$30 Billion RIA Platform Carson Group Approves Only 4 Bitcoin ETFs

Carson Group, the registered investment advisor (RIA) platform managing $30 billion in assets, has selected just four spot Bitcoin exchange-traded funds (ETFs) for its users.

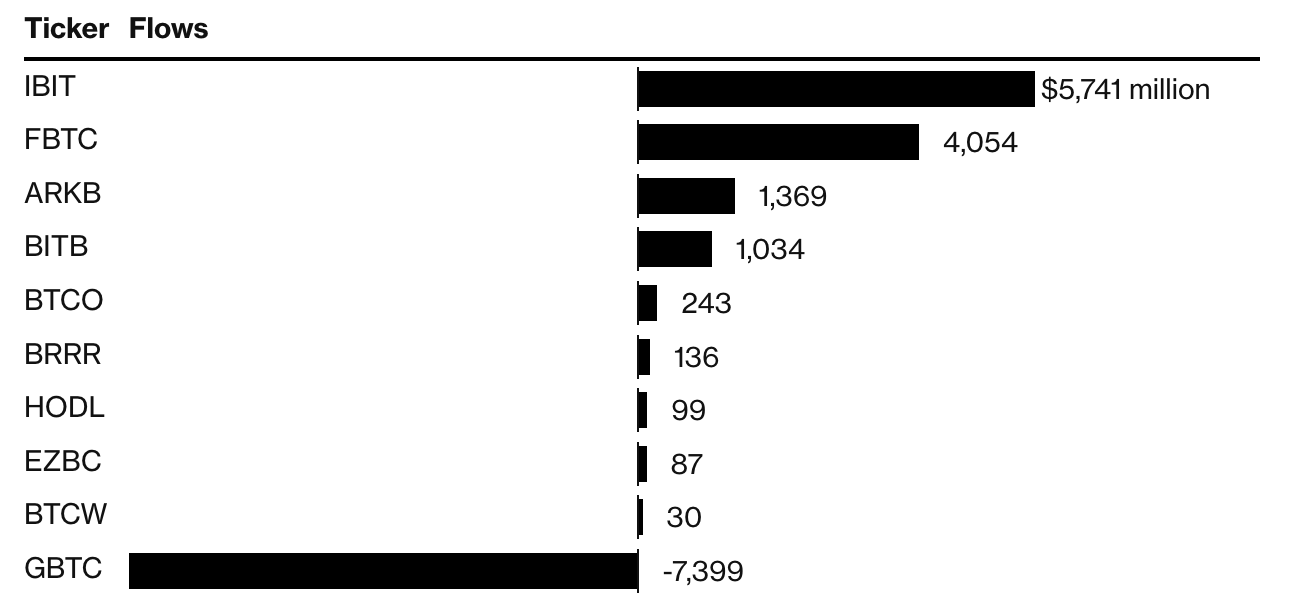

According to a recent report by Bloomberg, the four out of 10 SEC-approved ETFs included BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), Bitwise’s BITB, and Franklin Templeton’s EZBC.

Carson Group’s Selected Bitcoin ETFs

The platform’s selection of the four Bitcoin ETFs was initially driven by a focus on funds that have demonstrated outstanding growth and popularity.

For instance, Carson’s Vice President and Investment Strategist Grant Engelbart explained that “significant asset growth” was a key factor for including BlackRock’s and Fidelity’s Bitcoin ETFs in the platform’s offerings.

“We feel it is important to offer these products as a result from two of the largest asset managers in the industry,” said Engelbart.

As for the less prominent funds offered by Bitwise and Franklin Templeton, the company turned its shift to the products with the lowest planned fees of 0.2% and 0.19%.

“Bitwise and Franklin Templeton have committed to being the lowest-cost providers in the space, and have also seen large inflows and trading volumes,” Engelbart stated.

“Both firms also have established in-house digital asset research teams and expertise that we feel are beneficial to the continuing growth and management of the products,” said Engelbart. “As well as advisor research and education.”

Platform Approvals and Advisor Endorsements

The prosperity of spot Bitcoin ETFs essentially relies on the new investors and the inflows they bring to the products. While Grayscale’s Bitcoin Trust (GBTC) recorded some of the lowest outflows over the past few days, all providers have endeavored to attract more audiences.

Bitwise co-founder and CEO Hunter Horsley pointed out that approvals from platforms and financial advisors can be a “huge catalyst” for growth.

Carson Group, one of the largest US financial advisory firms, has approved four Bitcoin ETFs for clients https://t.co/Qqa6nyPDCH

— Bloomberg Crypto (@crypto) February 23, 2024

“Over half of US wealth is part of a platform and can only use a product once it’s approved,” said Horsley.

“We frequently hear ‘I want access to Bitcoin but our platform hasn’t approved anything yet. The platforms are busy but now that there are ETFs and a few over a billion AUM, they’re doing the work.”