Bond Yields Nearing Zero Offer Support to Bitcoin – Analyst

While some analysts now point out that bitcoin (BTC) is looking somewhat weak from a charting standpoint, others are painting a bullish picture for bitcoin, with lower bond yields and a weak stock market, leading investors to look for alternatives outside of the financial system.

Among the many analysts who point to the current economic backdrop to build a bullish case for bitcoin is Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence. Writing on Twitter on Monday, McGlone said that bond yields that are headed “toward zero,” combined with a volatile stock market and rising national debt levels are improving the “fundamental and technical underpinnings” for both gold and bitcoin, and that this is even more so the case now compared to before the COVID-19 outbreak.

Elaborating on the tweet, a Bloomberg article on Monday cited a note written by McGlone as saying that he expects bitcoin to continue rising this year, although at a slower pace compared to earlier:

“In the third year since its peak, we expect Bitcoin to continue doing what it has been, appreciating, but at a languid pace […] Bitcoin’s 2020 average price about USD 8,070 to April 17 is the highest annual measure ever, indicating a market that is simply marking time.”

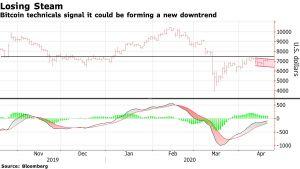

Despite this bullish statement, bitcoin’s MACD (moving average convergence-divergence) indicator shows that the asset’s bullish trend is losing steam.

However, despite this bearish technical picture, there are more high-profile investors and analysts who are bullish on bitcoin for the same reasons as Bloomberg’s commodity strategist.

Among them is the popular investor and Real Vision founder Raoul Pal, who voiced a similar view about the bond market, saying:

“I know it’s not a popular view, but I don’t see any way that the dollar doesn’t explode higher and US rates don’t go negative…I think they go hand in hand and it’s coming soon.. Yes, and I’m still bullish bitcoin and gold. Also not mutually exclusive.”

Pal also posted a chart showing just how close US 5-year treasury bonds are from falling to zero:

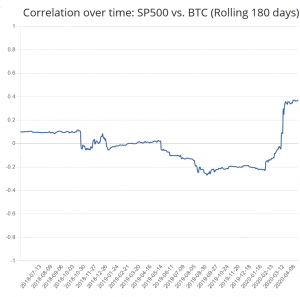

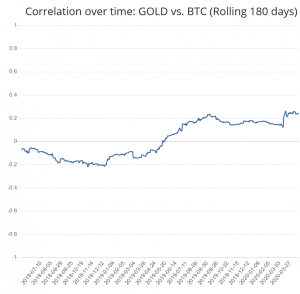

Despite the overwhelming support for both bitcoin and gold from macro-focused investors and analysts, however, the question of whether bitcoin is correlated to stocks, gold, or any other asset remains a controversial topic.

Data from Blockchaincenter.net shows bitcoin is indeed not correlated to gold, the traditional safe haven in the world of finance. Further, the data shows that bitcoin and the stock market – represented by the S&P 500 stock index – were not positively correlated until the COVID-19 crisis hit the markets, after which it saw a weak, but growing correlation.

__

At pixel time (10:39 UTC), BTC trades at c. USD 6,860 and is down almost 4% in a day, erasing all its weekly gains and trimming monthly gains to less than 10%. The price is up by 30% in a year.