Bitcoin Price and Ethereum – Fear & Greed Index Signals “Extreme Risk”

Most cryptocurrencies were trading in the negative early on October 11, as the global crypto market cap fell 3.26% on the previous day to $916.30 billion. Over the last 24 hours, however, overall crypto market volume increased by 63.81% to $54.09 billion.

The overall volume in DeFi was $3.64 billion, accounting for 6.73% of the total 24-hour volume in the crypto market. The overall volume of all stablecoins was $51.01 billion, accounting for 94.31% of the total 24-hour volume of the crypto market.

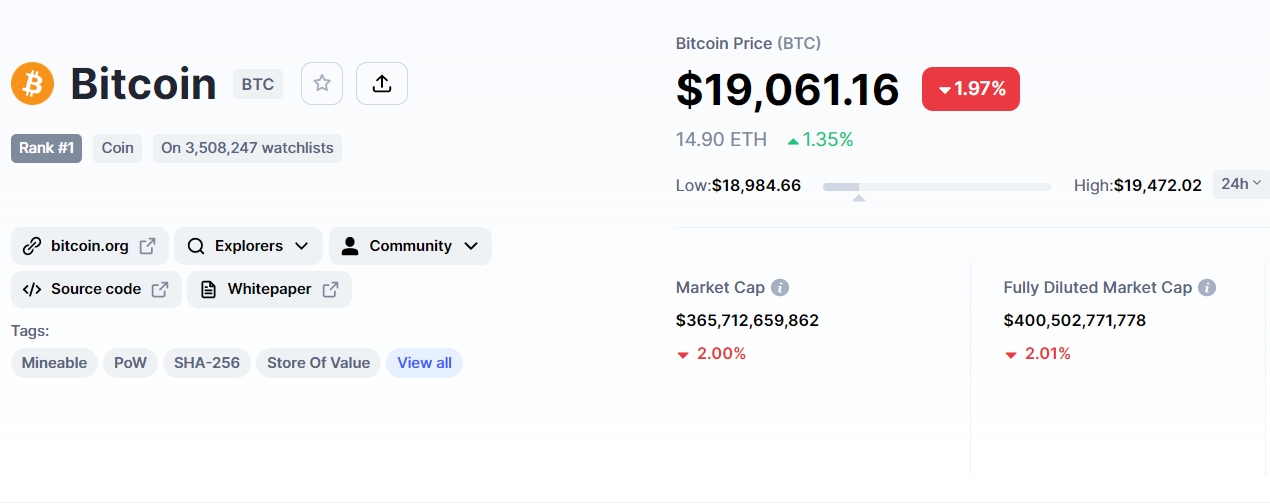

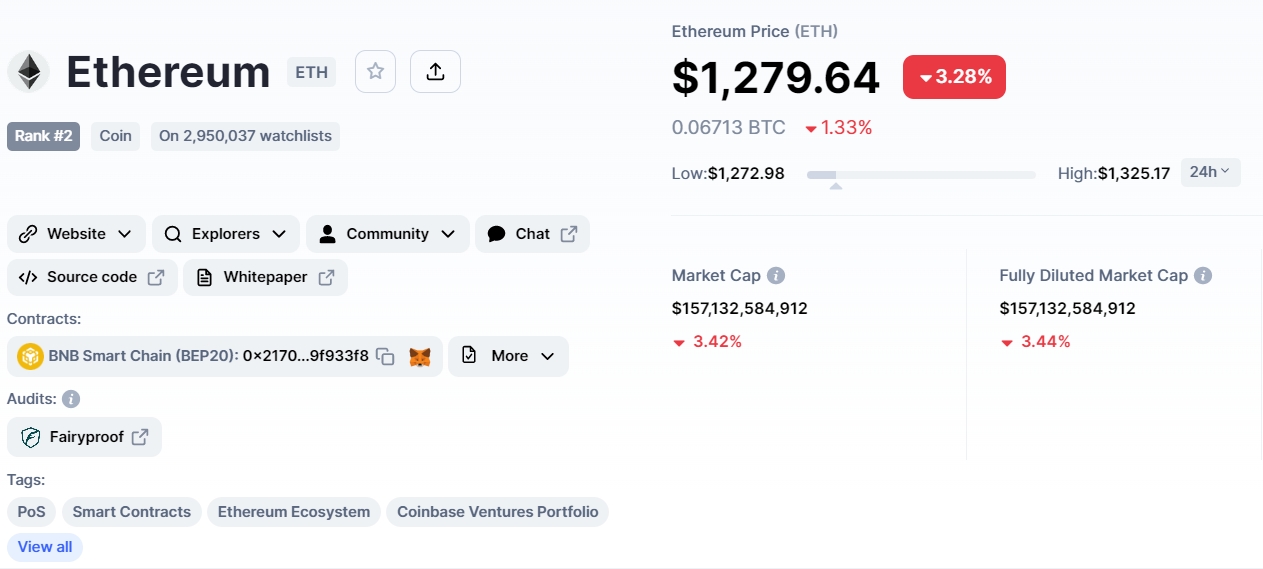

During the Asian session, Bitcoin is trading slightly bearish, dropping 2.05% in 24 hours to trade at $19,061.16. Whereas the second leading cryptocurrency, Ethereum, is down 3.28% to trade at $1,279.64.

Fear & Greed Index Signals “Extreme Risk”

Investors in the volatile cryptocurrency industry often show extreme displays of emotion. When the market rises, avarice can cause people to act in ways they later regret (fear of missing out). Also, the sight of red numbers often causes people to sell their coins for nonsensical reasons.

The Fear and Greed Index is here to protect you from making irrational decisions based on your own emotions.

On Tuesday, the cryptocurrency market remained in a “risk-off” mode, with the fear & greed index indicating “extreme fear.” Typically, investors avoid risky assets and continue to invest in safe-haven assets such as the US dollar, gold, and government bonds.

Extreme fear can indicate that investors are overly concerned. That could be a good time to buy.

Bitcoin Price

The current Bitcoin price is $19,071.56, and the 24-hour trading volume is $2.9 billion. In the last 24 hours, Bitcoin has dropped 2.01%. CoinMarketCap currently ranks first, with a live market cap of $365 billion.

Paul Tudor’s Remarks Underpin Bitcoin Price

Paul Tudor Jones, an investor worth a billion dollars and a prominent hedge fund manager, spoke with CNBC on Monday about Bitcoin and the state of the American economy. Jones established Tudor Investment Corporation. Forbes estimates his wealth at $7.5 billion at the moment.

Paul Tudor Jones Tells CNBC ‘Spectacular’ Times for Macro https://t.co/LNKt8tNL6a

— Bloomberg Markets (@markets) October 10, 2022

When asked whether he still has any Bitcoin in response to a query regarding its potential use as an inflation hedge, Jones said:

I’ve always had a small allocation to it [bitcoin] … In a time where there’s too much money, to much fiscal spending, something like crypto, specifically bitcoin and ethereum, that will have value at some point.

Moreover, We’re going to have to have fiscal retrenchment.

When questioned if the crypto he referenced will be “at a price much higher than where we are now,” the millionaire said, “Oh yeah I think so.”

Jones elaborated on his assessment of the American economy. When asked if the economy is in a downturn, he responded:

I don’t know whether it started now or it started two months ago. We always find out and we are always surprised at when recession officially starts, but I’m assuming we are going to go into one.

Hence, Paul Tudor Jones’ comments are benefiting Bitcoin and may help to support its price.

Bitcoin Price Prediction & Technical Outlook

Recalling my Bitcoin price prediction, the BTC/USD pair trading exactly in line with it and is falling toward an immediate support level of $18,970. The triple bottom pattern is likely to extend support here, and BTC may rebound if it can stay above this level.

The BTC is still bearish, with the 50-day moving average (MA) providing significant resistance at $19,850. A break below $18,970 support, on the other hand, may push BTC to $18416.59 or $17,709 levels.

A descending triangle pattern remains in place on the daily timeframe, and it is likely to keep BTC bearish until it breaks out of the $20,275 resistance level.

Bitcoin has the potential to challenge the next resistance level of $21,905 or $22,760 if it rises above $20,475.

Ethereum Price

The current price of Ethereum is $1,280.18, with a 24-hour trading volume of $9.6 billion. In the last 24 hours, Ethereum has dropped 3.44%. CoinMarketCap currently ranks #2, with a live market cap of $157 billion.

Ethereum Supply Turns Deflationary

Ethereum is confronting an inverse conundrum as the world’s banking institutions deal with unprecedented inflation. Ultrasound.money reports that since Saturday, the ether supply has decreased by nearly 4,000 tokens, but the price has not responded accordingly.

To date, the price of ETH has dropped 3.6% in the same time period, to $1,307 despite the shrinking quantity of ETH.

For the first time since the Ethereum network made its historic switch to proof of stake in September, the network has entered a deflationary run, with more ETH being destroyed than created.

XEN is over 40% of all Ethereum Transactions. pic.twitter.com/Y5HO5MLN9U

— XEN Crypto Official (@XEN_Crypto) October 8, 2022

A new token project, XEN Crypto, is to blame for the unexpected increase in Ethereum traffic and subsequent gas fee increase that caused ETH to deflate.

In the last 24 hours, XEN Crypto transactions consumed 40% of the total network gas, as reported by etherscan.io.

Typically, a declining supply drives an uptrend in the coin, but for the time being, investors appear to be pricing in a stronger US dollar and Fed rate hike expectations, keeping ETH under pressure.

Ethereum Price Prediction & Technical Outlook

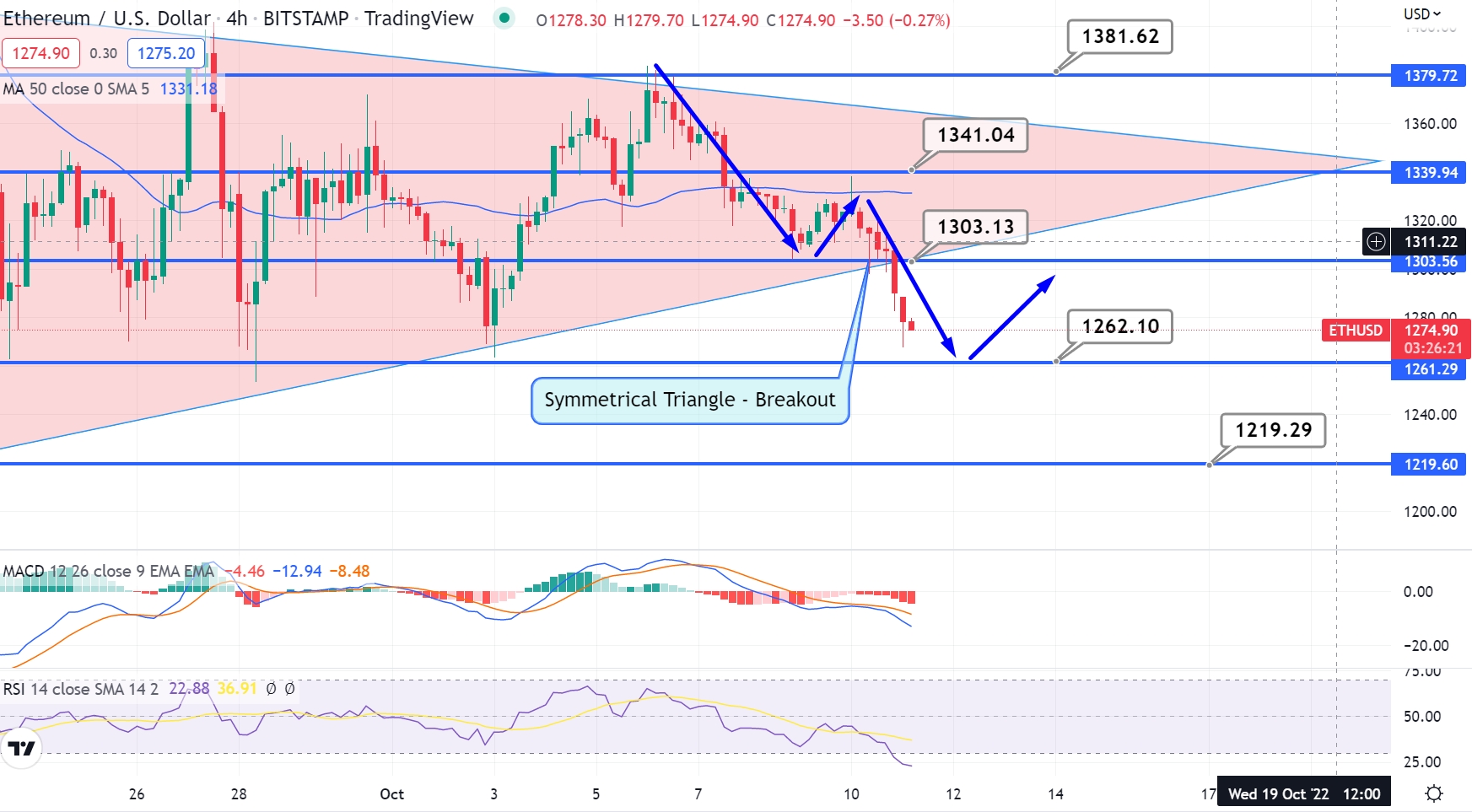

According to our previous Ethereum price prediction, the ETH/USD pair has broken through a choppy trading range of $1,300 to $1,400 on the bearish side, as well as a symmetrical triangle pattern.

ETH has formed a bearish candlestick pattern, “three black crows,” on the 4-hour chart, which is likely to keep Ether under pressure. Furthermore, the RSI and MACD have crossed below 50 and 0, indicating a strong selling trend in ETH.

The bearish breakout of the triangle pattern is expected to push ETH toward the $1262 immediate support level. Further down, ETH’s next level of support is at $1219.

New Altcoin News

Tamadoge, a meme coin, remains prominent amid its Ultra-rate NFTs, which are available on OpenSea, starting at 1 WITH. Tamadoge has risen to become the third most valuable meme coin in the cryptocurrency market and can be traded on multiple exchanges such as OKX, MEXC, BKEX, BitMart, and LBank.

The IMPT token, the project’s native currency, on the other hand, has performed admirably in its presale, raising $3.1 million since October 3. The presale is still open until November 25 or until it sells out.

Find The Best Price to Buy/Sell Cryptocurrency: