On-Chain Data Suggests Bitcoin Whales are Unloading BTC at a Record-Breaking Rate – What’s Going On?

Bitcoin (BTC) whales are now unloading coins at a pace never before seen as measured on a 30-day basis.

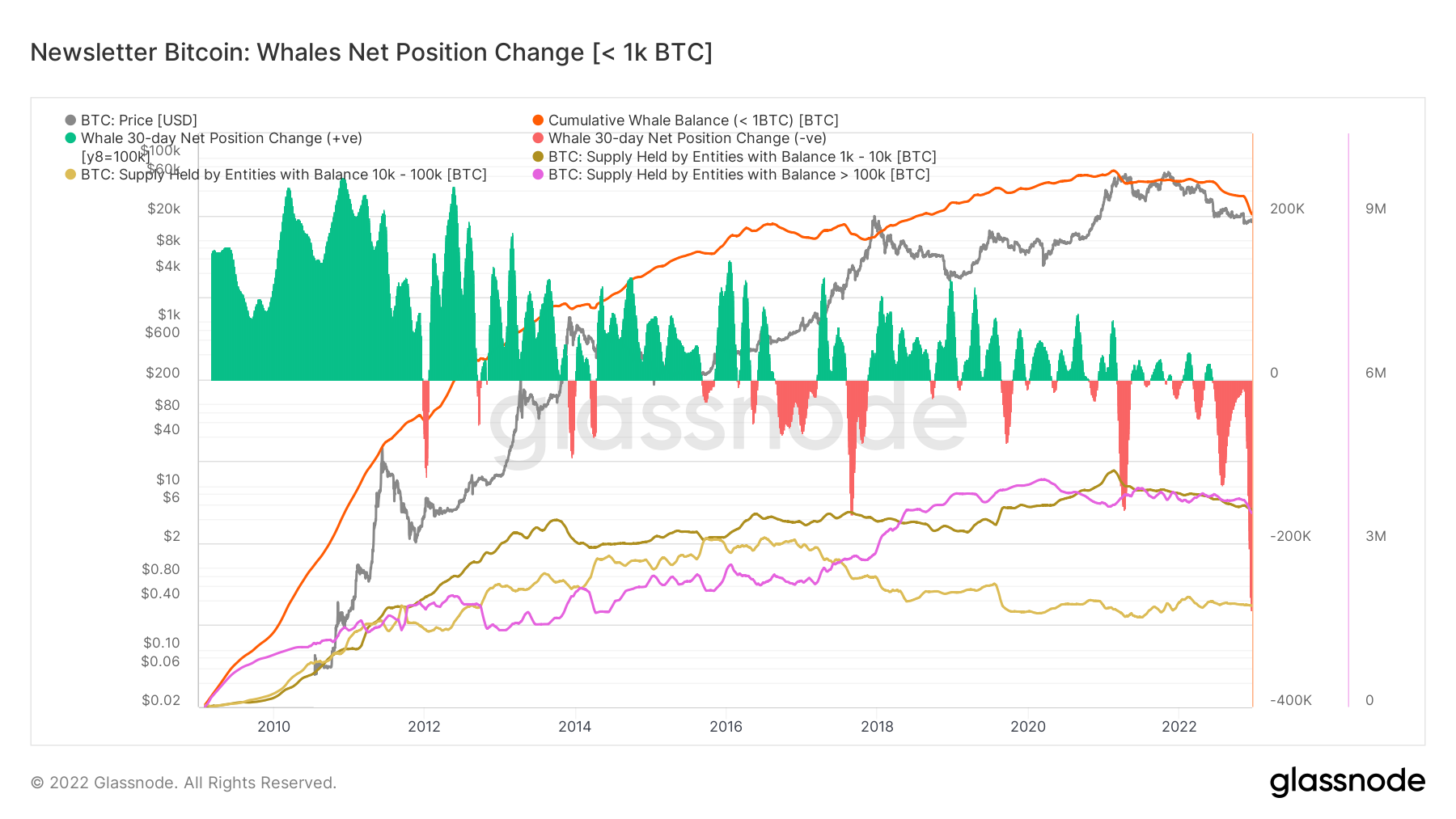

In total, whales have offloaded some 280,000 BTC in the past 30 days, data from the on-chain analysis firm Glassnode showed as of Sunday. That is the highest number in any 30-day period, according to the firm.

According to estimates, the so-called Bitcoin whales – defined as those holding more than 1,000 BTC – control a combined 9 million BTC. The massive number makes up nearly half of the circulating BTC supply, which currently stands at 19.24 million BTC.

Broken down into smaller segments, the Glassnode data showed that whales with between 1,000 and 10,000 BTC hold a combined 3.6 million coins, those with between 10,000 and 100,000 BTC hold a combined 1.9 million coins, and those with more than 100,000 BTC in their wallets hold 3.6 million coins.

It is unclear exactly why the Bitcoin whales have been selling coins, but it could be related to fears around Binance and other crypto exchanges in the wake of the FTX collapse. Questions have been raised online after Binance released its proof-of-reserves report by auditing firm Mazars, which some have claimed is of little value.

Others, such as on-chain analysts at CryptoQuant, have said Binance’s on-chain reserves “are not showing ‘FTX-like’ behavior at this point.”

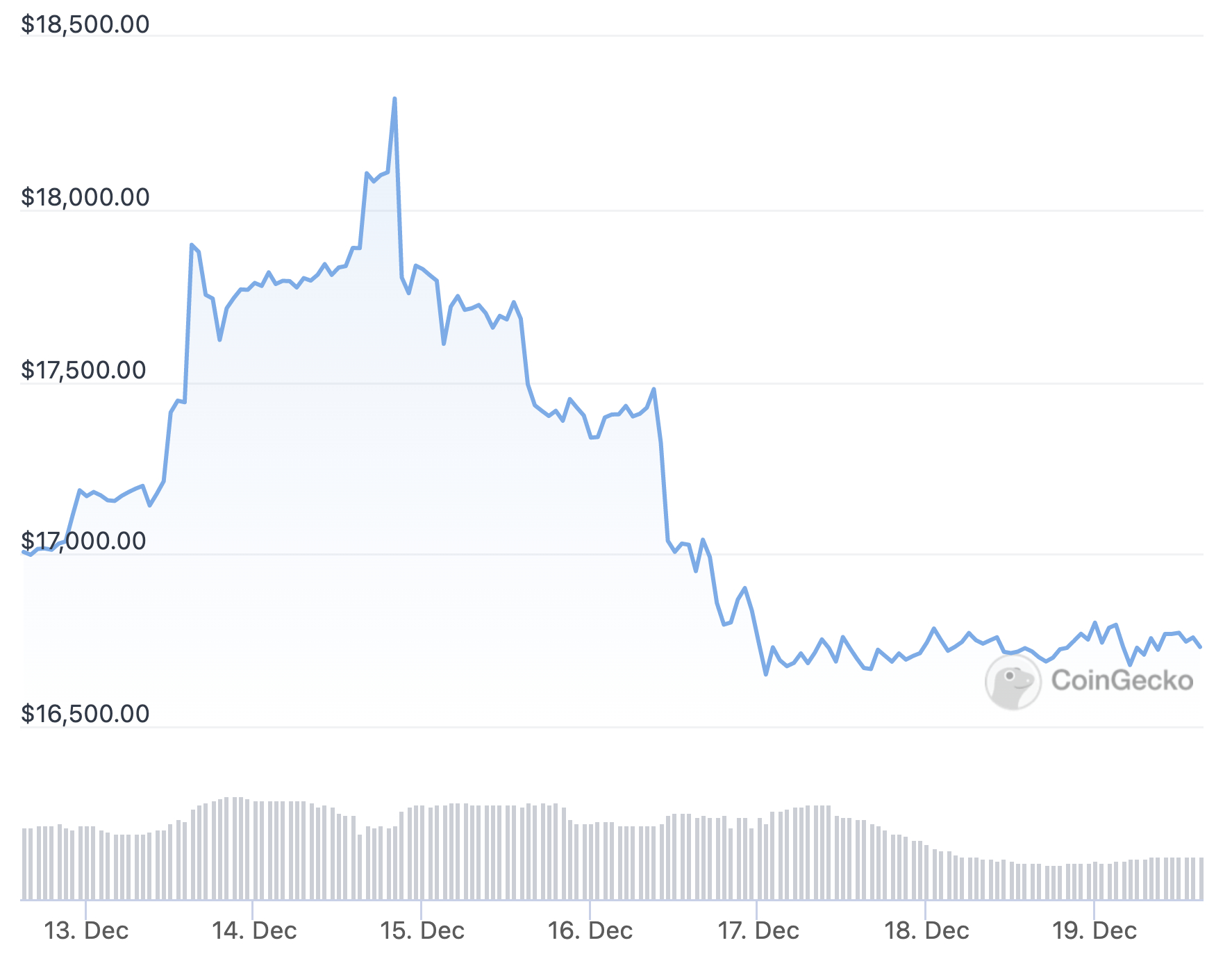

Despite the news of the record selling by whales, bitcoin’s price has remained remarkably stable over the past 24 hours. As of press time on Monday, the price was up a mere 0.1% for the past 24 hours to 16,743. For the past 7 days, the price is down just 2%.

Bitcoin’s supply is capped at 21 million coins, a milestone that is expected to be reached in the year 2140. However, many coins have been lost over the years, which means that the actual circulating supply can be expected to be much smaller than that.