Bitcoin, Ethereum Futures Volumes Decline Along with Decreasing Volatility

Along with decreasing volatility in the spot price of major cryptoassets, trading volumes in both bitcoin (BTC) and ethereum (ETH) futures contracts have also been on the decline across exchanges since the crypto market crash in mid-March.

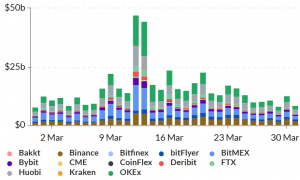

As would be expected, the futures market was most active during the major sell-offs on March 12 and 13, but has since declined steadily. The decline was seen across most marketplaces, although it was most pronounced on the major exchanges OKEx and Bitfinex.

BTC Futures – Aggregated Daily Volumes

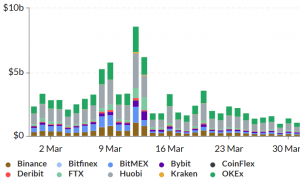

The same was also the case for ethereum futures, although this is a smaller market that trades on far fewer exchanges. The Huobi exchange, which recorded the highest trading volumes during the market crash, has also seen the largest decline.

ETH Futures – Aggregated Daily Volumes

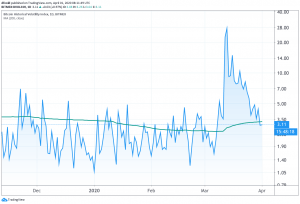

Meanwhile, the consistent decline in US dollar-denominated trading volumes have been seen while the price of the same cryptoassets has increased. Further, volatility has remained relatively high for both assets, although this has also gradually decreased since March 12. In bitcoin’s case, the volatility is now back at the 200-day moving average level.

Since reaching a low of USD 3,858 on March 13, bitcoin has risen close to 70%, which is something that would usually attract speculators to the market. Under normal circumstances, the trading volumes as measured in USD should also rise as the price of the underlying asset (bitcoin and ethereum) rises. In this case, however, the opposite has happened.

The decline in volume mirrors what was seen after another price drop earlier in March, when options volumes quickly died off on leading exchanges after the market stabilized. Back then, however, the volatility in the market was far from the levels we have seen in recent days and weeks.