Bitcoin Price and Ethereum – Casper, Ethereum Name Service, & Maker Pump Near 20%

Early on October 10, major cryptocurrencies were trading in the negative, with the global crypto market cap standing at $944 billion, down 1.04 percent from the previous day. The entire cryptocurrency market volume in the last 24 hours is $31.85 billion, a 37.51% fall.

Bitcoin, the leading cryptocurrency, is consolidating near $19,460, up 0.08% during the Asian session.BTC has formed a Doji candle, followed by a strong bearish trend, indicating that bears have been exhausted and that bulls may enter the market to capture an oversold coin.

Similarly, Ethereum is trading choppy near $1,326, up 0.06%. The ETH/USD pair has yet to break out of the ascending triangle pattern I discussed in my previous report.

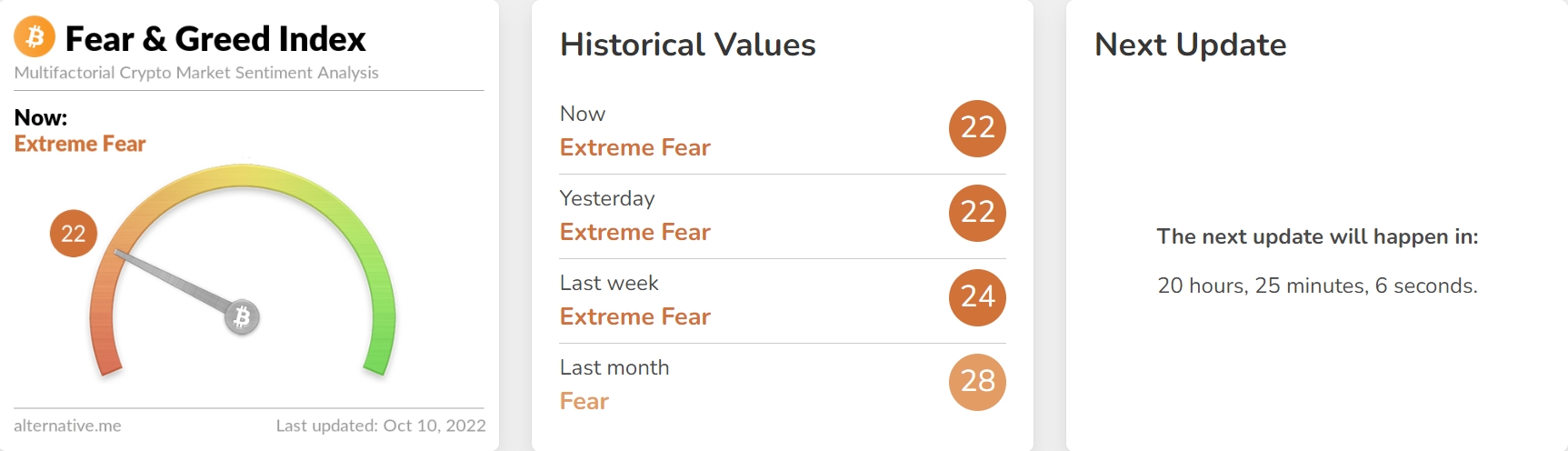

Fear & Greed Index Signals Extreme Fear

The market continues to trade with a risk-off sentiment, with investors preferring safe-haven assets such as gold and the US dollar. The fear and greed index indicates “Extreme Fear” in the market, which could be one of the reasons for the overall cryptocurrency market slowdown.

At the same time, investors believe that “Extreme Fear” is a good time to enter the market because most crypto coins are oversold, and this could be a good time to go long on an oversold coin.

Stronger US dollar & Fed Rate Hike Sentiment

On Friday, the US Bureau of Labor Statistics reported labor market figures for the United Statements. The US unemployment rate fell to 3.5% in September 2022, matching July’s 29-month low and falling short of market expectations of 3.75%. While nonfarm payroll employment increased by 263K in September, economists expected a 248K increase from the previous month.

With strong economic data, the US Federal Reserve may continue to raise interest rates, putting pressure on the crypto market. The market is taking a breather, just as expectations for further US interest rate increases are at an all-time high.

According to estimates, the US dollar may have a quarterly interest rate of 4.7%. If that is the case, the cryptocurrency market could recover in the spring of 2023, as expectations for interest rate cuts in the United States rise in tandem with falling inflation.

Robert Kiyosaki, the best-selling author of Rich Dad, Poor Dad, predicted that the US dollar would fall before January 2023. The price of Bitcoin, Ethereum, and other cryptocurrencies will rise.

Why I buy Bitcoin. Pension funds are biggest investment businesses in the world. https://t.co/Zo6VZEdR35

— Robert Kiyosaki (@theRealKiyosaki) October 7, 2022

This forecast comes as economic data indicate that the Fed’s monetary tightening efforts are beginning to bear fruit.

However, Michael Novogratz, CEO of Galaxy Digital, stated that while Bitcoin is still a great investment vehicle in the current environment, it is unlikely to surpass $30,000 by the end of the year.

https://www.twitter.com/TokenJay/status/1577334522978656258?s=20&t=g8l2t65jGyyFDW6SMIcPFgHe claims that the Fed’s efforts to combat inflation have significantly impacted Bitcoin and that the market can only grow if this policy is relaxed.

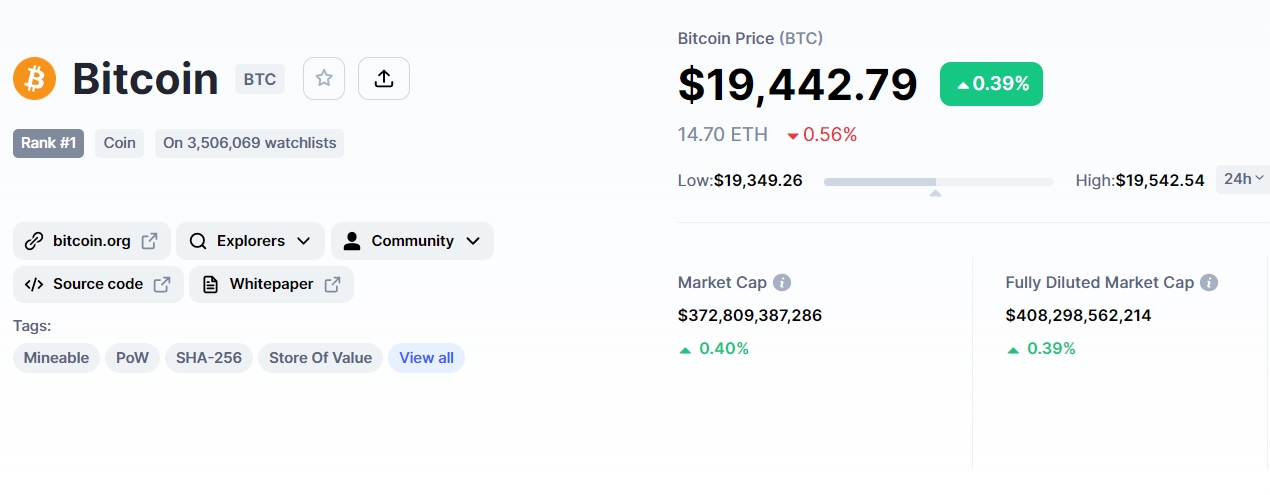

Bitcoin Price Prediction & Technical Outlook

The current Bitcoin price is $19,471.61, and the 24-hour trading volume is $17.39 billion. Bitcoin has increased by 0.46% in the last 24 hours. CoinMarketCap currently ranks first, with a live market cap of $373 billion.

Bitcoin has failed to regain its 2021 momentum. Furthermore, high Federal Reserve interest rates have hampered the price of other prominent cryptocurrencies.

Bitcoin has recovered this week due to an unexpected bitcoin price forecast from a well-known US regulator.

On the technical front, Bitcoin is expected to find immediate support near $18,970 and resistance at $19,950. The 50-day moving average (MA) keeps the BTC bearish while providing significant resistance at $19,950.

On the daily timeframe, a descending triangle pattern remains in place, and it is likely to keep Bitcoin bearish until BTC breaks out of the $20,275 resistance level.

Above $20,475, Bitcoin has the potential to challenge the next resistance level of $21,905 or $22,760. On the other hand, a break below $18,970 support may push BTC towards $18416.59 or $17,709 levels.

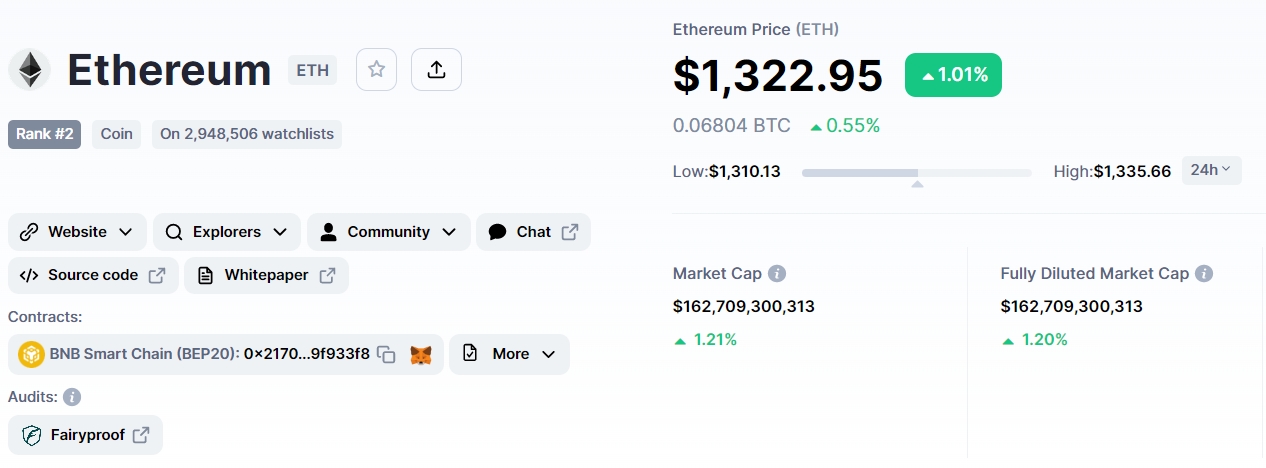

Ethereum Prediction & Technical Outlook

The current price of Ethereum is $1,325.77, with a 24-hour trading volume of $5.82 billion. In the previous 24 hours, Ethereum has gained 1.20%. CoinMarketCap now ranks #2, with a live market cap of $162 billion.

Ethereum has been recovering after suffering significant losses due to the selling pressure from the Merge. According to recent data, there was a huge increase in the Ethereum network’s size, which might be good news for the altcoin.

Santiment, an on-chain intelligence tool, has shown that network growth has increased dramatically. Even more impressively, the surge was the highest increase in network size since December 2021.

largest rise in network growth on $ETH since DEC 2021

— Dean(I❤BTC) (@Deanicide) October 9, 2022

big moves coming!! data from @santimentfeed #ETH pic.twitter.com/TpWRqn2bRh

An increase in this measure suggested a rise in the number of unique addresses that sent Ethereum for the first time. That meant Ethereum was gaining popularity. However, Ethereum has the potential to exhibit a bullish trend; perhaps a stronger dollar is keeping it under pressure.

The ETH/USD pair is trading in the same narrow range of $1,300 to $1,400. An ascending triangle stays intact on the daily timeframe, extending resistance near $1,400 and offering immediate support near $1,300.

Leading technical indicators like the RSI and MACD are now diverging, with the RSI indicating a selling trend while holding below 50 and the MACD indicating a buying trend.

In contrast, the 50-day moving average implies a selling tendency in Ethereum. However, a bearish breakdown of the $1,300 level might bring ETH down to $1,225 or $1,110.

Casper, Ethereum Name Service, & Maker Pumps Near 20%

In addition to Bitcoin and Ethereum, the altcoins are also making headlines, having soared nearly 20% in the last seven days.

Casper Pumps 22.52%

Casper’s current price is $0.036241, with a 24-hour trading volume of $18 million. Casper has increased by 3.14% in the last 24 hours and nearly 22.52% in the last seven days. CoinMarketCap currently ranks #90, with a live market cap of $377 million.

Ethereum Name Service Storms 20%

In contrast to the general direction of the cryptocurrency market, Ethereum Name Service (ENS) has seen a rise of around 20% over the past week. The 98th-ranked digital currency began trading at $14.29 on October 3 and peaked at $17.48 on October 10.

The on-chain events were analyzed, and the development of ENS was found to be skyrocketing. Data from Santiment shows that after dropping to 3.146 on October 2, development activity on the ENS has steadily increased this week to reach 6.79.

Maker Pumps Up 17.50%

Recently, MakerDAO, the protocol’s governing body, announced that a community-wide vote that has been going on for months had been concluded. The poll aimed to choose the most profitable investment strategy for Maker treasury funds.

A new Executive Vote is live on the Governance portal.

— Maker (@MakerDAO) October 5, 2022

🗳 https://t.co/TMNDkvVqHB

Governance participants can use their MKR to pioneer a new real-world asset vault type.

Additionally, this Executive Vote includes MKR transfers and SPF funding.

Let's see the details.

↓

1/ pic.twitter.com/Aqd8ywjMFn

The result was a $500 million investment in corporate and short-term US Treasury bonds. The decentralized autonomous organization (DAO) authorized a pilot transaction of $1 million on October 6th, with the remainder of the funds to be transferred following community approval. The executive vote came from Maker token holders.

MakerDAO has supported reducing the concentration of collateral used to back DAI, reducing the risk to the DAI peg and MakerDAO’s solvency. It would also allow the DAO to deploy unspent funds and increase the protocol’s income.

In response to the voting, the MKR price has risen significantly, gaining nearly 20% in the last seven days. It is trading near $914.68, up 5.62% in 24 hours.

MKR is currently facing strong resistance near the $999 level, which is being extended by a downward trendline. A break above this level could push the price up to $1,187 or $1,393. At the same time, MKR’s support remains at $876 or $697.

New Altcoin News

Tamadoge, a meme coin, has gained traction since its yearly low of $0.01683. OpenSea is now selling ultra-rare Tamadoge NFTs for 1 WETH. Tamadoge has risen to become the third most valuable meme coin in the cryptocurrency market.

IMPT’s presale, on the other hand, remains in the spotlight. Despite the fact that the blockchain-based carbon credit marketplace launched its auction during a bear market in cryptocurrency, demand for the marketplace token remained high.

The IMPT token, the project’s native currency, has already raised an incredible $2.6 million after only seven days of presale, having sold 146.36 million tokens.

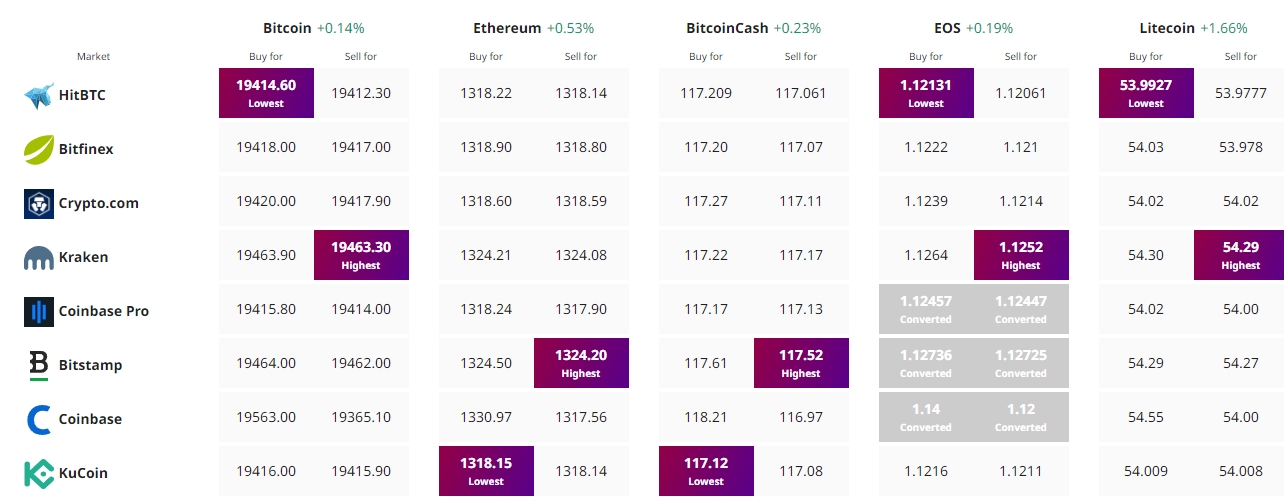

Find The Best Price to Buy/Sell Cryptocurrency: