Beware! Pump-and-Dumps Persist in the Market

Market manipulation is still flourishing in the crypto world. The Wall Street Journal said it had identified 105 groups on chatting apps Telegram and Discord offering “trading signals,” a type of service that is often associated with pump-and-dumps.

In total, the WSJ said that between January and the end of July it identified 175 “pump and dump” schemes involving 121 different digital coins, which show a sudden rise in price and an equally sudden fall minutes later. The report mentions coins such as version, cloakcoin, granitecoin, pesetacoin, stealth, and agrello.

Among the pump-and-dump groups examined by the newspaper, the biggest group – identified as “Big Pump Signal” – had more than 74,000 members in its Telegram channel. Since December, the group has reportedly initiated 26 pumps, totaling around USD 222 million in trading activity.

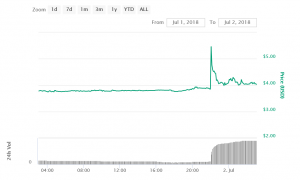

For example, on July 1, after followers of Big Pump Signal were commanded to start buying a token called cloakcoin, the price jumped 50% to USD 5.77 on Binance, a major exchange, before dropping almost a dollar after two minutes, according to the report. In total, 6,700 trades worth USD 1.7 million were executed—compared with virtually no trading the hour before, it added, saying that one user claimed he made USD 1,400 on this pump without going “big”.

Cloakcoin price chart:

Many of the groups charge monthly fees of USD 50 to USD 250 or require members to evangelize the service for access to trading information, the WSJ said.

Pump-and-dump schemes are among the oldest forms of fraud in financial markets and can happen either by traders talking up the price of a particular asset before they cash in on it, or by a group of traders getting together to buy an asset, driving up the price in the process. Once the price has reached the pumpers target, they rush to sell, leaving behind the unknowing traders who bought in.

Although pump-and-dumps have long been outlawed in traditional financial markets, they still persist to some degree. In the US, the Securities and Exchange Commission (SEC) regularly goes after groups that profit from the activity, particularly in the very small so-called micro-cap stocks.

In crypto, however, regulators have yet to bring up even a single case against the fraudsters behind these schemes. One problem faced by regulators is that it can be difficult to determine who has jurisdiction over the markets where the fraud takes place. As a largely unregulated market, crypto is traded without regard to national borders and by traders who sometimes stay anonymous, meaning it is an almost impossible task for regulators to take on.

Essentially a zero-sum game, a pump-and-dump transfers money from those who jump on the bandwagon when they see the price of an asset gain momentum, to those who initiated the dump. In reality though, it is often only the initiator of the pump signal that is able to sell off the asset with a profit before it’s too late.

As reported, bitcoin price manipulation has already put trust in cryptocurrencies at risk. According to professor Neil Gandal and assistant professor Tyler Moore, exchanges should do more to mitigate this problem, for example by sharing information about the trading behavior of very large traders on their platforms.

“The consequence of not taking steps in this direction is likely a loss of faith in cryptocurrencies,” the two scholars wrote in an article.