Aave’s LEND Skyrockets by 8,000% Against Bitcoin In ‘Over-extended’ Rally

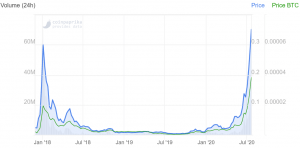

After a strong rally in the past few months, LEND, the native token of Aave, the third biggest DeFi (decentralized finance) platform by total value locked (TVL), is now up by 8,087% against bitcoin (BTC) in the past 12 months while long-term investors dumping their coins on FOMOing buyers.

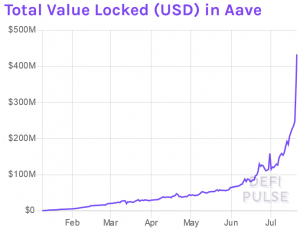

Meanwhile, TVL on the platform jumped by 68% in a day and reached USD 416m today, according to DeFi Pulse data.

LEND has also surged 47% over the past 7 days alone, making it the week’s best performer among the top 60 cryptoassets by market capitalization. The token is also up by 4.5% over the past 24 hours, reaching USD 0.35 as of press time (12:10 PM UTC). LEND jumped by 7,021% against USD in the past year, surpassing its previous all-time-high, reached in January 2018.

LEND price chart:

Meanwhile, Kelvin Koh, Co-founder and Partner at crypto hedge fund Spartan Capital, said yesterday that his earlier USD 450 million prediction for Aave’s TVL now “looks conservative.” Instead, Koh said that he now believes Aave’s TVL will challenge Compound’s USD 623m (today’s data) TVL “in a matter of weeks,” which in turn will provide “more fuel” to the LEND token.

As referenced in the tweet, the updated prediction from Koh came after he two weeks ago predicted that the roll-out of Aave’s credit delegation system would be “a game-changer” that will cause the TVL measure on the platform to triple “at least.”

Aave’s TVL at the time stood at over USD 150m.

However, Koh is not the only one at Spartan Capital who is bullish on Aave. In addition, the fund’s research head, Jason Choi, also posted on Twitter yesterday that he pitched to his company two months ago that LEND’s market capitalization would overtake that of Maker’s MKR token.

MKR is now ranked 29th by market capitalization (USD 463m), LEND – 31st (USD 454m).

In addition, the bullishness surrounding Aave also appears to have been boosted by news from last week that the crypto investment firms Framework Ventures and Three Arrows Capital have bought USD 3 million worth of LEND tokens, while pledging to actively contribute to the growth of the protocol.

‘Over-extended’ rally

However, contrary to most Aave indicators, ownership metrics raise concerns about LEND, according to an analysis by the DeFi-focused platform The Defiant.

“In general, the total number of addresses with a balance of a token tends to rise along with its price. However, this has not been the case for LEND in 2020, with the number of holders dropping by year-to-date,” the report said, adding that holders, including long-term investors, are realizing profits by selling their LEND tokens.

“Despite the significant drop in holders seen in late June, the trend appears to be reversing throughout July so far,” the report said, suggesting that “more retail users are buying LEND following the trend towards DeFi tokens.”

According to the report, the amount of LEND tokens held for over a year has dropped by 42%, while the number of addresses holding LEND for less than a month has increased by almost 50% just in the last 30 days, “signaling a high likelihood of retail FOMO [fear of missing out] taking place.”

“That being said, on-chain indicators suggest that the current rally may be over-extended as retail users enter the frenzy and large players appear to be selling,” the report concluded.

____

Learn more: Yield Farming ‘Frenzy’ Didn’t Boost DeFi User Numbers