continue exploring other stablecoins, like:

Tether (USDT). The oldest and most popular USD-backed stablecoin used by many exchanges.

USD Coin (USDC). USD-backed ERC-20 token by Circle.

Gemini Dollar (GUSD). USD-pegged regulated ERC-20 token issued by Gemini exchange.

TrueUSD (TUSD). An ERC-20 USD stablecoin launched by the TrustToken project.

Dai (DAI). ERC-20 stablecoin, backed by USD.