Bitcoin Now Retail Inflation Hedge, Experts Agree – and Altcoins May Follow Suit

The most popular cryptocurrency, bitcoin (BTC) has become a mainstream hedge as a store of value – for a diversifying set of investors, experts have claimed, with altcoins also set for a retail boost further down the line.

A broadening tranche of analysts and industry insiders are adding their voices, as Jeff Currie, the Head of Commodities Research at Goldman Sachs, told Bloomberg TV,

“I would argue that bitcoin is the retail inflation hedge. You look at gold. People like to say it stole demand from gold. There’s really no evidence that it has.”

He added that if “you overlay a chart of bitcoin on the price chart for copper they look very similar,” also opining that other metals have similar correlations with BTC at that gold and bitcoin can co-exist.

His comments echoed sentiments expressed by PwC’s crypto lead Henri Arslanian, who told the same media outlet that “institutional investors are coming in and that pretty much changes their game when it comes to the whole cryptoassets market.”

Arslanian added,

“[We] have seen on numerous companies buy bitcoin as part of a treasury because they see it as a hedge against inflation. So I think many people are now seeing it as that.”

This kind of “positioning” toward bitcoin is “particularly” coming “from a lot of the more traditional financial” firms “or corporates,” he concluded.

The experts were speaking as BTC and altcoins appear to be correcting their gains, with BTC now consolidating after failing to clear the USD 23,200 mark today.

At the time of writing (15:59 UTC), BTC trades at USD 22,550 and is down by 3% in a day, trimming its weekly gains to 24%. Meanwhile, other cryptoassets from the top 10 club are down up to 6% today.

Industry insiders have been having their say, too.

Philip Gradwell, the Chief Economist at blockchain analysis firm Chainalysis, wrote in his newsletter yesterday that he expected to see “significant swings in the price over the next few days as the market tries to find a balance between demand and supply.”

However, he expressed no shortage of optimism, adding,

“I don’t expect to have to wait as long for a new all-time high after today as I did after December 17, 2017. In 2020, bitcoin has matured as a financial asset that is well suited to our current macro environment and due to this large investors have purchased millions of bitcoin, significantly reducing the remaining supply available to buy.”

There was yet further reason for festive BTC cheer as Gradwell wrote that with the macro environment “unfortunately unlikely to change soon,” high prices would “attract even more demand, likely pushing prices higher.

He also stressed that there is much less liquidity in the current market than there was in 2017, which would explain the rapid price increase this week.

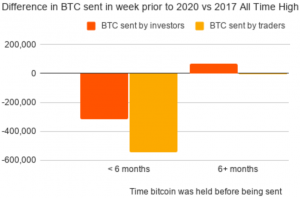

801k fewer BTC were sent in the week prior to 2020’s all-time high (ATH) vs. 2017’s ATH, with 546k fewer BTC sent by short term traders:

“Interestingly, investors who have held bitcoin for 6 or more months have added 68 thousand bitcoin to current liquidity relative to 2017. This suggests that some investors are taking a more calculated view of the market this time around and realizing their gains rather than remain long,” he added.

Meanwhile, Konstantin Anisimov, the Executive Director of the CEX.IO trading platform, told Cryptonews.com that the world better get used to the look of BTC at USD 20,000 – or even higher – stating,

“With its price sitting firmly above USD 20,000, its next goal seems to be the USD 25,000 mark. Meanwhile, USD 20,000 could become the coin’s new strong support level. With only two weeks remaining before the end of the year, many assume that the rally will be short, but impactful.”

However, he warned that sharp correction is also possible, “considering the time of the year and the upcoming winter holidays.”

“For the time being, BTC is testing out the new price range, occasionally encountering smaller resistances that fall rather quickly. The USD 25,000 level is expected to be the real obstacle for the coin, and it will be interesting to see if the surge will allow it to break this level and set up an even higher all-time-high before the year ends,” he added.

The CEX.IO chief concluded that “given the increasing demand from institutional investors who are looking to hedge against inflation” BTC could “double in price within months […] which will help it surpass USD 90,000 by the end of 2021.”

Meanwhile, Joe DiPasquale, the CEO of the crypto fund manager BitBull Capital, also told Cryptonews.com,

“[Regarding] retail interest in bitcoin, it is natural for retail traders to take an interest after an all-time high is broken. Only once bitcoin settles down in new price ranges can we expect retail interest to be directed towards altcoins.”

As reported earlier this year, major crypto exchange Coinbase claims that although most of its users initially favor BTC, the vast majority also go on to trade altcoins.

“Among customers with at least five purchases, 60% start with bitcoin but just 24% stick exclusively to BTC,” they said back then, adding that as people feel good about their initial crypto investments in bitcoin, they branch out to find other possible categorical winners, while BTC remains most investors’ safety net of choice.

___

Learn more:

More People Seem Interested in Buying Bitcoin (and Ethereum) Than Selling It

Bitcoin, Ethereum, XRP, Bitcoin Cash, Litecoin, Chainlink Price Predictions for 2021

Exchanges Send More USD 1M Bitcoin Transfers as Investors Look For a Hedge

This Bitcoin Cycle Is ‘Right On Track’ With ‘Striking Similarities’

(This article was updated at 17:01 UTC to add an interview with BitGo CEO.)