After Bashing Yield Farming, Buterin Offers a ‘Billion Dollar’ DeFi Idea

After criticizing yield farming once again and looking for a “least favorite DeFi project”, Ethereum (ETH) Co-founder Vitalik Buterin revealed his own vision for a new decentralized finance (DeFi) project.

This time, it’s about forking Maker (MKR).

“All I want for [DeFi] is for someone to fork Maker, rip out the governance and replace it with automated interest rate targeting, rip out the [Dai Savings Rate] and have the token itself just target ‘index * (1 + interest_rate)**time,’ and generalize it to a whole bunch of price indices,” Buterin tweeted.

The idea was picked up by other members of the cryptoverse, saying that this idea might become a reality soon.

However, Buterin’s earlier attempt to ask “anyone who normally sees themselves as a [DeFi] enthusiast” about their “least favorite DeFi project” was met with more criticism.

Linda Xie of Scalar Capital said that these types of questions “can potentially be discouraging to teams” working on Ethereum. “Maybe we can focus on what are ways to improve existing popular DeFi projects or something along those lines,” Xie added.

Also, yesterday, Buterin once again reiterated his criticism of yield farming projects promising unusually high yields, suggesting central bank money printing is nothing compared to the minting of tokens required to keep the DeFi boom going:

“Seriously, the sheer volume of coins that needs to be printed nonstop to pay liquidity providers in these 50-100%/year yield farming regimes makes major national central banks look like they’re all run by [former presidential candidate in the US] Ron Paul,” Buterin sarcastically said. Paul criticizes the US Federal Reserve for “creating trillions of new dollars out-of-thin-air” and claims that “a return to sound money is an absolute necessity, and only a matter of time.”

Meanwhile, in July, Buterin said that he has a bit of “love and hate” for the influx of DeFi apps and added that the high interest rates that some liquidity providers are collecting would prove “unsustainable in the long-term.”

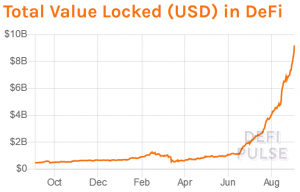

Today, the total value locked in DeFi surpassed USD 9bn.