Bitcoin Predicted to Continue Higher After Breaching USD 10k

After bitcoin (BTC) forcefully broke through the USD 10,000 mark on Sunday, followed by a flash-crash down to USD 9,700 on Monday morning, analysts now predict that even larger gains may lie ahead for the number one digital asset.

Source: iStock/bombuscreative

While the short-lived sell-off seen in the early hours of trading on Monday may have scared off some short-term speculators, the consensus in the community appears to be that this is normal profit-taking, potentially combined with a so-called “gap fill” on the CME futures market.

$BTC Update

— Hsaka (@HsakaTrades) February 10, 2020

First gap filled.

CME went from trading at a premium to Mex to a $200 discount momentarily. pic.twitter.com/aFdAABJisx

At pixel time (08:39 UTC), BTC trades at c. USD 9,943 and is down by 2% in a day, trimming its weekly gains to 6%. The price is up by 24% in a month.

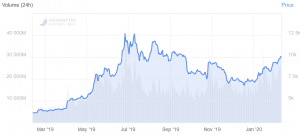

BTC price chart:

Source: coinpaprika.com

A gap in trading refers to the gap between the closing price one day and the opening price on the next trading day. In the case of the CME, trading is closed during weekends, and the futures market, therefore, has to catch up with that has happened in the spot market over the weekend. With large weekend moves in the underlying market, a gap up will be visible on the futures chart, and traders tend to “fill” these gaps by selling futures contracts.

Looking at the longer-term picture, however, Willy Woo, a popular bitcoin analyst, said the breakout we have witnessed in bitcoin is “the real deal,” given that “fundamental investment activity is backing” it.

Lower chart tracks investor velocity (the buy and hold people, not short term traders). This metric corrects for degradation of signal from coins moving off the blockchain onto layer 2 (exchanges etc), that was something NVT was prone to. It's proprietary to @AdaptiveFund

— Willy Woo (@woonomic) February 9, 2020

Sharing this bullish sentiment was also Anthony Pompliano, famous crypto personality and co-founder of Morgan Creek Digital, who shared his take on the breakout on Twitter, writing:

“Bitcoin just hit USD 10,000. I still think that Bitcoin will hit USD 100,000 by end of December 2021. Fixed supply. Increasing demand. Time will tell. #Bitcoin ₿”

And if that’s not enough, the recently bullish price moves are also supported by the much-discussed halving in bitcoin mining rewards, which is expected to occur in May this year. As pointed out by crypto exchange Coinbase on Twitter, halvings have historically been a precursor to large gains in the price of bitcoin.

In May 2020, #Bitcoin will experience its third “Halving.” Bitcoin is a digital asset with a fixed & predictable supply, unlike dollars. Bitcoin is designed to be scarce, like gold. Here’s what that means and why it matters in historical context: https://t.co/CLXp7Okb04

— Coinbase 🛡️📞 (@coinbase) February 7, 2020

However, opinions still vary whether it will happen again.

In terms of the broader economy, fears for a global economic slowdown, whether caused by virus fears or geopolitical issues, may also have made bitcoin a more attractive investment among some in the traditional asset management space:

“There’s certainly a narrative in the investment community that bitcoin is solidifying its place as a store of value, a flight to safety, inflation hedge,” Michael Sonnenshein, managing director of Grayscale Investments, told Bloomberg in a recent interview.

Lastly, the recent move in bitcoin also appears to be supported by technical analysis, with Rob Sluymer, a chartist at Fundstrat Global Advisors writing in a note shared by Bloomberg that “bitcoin appears to be in a textbook re-acceleration.” He added that any pullback would most likely be relatively shallow, and that bitcoin would then be “resuming its longer-term uptrend into year-end.”

Oh boy. Looks like we're forging ahead here.

— Mati (@MatiGreenspan) February 10, 2020

If I had to gander a guess, I'd put the next major resistance level just shy of $12k, right on the 3rd fib level.

Also looking forward to a golden cross, which will likely happen this week. pic.twitter.com/giGTMqTYXP

Learn more: Bitcoin Realism Is More Sustainable Than Altcoins Rally – Strategist