Bitcoin Plays With USD 8,000, Crypto Market Cap Jumps 8%

The most popular cryptocurrency, Bitcoin just took another USD 1,000 leg up this week and trades above USD 8,000 today, while the absolute majority of other coins out of the top 100 are in green, also (15:05 UTC.) (Updated on 15:12 UTC, to reflect price changes.)

After surpassing USD 8,250 earlier today, Bitcoin corrected lower, to USD 8,037, a level last seen in July 2018, and is still up by almost 8% in the past 24 hours. Also, Bitcoin dominance, or percentage of total market capitalization, increased to almost 59%. At pixel time, total crypto market capitalization is almost USD 240 billion.

BTC price chart:

Other major coins are also registering strong gains today: Ethereum is up by more than 6%, XRP rallied 28% and other tokens among the top 10 are up 2%-13%.

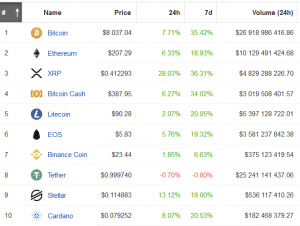

Top 10 coins by market capitalization:

(15:05 UTC)

“There are more than a dozen reasons why the crypto markets are surging lately, <…> but the ultimate reasons are nothing new and can be explained quite simply. Bitcoin has a strictly limited supply of 21 million coins that will ever be minted,” Mati Greenspan, senior market analyst at the eToro trading platform, said, adding that each time we get a wave of demand, there simply aren’t enough coins to go around, which pushes the price up at a rapid pace.

The analyst reminded that about 4 million of bitcoins have not yet been mined and another 4 million are estimated to be lost for good.

“So, the circulating supply at the moment is closer to 13 million coins. Of those, there are a lot of people who are simply not willing to sell at any price. So the liquidity of this market is incredibly thin,” Greenspan explained.

He also stressed that bull runs aren’t made in a single day and the market has been building up to this ever since the mid-December low. Moreover, the volumes have also been incredibly strong lately.

“As we know, bitcoin tends to go through some massive boom and bust cycles.<…> If the cycle repeats itself and we do see a 1,000% surge from the recent lows, that will bring the price up to USD 31,000. Given that crypto adoption is still in the very early stages, suddenly price predictions like USD 50,000 to USD 100,000 per coin don’t seem so incredibly insane,” the analyst said, stressing that this is still “an incredibly risky investment”.

“There’s even a fair chance that it will go from here straight to zero. Especially after a surge like we saw this weekend, I’d say that a minor retracement can probably even be expected,” he added.

Meanwhile, on Monday, a few bullish announcements broke the news:

- A bunch of high-profile retailers now can accept payments in crypto.

- Bakkt aims to list Bitcoin Futures in the coming months.

- Bitfinex claims it raised USD 1 billion.

- Microsoft announced they’ll be launching a new network atop the Bitcoin blockchain.

Moreover, CME Group said that CME Bitcoin futures reached an all-time high on May 13:

Meanwhile, Jeff Dorman, Chief Investment Officer at Arca, a Los Angeles-based crypto investment management firm, said in a blog post that “We’re now in a period where all of the bad news is largely ignored and brushed off.”

“However, it’s important to keep some perspective. Even after this rally, the market is just now back to November 2018 levels. Bitcoin may have risen 100% in a few months, but it’s still -65% from [all-time highs] (meaning, a 100% rally barely makes a dent in the scheme of last year’s losses),” he stressed.

_____

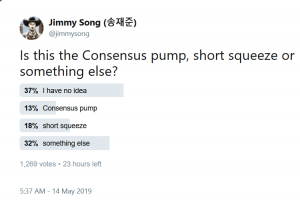

Reactions:

__

__

__

__

N.B.: TD Ameritrade is not trading crypto yet, read more here.

__

__

__