As Countries Advance Fiscal Cooperation, Higher Taxes Could Come Crypto’s Way – Davos

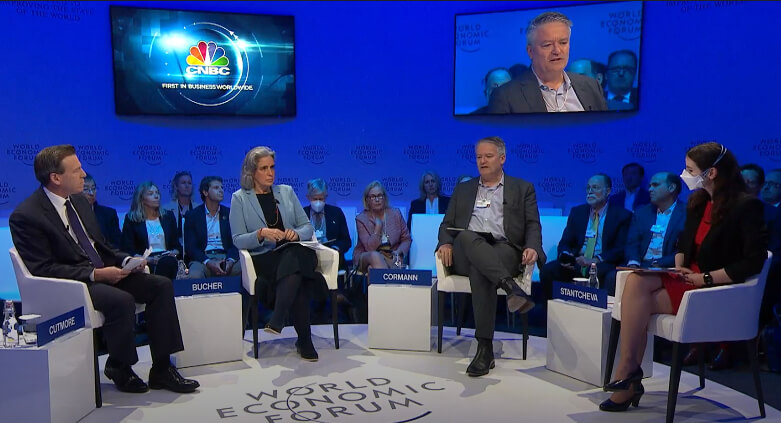

Source: a video screenshot / weforum.org

Developed countries from across the world are moving towards increased fiscal cooperation that could lead to tighter taxation of corporations but also of personal assets under the so-called wealth tax, as indicated by the participants of a panel held during this year’s edition of the World Economic Forum in Davos. This development could lead to the tightening of the world’s fiscal regimes on cryptoassets and crypto businesses, among others.

The panel, A Reimagined Global Tax System, was dominated by voices in favor of higher wealth and capital taxation. The panelists commented on the October 2021 international agreement on base erosion and profit shifting (BEPS) which has so far been joined by 141 countries and jurisdictions, all pledging to implement a 15% global minimum corporate tax rate.

Mathias Cormann, Secretary-General of the Organisation for Economic Co-operation and Development (OECD), said that new regulatory measures are required to enable the tax administrations across the world to fully enforce their tax laws on major players.

“In my opinion, it’s in the rational interest of the United States to be part of the deal,” Cormann said, replying to a question from the audience on the potential implications of a Republican takeover of Congress when Americans elect new lawmakers this November.

Stefanie Stantcheva, Nathaniel Ropes Professor of Political Economy at Harvard University, argued that there is a growing drive among states to harmonize their tax policies to close fiscal loopholes that allow capital to avoid taxation.

“I do think that this global tax agreement is in the spirit of taxing capital better,” she said, adding that increased fiscal cooperation between various countries “is really critical to allow better enforcement.”

Gabriela Bucher, Executive Director at non-governmental organization Oxfam International, said that there is a need for a global asset registry that would be transparent, allowing the wealth of individuals across the world to be taxed. There is a group of countries that tax individual assets, but in 2017, only 4% of the total collected taxes were generated by wealth taxation, she said.

“There used to be more countries that had them, and … we see mostly positives when it comes to transparency” with regards to a tax on wealth, according to Bucher.

____

Learn more:

– How the Crypto Industry is Increasingly Paying Its Share of Tax

– Crypto Tax Trends in 2022: Increased Reporting, Updated Rules, and a Wealth Tax Debate

– A Small Survey Shows that US Crypto Investors Have Big Problems with Taxes

– G7 Keeps Pushing for Crypto Regulation, Here’s What’s Already Happening

– Argentinian Banking Heavyweight to Launch Bitcoin, Ethereum Trading, While Tax Body Urges Tighter Crypto Monitoring

– Spanish Crypto Investors ‘Fleeing to Portugal to Escape Taxes,’ Say Lawyers