Aave’s LEND Soars, Flips Maker as UK Regulatory Approval is Secured

Decentralized finance (DeFi) platform Aave’s LEND token is soaring in the crypto market today, after Aave’s UK business entity was finally granted an Electronic Money Institution license by the UK’s financial regulator yesterday. Furthermore, it flipped Maker (MKR) as the largest DeFi platform by total value locked.

Source: Adobe/gesrey

Source: Adobe/gesrey

As of 9:25 UTC, the 25th coin by market capitalization, LEND, was up by nearly 22% over the past 24 hours to trade at a price of USD 0.716 per token. The gain made LEND today’s best-performing asset among the top 60 cryptoassets by market capitalization, while also positioning it as one of the best performers in the past 7 days with a gain of nearly 18%, according to Coinpaprika’s ranking.

LEND 7-day price chart. Source: Coinpaprika.com

LEND 7-day price chart. Source: Coinpaprika.com

Today’s strong performance for the token came after the team behind Aave yesterday announced that they had received a UK Electronic Money Institution license from the Financial Conduct Authority (FCA). According to the announcement from Aave, the license will allow its UK-based business branch, Aave Limited, to “facilitate payments and currency conversions, as well as issue electronic money accounts for consumers and businesses.”

In its announcement, Aave further said that the newly issued license is part of a vision to “bring the DeFi and Fintech spaces closer together,” and that it will allow Aave to provide access to DeFi platforms directly from fiat-based electronic money accounts.

Given many banks’ reluctance to working with crypto companies, bridging the gap between traditional fintech and crypto is something that has previously proved difficult to do. But with the necessary regulatory approval now secured, Aave aims to open up DeFi to an even wider user base, eventually “moving toward mainstream adoption.”

In addition to its potential for wider mainstream adoption however, Aave is also seeing success among existing crypto users, with its crypto lending and savings platform now having flipped Maker (MKR) as the largest DeFi platform by total value locked.

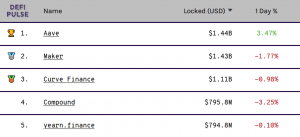

According to data from DeFi Pulse, Aave, which boats USD 1.44 billion in total locked value, now ranks first – ahead of Maker, Curve Finance, and Compound, which come in 2nd, 3rd, and 4th, respectively.

Source: DeFi Pulse

Source: DeFi Pulse

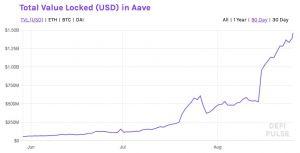

The flipping of Maker, which for a long time reigned as the largest DeFi platform, occurred after what has been an impressive month for Aave, growing its value locked from just under USD 500 million in the beginning of August, and to an all-time high of USD 1.44 billion as of today.

Source: DeFi Pulse

Source: DeFi Pulse

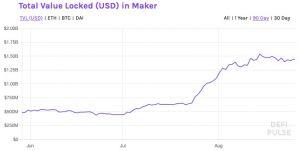

And while Aave has soared in popularity, the former king of the DeFi space has largely seen its locked value stagnate since mid-August, with Maker moving from a locked value of USD 1.54 billion on August 14 to USD 1.43 today.

Source: DeFi Pulse

Source: DeFi Pulse

____

Learn more:

A16z Crypto Calls for ‘More Nuanced’ UK Regulatory Framework for Digital Assets

Yield Farming ‘Frenzy’ Didn’t Boost DeFi User Numbers

Aave’s LEND Skyrockets by 8,000% Against Bitcoin In ‘Over-extended’ Rally

LEND Jumps 16% on Aave Decentralization and Token Migration News