Bitcoin Mining Difficulty Nears All-Time High Amid Dropping Profitability

Today, Bitcoin (BTC) mining difficulty, or the measure of how hard it is to compete for mining rewards, jumped the most since January this year, nearing its all-time high and cutting into the profit margins of miners at the time when their business profitability is declining.

The measure jumped 9.26%, reaching 30.98 T and nearing its all-time high of 31.25 T, reached in May this year. The difficulty level is automatically adjusted roughly every two weeks to ensure there are 10 minutes between each block mined. Recently, it fluctuated around 9 minutes.

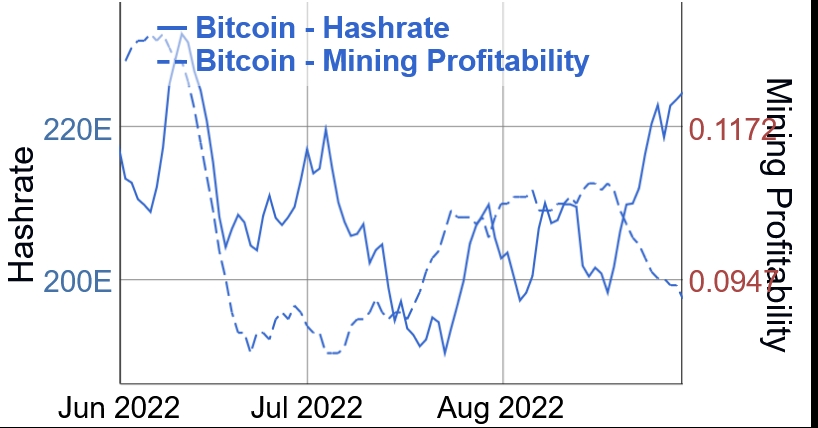

Meanwhile, since the previous difficulty adjustment on August 18, the mining profitability dropped by over 15% as the price of BTC also declined by more than 15%. Hashrate, or the computational power of the Bitcoin network, jumped in the same period of time.

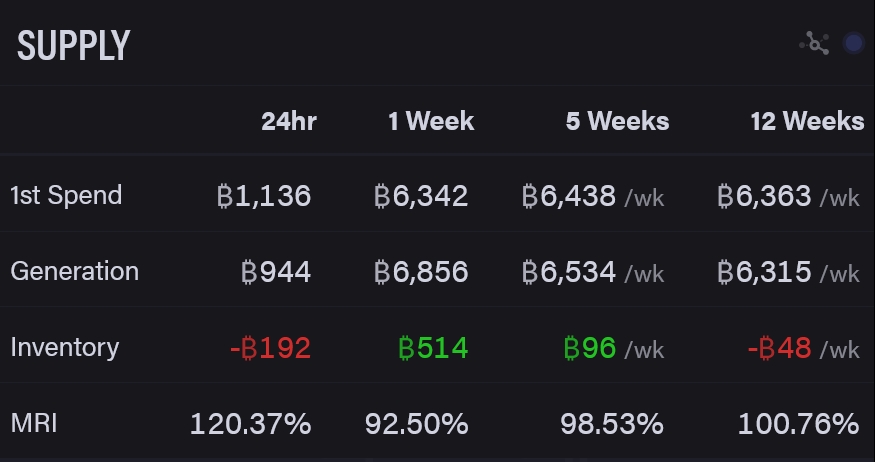

Also, in the past week, miners increased their net inventory of BTC.

At 08:19 UTC, BTC trades at USD 20,283 and is down 1% in a day and 6% in a week.

___

Learn more:

– Is It Time To Begin Talking Seriously About Bitcoin Tail Emissions?

– Bitcoin Miners in Q2 Sold 660% of What they Sold in Q1 – Report

– No ‘Black and White’ Answer to the Proof-of-Work vs. Proof-of-Stake Question, Says Kraken

– Q2 Saw Over 59% of Bitcoin Mining on Sustainable Energy Mix – Bitcoin Mining Council