Bitcoin in ‘Oversold’ Area, Ethereum Down 54% from ATH as Markets Brace for Fed

Prices of major cryptoassets, including bitcoin (BTC) and ethereum (ETH) continued to fall on Monday, with technology stocks leading the way down as market participants are getting ready for a US Federal Reserve (Fed) meeting set to begin on Tuesday.

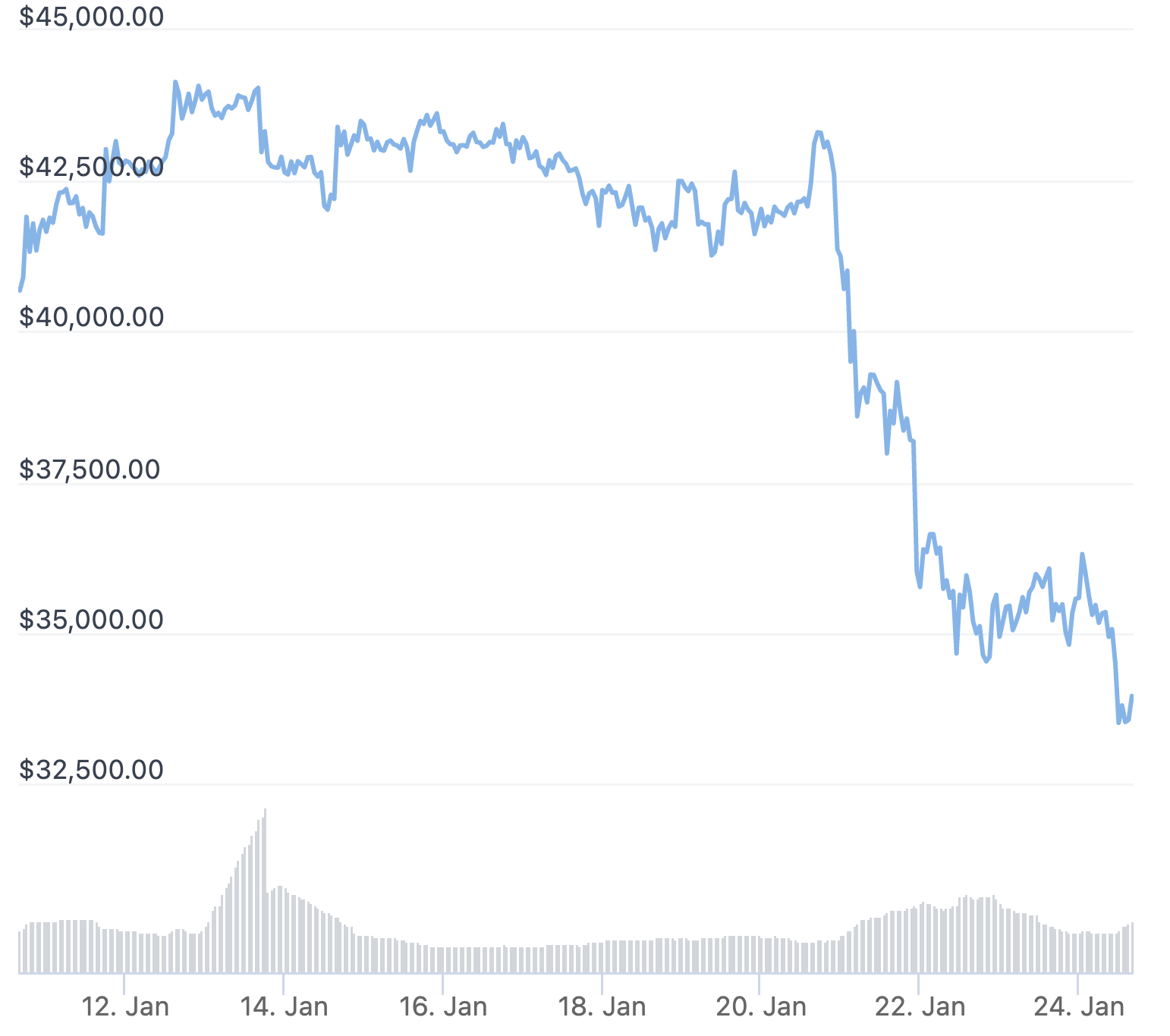

At 14:36 UTC, BTC traded at USD 33,690, down almost 5% for the past 24 hours and 21% for the past 7 days. The number one cryptocurrency has now dropped more than 50% from its USD 69,000 all-time high, dipping as low as USD 32,917 on Monday before later trimming some of its losses.

BTC price last 14 days:

Meanwhile, ETH stood at USD 2,225, down nearly 10% for the day and 34% for the week, down by close to 54% from its all-time high of USD 4,868.

ETH price last 14 days:

Although selling of the two largest cryptoassets has been intense over the past 24 hours, liquidations of leveraged futures positions in both coins were still relatively modest compared to the levels from Friday.

According to data from Coinglass, long liquidations of bitcoin futures reached USD 71.7m over the 12 hours from midnight to noon UTC on Monday, well below the USD 182m in liquidations seen during the same time period on Friday. Meanwhile, ETH long liquidations stood at USD 73.7m, compared to 107.5m during the same 12 hours on Friday.

The sharp moves in both crypto and traditional financial markets on Monday came as the US Federal Reserve is set to meet on Tuesday and Wednesday this week, with inflation expected to be high on the agenda.

The key issue investors are waiting for is how much interest rates will rise this year, and when the hikes will begin. According to a general consensus among economists, a 0.25% interest rate hike is expected in March this year. However, some analysts also said the Fed could act sooner than expected, CNBC reported today.

“We consider the higher risk is the [Fed’s] statement portrays an urgency to act soon, likely in March, in the face of very high inflation. The urgency could culminate in a decision to abruptly stop quantitative easing by mid-February,” analysts at Commonwealth Bank of Australia wrote in a note cited by CNBC.

Meanwhile, according to Dylan LeClair, senior analyst at UTXO Management and co-founder of the BTC-focused consultancy 21st Paradigm, bitcoin has largely followed technology stocks down, with the correlation between the Nasdaq stock index and BTC reaching one of its highest levels ever at 0.8.

Talk of the town has been the recent $BTC correlation to the Nasdaq (and other types of risk assets).

— Dylan LeClair 🟠 (@DylanLeClair_) January 24, 2022

Currently the Nasdaq is 14% off the highest and the most oversold its been since March 2020. The breakdown has been sharp.$BTC – $NDX 30 day correlation at 0.80

1/ pic.twitter.com/2i3tD71KN2

LeClair added that although a relatively large share of the bitcoin supply is currently in the hands of long-term holders, “strong spot demand” – and not demand from derivatives traders – is what is really needed for the bull market to resume.

“Volatility is your opportunity, and thankfully it doesn’t look like it’s going away anytime soon,” the analyst wrote.

Further speculating on when a bottom might be in, Ki Young Ju, CEO of the on-chain analysis firm CryptoQuant, suggested that traders could keep an eye on bitcoin’s market value to realized value (MVRV) ratio, saying that history suggests a “cyclical bottom” may be seen when the MVRV moves below 1.

MVRV is currently 1.50, which indicates #Bitcoin wallets still have +50% unrealized profits.

— Ki Young Ju (@ki_young_ju) January 24, 2022

If this is the end of the bull cycle, we should keep our eyes on this classic indicator to catch the cyclic bottom.

Historically, the cyclic bottom comes when MVRV reached below 1. pic.twitter.com/d2oOqdS8TF

The same metric was also pointed to by Ryan Selkis, founder of crypto analytics firm Messari, who this weekend told his Twitter followers to “buy BTC when MVRV dips below 1,” which he said is around USD 28,000.

https://www.twitter.com/twobitidiot/status/1484925117490728975?s=20Also speculating on when a bottom may be in from a technical analysis perspective, Marcus Sotiriou, an analyst at digital asset broker GlobalBlock, wrote in a note on Monday that the daily Relative Strength Indicator (RSI) has now reached its lowest level since the infamous COVID crash in March 2020.

Similarly, Sotiriou also noted that the weekly RSI is close to being in “oversold” territory with a reading of 37 (35.9 at 14:36 UTC).

“The fact that every bear market bottom for bitcoin has ranged between 29-35 on the weekly RSI suggests that the risk/reward is advantageous for buying in this area if you believe in the long-term value of this asset class,” the analyst wrote.

In addition to technicals like the RSI suggesting oversold conditions, Sotiriou also said that bitcoin appears to be trading in “a ranging environment rather than a trending environment,” and that this range is between USD 29,000 and USD 69,000. With bitcoin currently in the low USD 30,000 area, current prices could be “advantageous to buy,” the analyst said.

On the more bearish side, however, Crypto-TA.nl founder Crypto_Ed wrote that he expects further losses in the short-term, with USD 30,000 being a potential area of support.

“1 more (marginal?) new low is what I expect for today. Doesn’t change the bigger perspective: after some bounce another leg lower towards 30-32k,” the crypto trader said.

____

Other reactions:

Not so sure the top scenario is a short or medium term good one for Bitcoin, agreed on the others

— Alex Gladstein 🌋 ⚡ (@gladstein) January 24, 2022

Another reminder that we had three rate hikes in 2017 during the biggest crypto rally ever

— 朱溯 🐂 (@zhusu) January 24, 2022

https://www.twitter.com/MoonOverlord/status/1485577146043187207Hodl coins growing. Pleb buy #bitcoin now platforms running 🔥 hot > 90% buy ratio. Transferring btc to cold storage from the over leveraged and short-termists.

— Adam Back (@adam3us) January 24, 2022

https://www.twitter.com/Proof_0f_Watts/status/1485596916905881603I will finish by adding, I think being long SPOT BITCOIN here is completely reasonable. I believe price will resolve higher from these garbage levels once panic selling and capitulation has finalized

— ChimpZoo 🇸🇦 (@ThinkingBitmex) January 24, 2022

Maximum Gold Disdain vs. TINA – A key question of 2022 is what stops reversion of 2021 excesses facing #Fed restraint, which may shine on #gold. The elongated #stockmarket rally, recent commodity bounce and competition from #Bitcoin may have pushed the metal to maximum disdain – pic.twitter.com/CNpMZTA9Zc

— Mike McGlone (@mikemcglone11) January 24, 2022

_____

Learn more:

– IMF Warns of Dangers of Fed’s Rate Rise, Brazil Says Inflation ‘Won’t Be Temporary in West’

– Two Main Macro Scenarios in Play for Bitcoin & Crypto in 2022 – CryptoCompare

– Bitcoin, Ethereum Could Benefit If Stocks Drop After Fed Tightening – Strategist

– What is the Fed taper? This Is How the Federal Reserve Withdraws Stimulus

– Arthur Hayes Tells Crypto Traders ‘It Pays to Wait,’ Stronger USD Coming

– How Global Economy Might Affect Bitcoin, Ethereum, and Crypto in 2022