Bitcoin, Ethereum & Crypto Dive as Celsius Adds Fuel to the Fed Fire This Week

The bitcoin (BTC) and crypto market came under heavy selling pressure on Monday, fueled by fears in nearly all global risk markets related to high inflation and what the US Federal Reserve (Fed) might do to tame it. At the same time, the drama surrounding crypto lending platform Celsius (CEL) is adding fuel to the fire.

At 15:30 UTC, bitcoin (BTC) was down 18% over the past 24 hours and 23% over the past 7 days to USD 23,117, a level not seen since December 2020. BTC even briefly dipped below USD 23,000. At the same time, ethereum (ETH) stood at USD 1,220, down 21% for the day and 33% for the week, also revisiting its lows from January 2021.

Notably, the sharp price drop brought the total market capitalization of all cryptoassets below the USD 1trn mark for the first time since January 2021. At the time of writing, CoinGecko reported the total market cap it as USD 991bn.

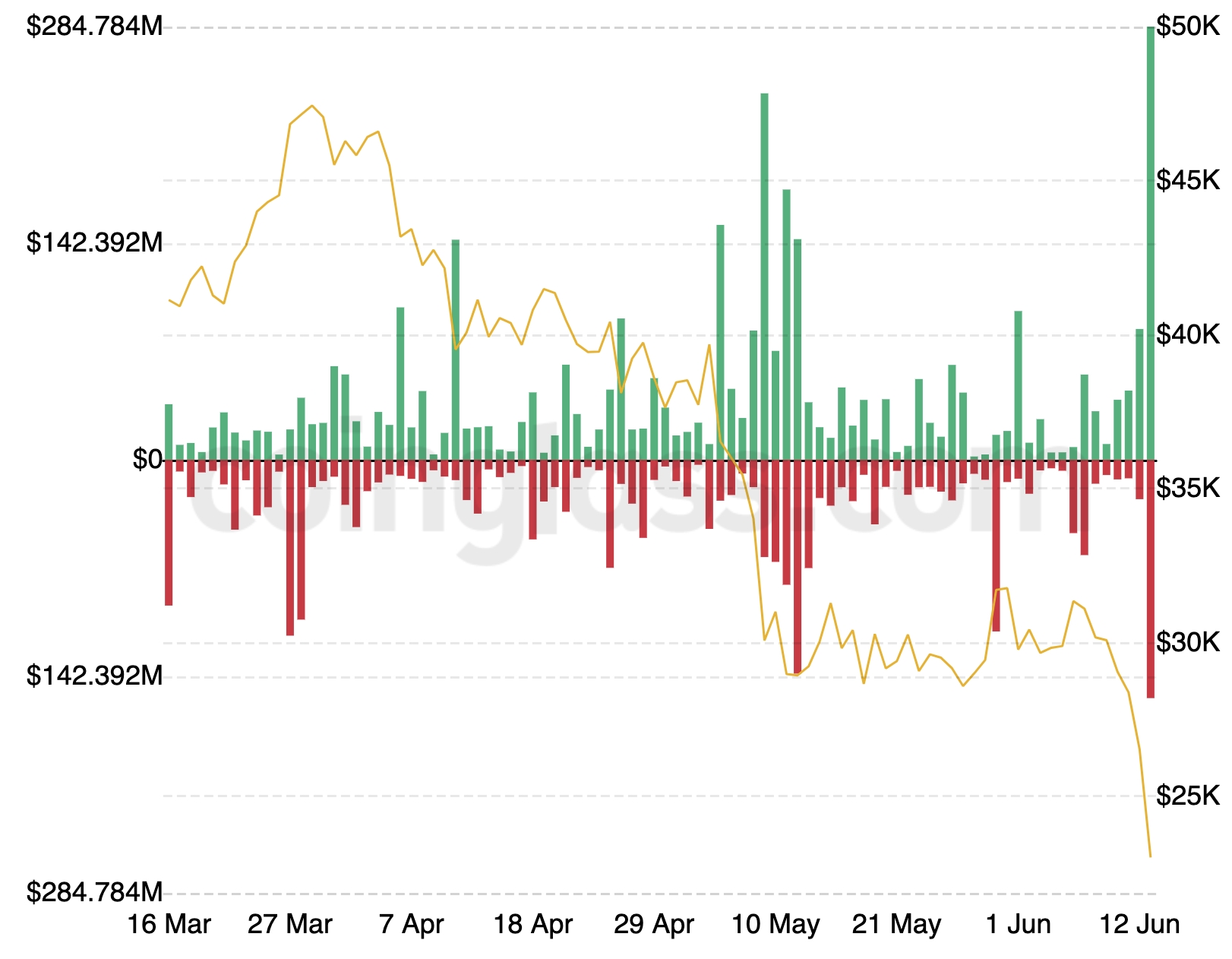

BTC past 14 days:

Not surprisingly, the market selloff came along with large liquidations of leveraged long positions in both BTC and ETH.

Between midnight UTC and press time (15:30 UTC), more than USD 284 in BTC longs were liquidated across exchanges as the price dived. The liquidations were the highest by far in more than three months.

The crash in the crypto market came as global stocks also sold off heavily, with stocks in Japan closing down 3% on Monday, and the S&P 500 index trading down 3% two hours into the open.

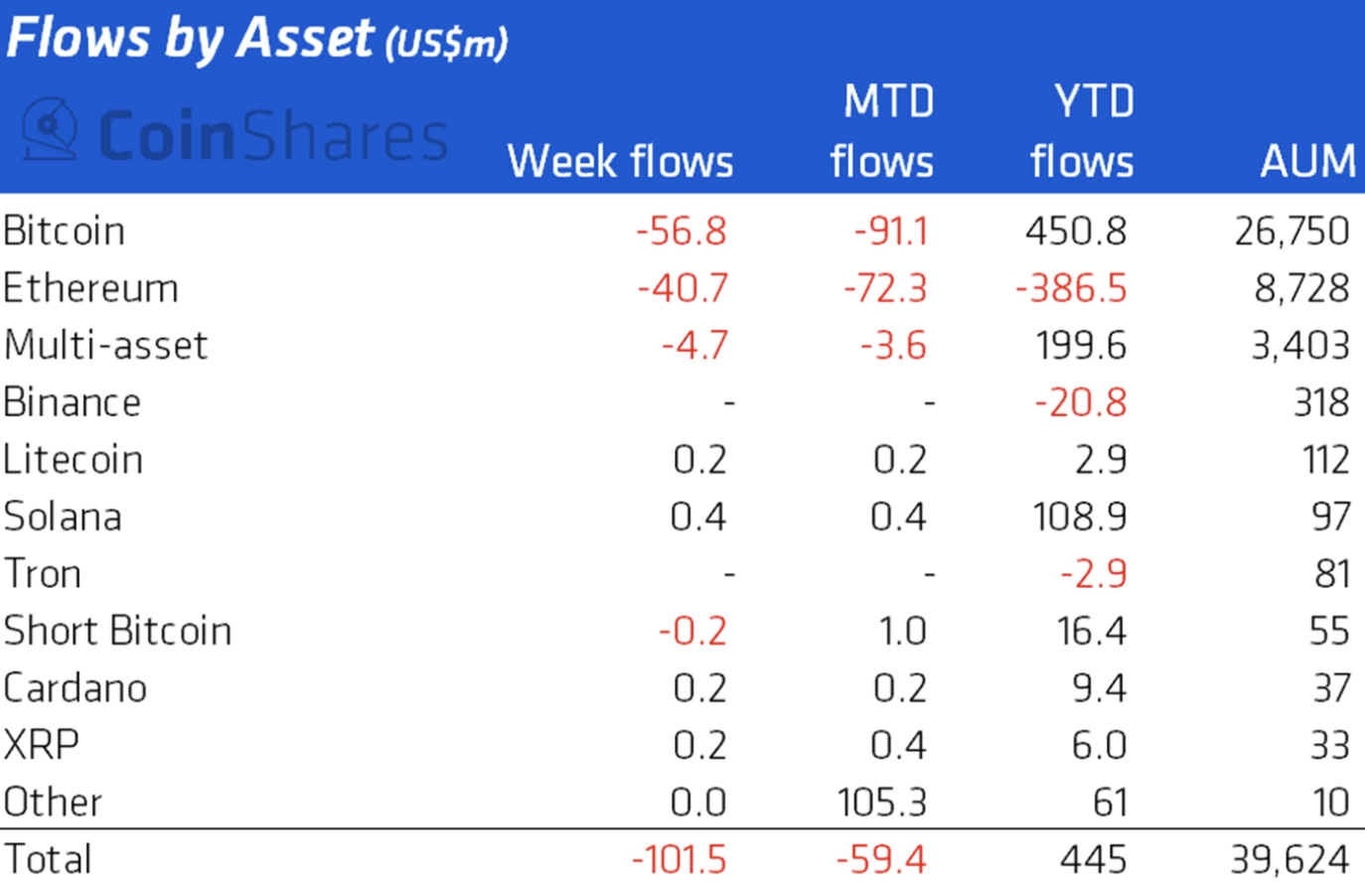

The crypto crash came as new data from the crypto research and investment firm CoinShares on Monday showed that investors last week pulled USD 102m out of digital asset investment funds.

Among the funds, those backed by BTC suffered the most, with USD 57m pulled out during the week. At the same time, ETH-backed funds saw outflows of USD 40.7m, while most altcoin funds saw only minor changes in investment flows.

Commenting on the outflows, CoinShares said investment flows have remained “choppy in anticipation of hawkish monetary policy […]”

“What has pushed Bitcoin into a ‘crypto winter’ over the last 6 months can by and large be explained as a direct result of an increasingly hawkish rhetoric from the US Federal Reserve,” the firm added.

Meanwhile, according to a statement from crypto exchange Bitfinex’s trading desk, crypto markets have been swept by “extreme volatility,” largely caused by macroeconomic factors.

“A pervasive macroeconomic backdrop of spiraling levels of inflation and continued interest rate hikes from the US’s Federal Reserve is also weighing on the bitcoin price. Bitcoin dominance continues to rise amid a flight to quality in the digital token ecosystem,” the exchange’s traders wrote in an emailed statement today.

Coinciding with the crypto selloff today was news from Celsius that the platform had halted all crypto withdrawals for clients. The news comes after rumors had circulated online for an extended period that the company is facing problems and may not be able to meet its customer obligations.

At the time of writing, the platform’s token CEL is down by close to 54% in the last 24 hours alone, trading at a price of USD 0.193. Over the past year, the token is now down a whopping 97%, per CoinGecko data.

Fed fears

Meanwhile, another key to fears that have taken hold of global financial markets now is the currently high inflation in the US, which has shown no signs of reaching a peak yet. On Friday last week, US inflation for May hit 8.6%, higher than the 8.3% analysts had expected.

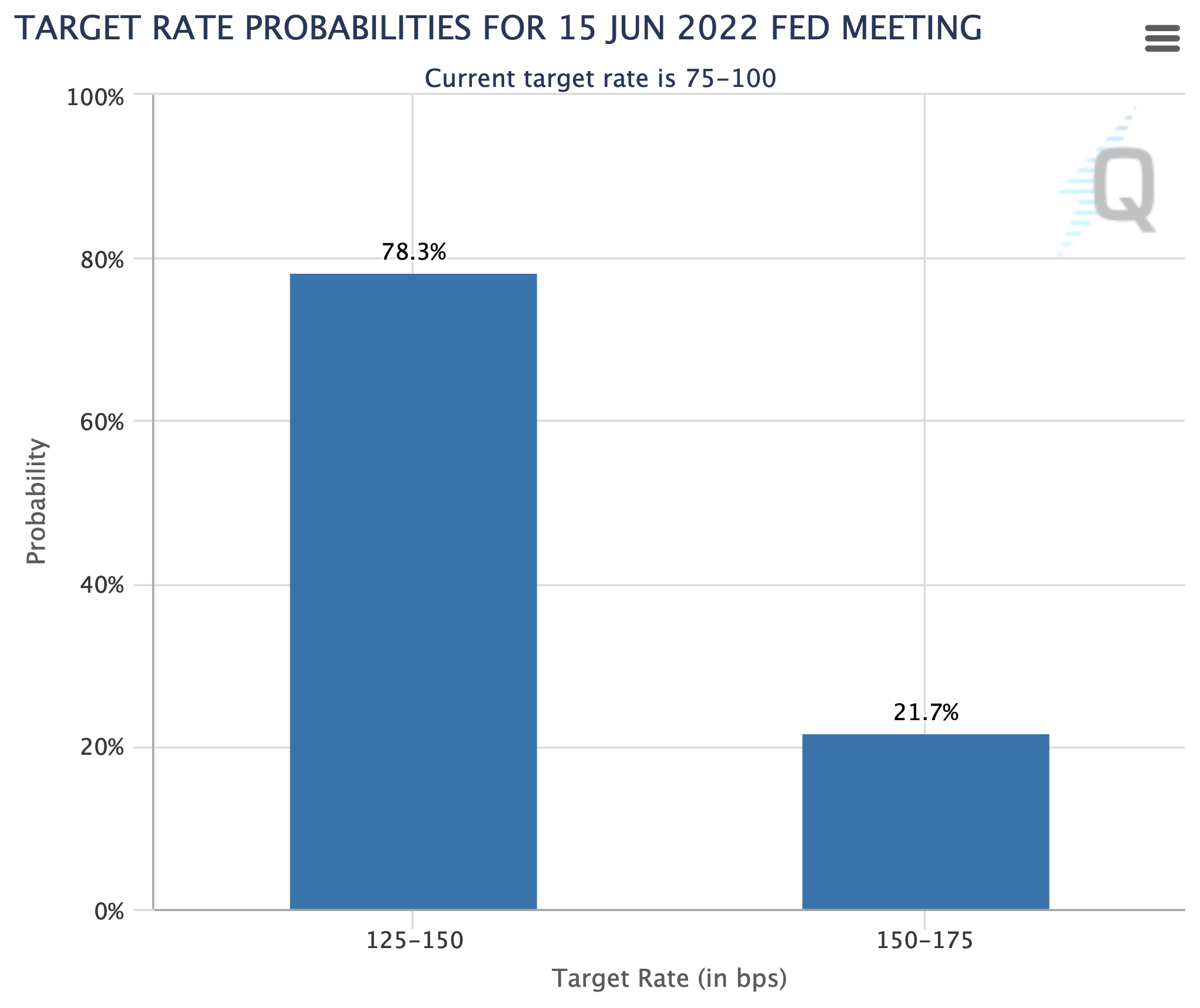

With the Fed set to announce its next interest rate adjustment on Wednesday this week, traders are increasingly nervous that the central bank will hike rates by 75 basis points rather than the 50 points that was widely expected.

Writing in his latest newsletter from Sunday, Nik Bhatia, a finance professor at the University of Southern California and author of the popular bitcoin book Layered Money, explained that the 2-year Treasury yield still indicates that the Fed will move on with a series of 50 basis point hikes this summer.

However, there are also signs that some traders are speculating on “75 basis point hikes for the rest of the summer,” Bhatia wrote.

The increasing risk for a 75-basis point rate hike this week can also be seen in trading data from derivatives exchange CME Group, which at the time of writing indicated a 21.7% chance of a 75-basis point hike, versus a 78.3% chance of a 50-point hike.

Judging from screenshots posted to Twitter, however, the chance of a 75 basis point hike is already down from more than 40% on Sunday.

Still light at the end of the tunnel

Still, there is light in the tunnel for those waiting for the Fed to pause its rate hikes, although it may seem far away, Goldman Sachs strategists said in a recent note.

“At some point, financial conditions will tighten enough and/or growth will weaken enough such that the Fed can pause from hiking. But we still seem far from that point, which suggests upside risks to bond yields, ongoing pressure on risky assets, and likely broad US dollar strength for now,” the note was quoted by Bloomberg as saying.

Meanwhile, leading voices of the crypto community on Twitter are working to keep the spirit up by sharing their own optimistic takes on the long-term outlook for Bitcoin and crypto.

“However long this bear market lasts, I think we can still count on bitcoin rallying early and aggressively in response to the next big USD/EUR stimulus program,” wrote Tuur Demeester, a popular early Bitcoin proponent. He added that he believes BTC adoption again will spike “once the new financial crisis leads to bank runs, capital controls, bail-ins.”

“During inflation bitcoin’s scarcity shines—during deflation its censorship resistance,” Demeester wrote.

Others used technical analysis tools such as the Directional Movement Index (DMI), a measure of strength in price trends, to predict that the downside momentum for BTC and ETH has been “exhausted” and “almost finished.”

However, soon after, both BTC and ETH went even lower, breaching important levels along the way.

Alex Krüger, a popular crypto trader and economist, stressed that the crypto selloff has more to do with panic across global risk assets than anything specific to crypto.

“Realize how little this crypto dump has to do with Celsius and the stETH [staked ETH] drama and all to do with the widespread panic in risk assets (equities and crypto alike) and broken charts,” Krüger wrote.

“Everybody making it about Celsius. Watch the media tomorrow. But without Friday’s [inflation] numbers and equities collapsing this would not have happened,” the crypto trader said.

A similar sentiment was also shared by others, with, for instance, Jim Bianco, President of Bianco Research, saying “When markets go bad, everything goes bad at once.”

Others also shared a similar sentiment:

we're just the hyperactive schizo canary in the coalmine

— nic 🌠 carter (@nic__carter) June 13, 2022

“While we may eventually see some short-term relief, in the medium term, everyone is really bracing for more downside. Crypto investors should be especially nimble and watch developments within the space as closely as in the broader macro-environment,” Mikkel Morch, Executive Director at crypto/digital asset hedge fund ARK36, said in an emailed comment.

According to him, bear markets have a way of exposing previously hidden weaknesses and overleveraged projects so it is possible that we see events like last month’s unwinding of the Terra ecosystem repeat.

“For example, Celsius and Tron are two projects that seem particularly risky at the moment,” he noted.

In either case, per Morch, it is good to remember that although bear markets bring a lot of pain to the investors in the short term, they are a very effective filter that helps the crypto space grow in the long term.

_____

Learn more:

– Bitcoin Historical Performance is No Guide for the Future in 2022

– USD 25K-USD 27K per Bitcoin Is ‘This Cycle’s Bottom’ – Arthur Hayes

– This Is Why Fed Might Attack Inflation More Aggressively

– Fed Has ‘Limited Firepower’ for Rate Hikes, Current Expectations Already Priced in for Bitcoin – CoinShares

– As inflation ‘Mellows Out’, a Bottom in Crypto is Likely in ‘The Back Half of 2022’ – VC Investor

– Bitcoin Undervalued, Crypto Now Better Than Real Estate – JPMorgan

– Crypto & Stocks ‘Decoupling’ Prediction Flops but There’s Still Hope

– Bitcoin Halfway to Next Halving – What Can History Teach Us?

___

(Updated at 12:45 UTC with CoinShares data and statement from Bitfinex. Updated at 15:45 UTC with updated prices, liquidations and total market capitalization. Updated at 16:02 UTC with a comment from Mikkel Morch.)