Accenture Sees Strong Demand for Digital Assets Among Asian Investors, but Hesitancy Among Advisory Firms

There is a strong demand for digital assets among investors in Asia, but wealth management firms remain hesitant to support them, according to a new report from consulting giant Accenture.

The report, titled The Future of Asia Wealth Management, stated that, although a large number of Asian investors have already allocated capital to digital assets, and many more want to invest in them this year, few advisory firms are willing or able to support clients on this.

According to the results of a survey in the report, more than half of Asian investors now hold digital assets in some form, whether directly as cryptocurrencies or other tokenized assets, or indirectly in the form of crypto-backed investment funds.

Additionally, a further 21% of those surveyed said they expect to invest in digital assets by the end of 2022.

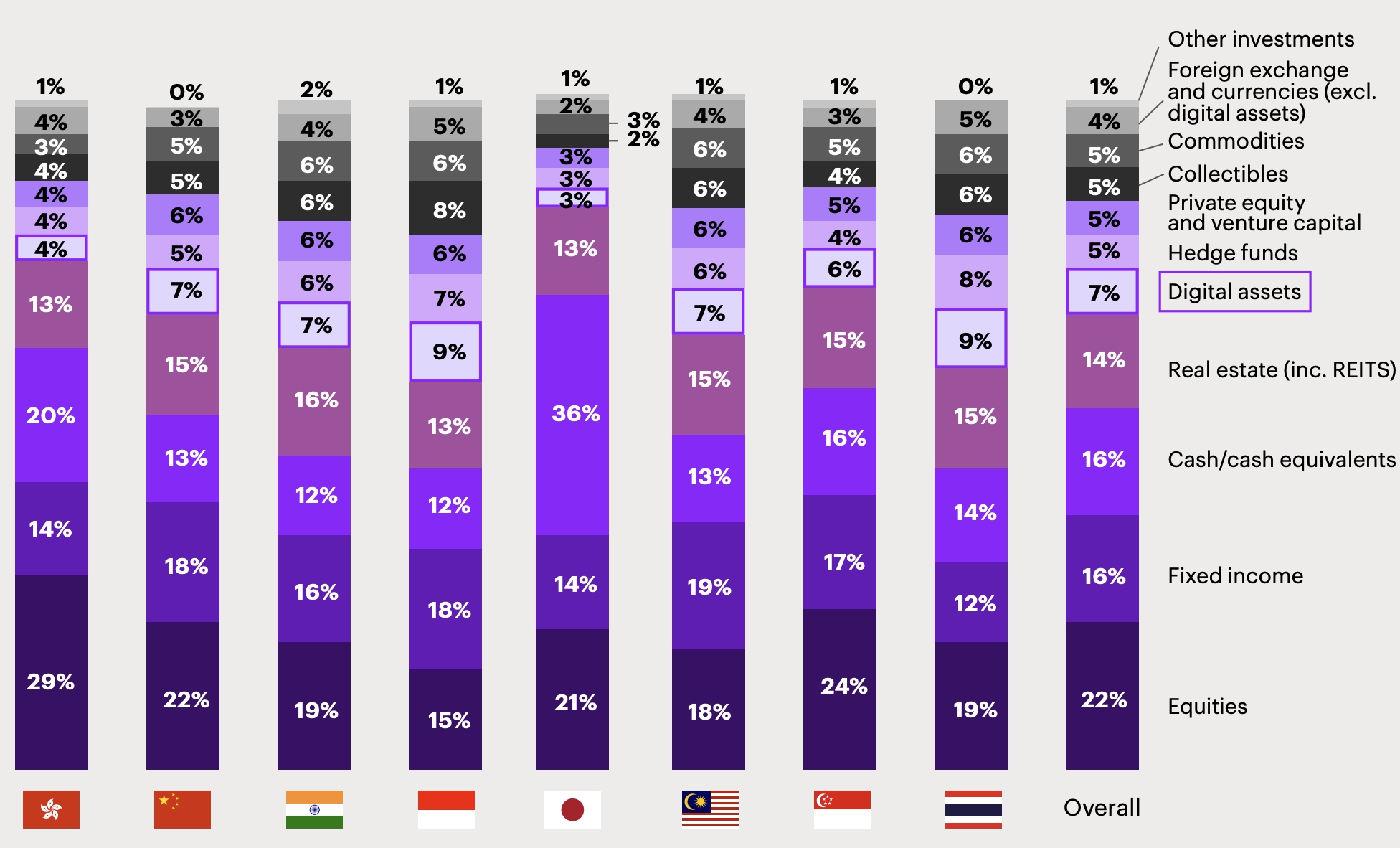

On average, digital assets now make up 7% of Asian investors’ portfolios. This makes it a “top-five asset class” among Asian investors, and more popular than foreign currencies, commodities, and collectibles among the surveyed investors, the report said.

Despite this strong demand for digital asset investments, a whopping two-thirds of the surveyed wealth management firms said they have no plans at all to offer digital assets to clients, while only 24% said that they are planning on it for the future.

As a result of the lack of support from professional wealth managers, affluent investors are left with seeking advice “on unregulated forums, including peer-to-peer advice on social media,” the report said.

Commenting on the findings, Nicole Bodack, Accenture’s group lead for Growth Markets, said that it is clear that investors are looking for new products to invest in, and that this includes digital assets.

Bodack added that it is key that advisory services are there to accommodate investors “as they grapple with market volatility, longer life expectancies and the plethora of investment information available online.”

The findings in the report were based on two surveys: one with about 3,200 investors as participants and another with more than 500 financial advisors at Asian wealth management firms.

____

Learn more:

– About 50% of Surveyed Crypto Owners Made Their First Buy in 2021 – Gemini

– More Investors Enter Crypto But Keep Multiple Financial Service Providers – Survey

– More Confidence By Banks Could Trigger ‘Second Wave’ Of Crypto Adoption – Expert Panel

– 40% of Surveyed Lower-income Individuals Want to Use Bitcoin – Not to Make Money

– 7 in 10 Retail and Institutional Investors Plan to Buy More Crypto, Bitstamp Survey Finds

– Just 18% of Respondents Do Not Expect Bitcoin to Become Legal Tender in 3 Years – Survey