Bitcoin Price and Ethereum Hold Crucial Support, Huobi Gains 75% In A Week

The Bitcoin price is trading choppy near $19,189 after being rejected below the $19,950 resistance level. While Ethereum‘s price has dropped by more than 2% to $1,298.

Since About Capital bought out the Huobi platform and appointed Sun as an advisor, the price of Huobi Token has skyrocketed. Therefore, Huobi remains in the spotlight after gaining more than 75% in a week.

Global Market Cap

During the early Asian session, most of the cryptocurrencies were trading negatively, as the global crypto market cap fell 1.9% on the previous day to $919 billion. The crypto market volume for the last 24 hours was over $64 billion, a decline of 23.4%.

The overall volume in DeFi is currently $3.8 billion, accounting for nearly 6% of the entire 24-hour volume in the crypto market. The volume of all stablecoins is now $59.9 billion, which is 93% of the total volume of the cryptocurrency market in a 24-hour period.

Top Altcoin Gainers and Losers

The top performers in the Asian session were Terra (LUNA), TRON (TRX), and UNUS SED LEO (LEO). The Terra (LUNA) price has risen by more than 3% to $2.8, while TRON’s price has risen by 3.5% to $0.063. In contrast, LEO’s price rose over 3% to $4.45.

The TerraClassicUSD price has remained bearish, falling nearly 10% in the last 24 hours to $0.046. Synthetix’s price has dropped more than 6% to trade near $2. The cryptocurrency market’s trading sentiment is slightly negative, and digital assets are struggling to rise.

Here are some of the events that stood out in the crypto news section:

US Retail Sales & Prelim UoM Consumer Sentiment

According to official data released on Friday, consumer spending was unchanged in September as prices rose rapidly and the Federal Reserve raised interest rates to slow the economy.

The advance estimate from the Commerce Department shows that sales in the retail and food services industries were flat in September after increasing by 0.4% in August. That was lower than the 0.3% increase predicted by the Dow Jones. Without accounting for automobiles, sales increased by 0.1%.

🔥 – BREAKING:

— Michaël van de Poppe (@CryptoMichNL) October 14, 2022

Retail Sales MoM come in at 0.0%, while 0.2% was expected and dropped from 0.3% from last month.

Core Retail Sales MoM 0.1%, while -0.1% expected, coming from -0.3% last month.

Import Prices: -1.2%

Export Prices: -0.8%

Prices still falling!

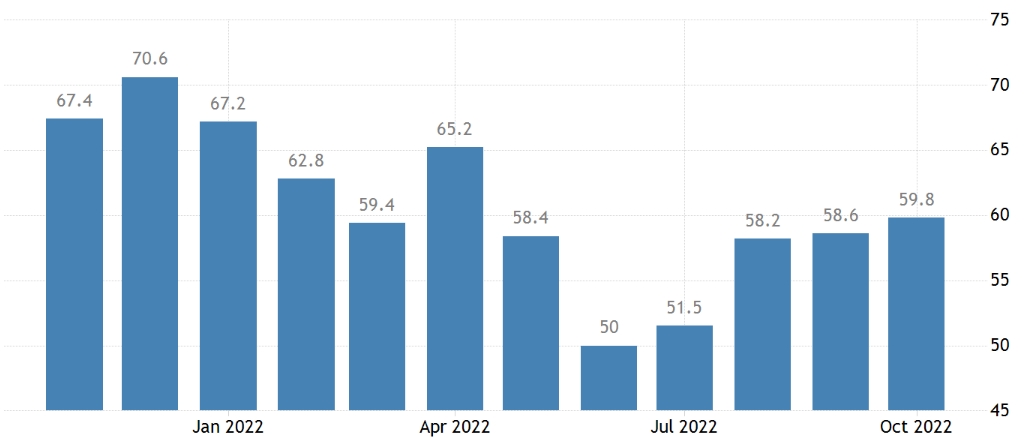

The University of Michigan‘s consumer sentiment figures, on the other hand, showed a significant improvement. Consumer sentiment increased in October 2022 to 59.8, the highest level in six months, from 58.6 the previous month and higher than market predictions of 59.

The score measuring perceptions of the immediate future of the economy increased to 65.3 from 59.7, but the latter dropped to 56.2% from 58.4%.

With stronger economic data, the Fed’s rate hike sentiment grows even stronger, driving the cryptocurrency market down.

Bitcoin Price

The current Bitcoin price is $19,191, with a $33 billion 24-hour trading volume. Bitcoin has dropped by more than 3% in the last 24 hours. CoinMarketCap is now the leader, with a $368 billion live market cap.

On the technical front, Bitcoin has found immediate support near $19,135 and has also crossed below the 50-day moving average, indicating a bearish trend. A break below $19,135 can push BTC’s price lower to previous triple bottom support near $18,709, while another break can take BTC to $18,246.

On the upside, resistance remains near $19,958. Investors are likely to consider selling if the price falls below $19,135 and vice versa.

Ethereum Price

The current price of Ethereum is $1,299, with a 24-hour trading volume of $11 billion. In the last 24 hours, Ethereum has dropped over 2%. CoinMarketCap now ranks #2, with a live market cap of $159 billion.

The ETH/USD pair is holding a critical support level of $1,292, which is supported by the 50-day moving average. Above this, ETH has a good chance of showing a bullish reversal, but the downward trendline will act as a barrier near $1,340.

A break of the $1,292 support level could expose ETH to the $1,269 or $1,225 support levels. Because the RSI and MACD are indicating a selling trend, investors are likely to wait for a bearish breakout before entering any ETH trades.

Huobi Gains 75% In A Week

Despite widespread losses across the cryptocurrency market, the Huobi Token’s value has soared by 75% in just the past seven days to trade near $7.5. The reason behind such a massive spike could be associated with the appointment of Tron founder Justin Sun as an advisor to Huobi.

I am very honored to be appointed as a member of the Global Advisory Board of @HuobiGlobal and work with industry, academic, and policy leaders to help guide and grow this innovative, vibrant, and resilient organization in its latest chapter of global expansion. Full sail ahead. https://t.co/txZspJaV4Q

— H.E. Justin Sun 孙宇晨 (@justinsuntron) October 9, 2022

Moreover, Sun’s name came up as a possible investor when the Chinese cryptocurrency exchange said it had been acquired by an investment firm called About Capital.

After joining Huobi last week as an advisor, Tron founder Justin Sun said that he had “tens of millions” of tokens on the exchange.

Sun has stated that the tokens are crucial to the company’s international expansion plans.

As shown in the chart above, Huobi is facing significant resistance near the $7.85 level, which has previously served as a triple bottom support. Under $7.75, the HT/USDT has formed doji and spinning top candles, which are likely to weaken the upward trend and may trigger a bearish retracement.

On the downside, HT has the potential to complete a 38.2% Fibonacci retracement at $6.65, while a further breakout could push it lower to $5.55, which represents a 61.8% Fibo level. Investors may consider selling below $7.85 and vice versa.

New Crypto Presales

Putting money into a fresh token presale is one strategy to beat the bearish crypto market and extreme volatility.

Our eyes have been on the IMPT token presale, a new cryptocurrency that has just crossed the $4.5 million mark in its initial seed round fundraising.

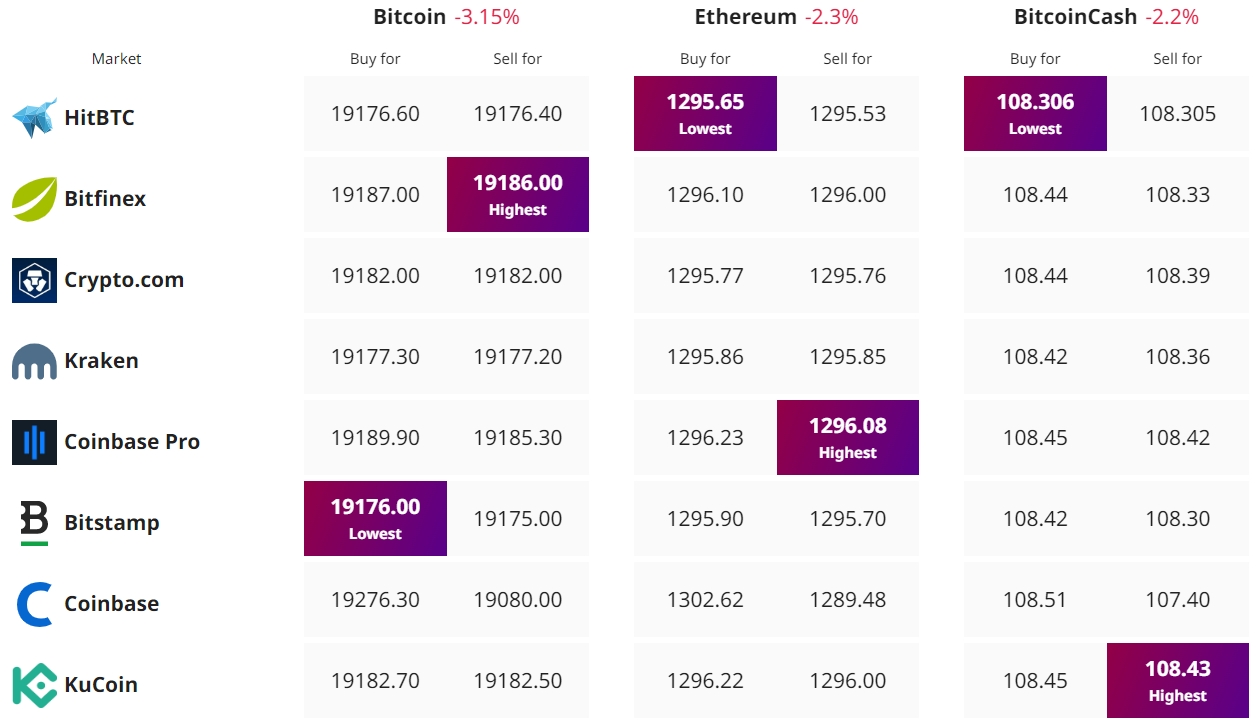

Find The Best Price to Buy/Sell Cryptocurrency