What the Network Value to Transactions Ratio Can Tell About Crypto

The ratio enables investors to compare how the market is pricing one unit of on-chain crypto asset transaction across different blockchain network. The main drawback is that it only takes on-chain transactions into consideration.

Determining the “fair value” of a cryptographic asset is perhaps the holy grail of digital asset investing. Given the infancy of crypto assets as an asset class, it is extremely difficult to evaluate how much a digital currency or token should be worth.

One way of gauging the value of crypto assets is by looking at the ‘Network Value to Transactions Ratio’.

What is the Network Value to Transactions Ratio (NVT)?

The Network Value to Transactions Ratio (NVT) is a valuation metric for cryptographic assets, which was developed by cryptocurrency researcher Willy Woo in 2017.

According to CoinMetrics, a cryptoasset analytics company, the Network Value to Transactions Ratio is a measure of the dollar value of crypto asset transactions relative to the network value, which is measured by its market capitalization. NVT is calculated by taking an asset’s network value and dividing it by the USD volume transmitted on the blockchain. This enables investors to compare how the market is pricing one unit of on-chain crypto asset transaction across different blockchain network.

A low NVT would, therefore, suggest that a crypto asset is more cheaply valued per unit of on-chain transaction volume. A high NVT would suggest the asset is overvalued compared to its peers and may be in bubble territory.

In that sense, the Network Value to Transactions Ratio can be seen as the cryptocurrency market’s equivalent to the P/E Ratio, which is used to determine the value of a stock in the equity markets.

Woo explains his logic behind the Network Value to Transactions Ratio in a Forbes article as follows: “We have a price per token, but it’s not a company so there are no earnings to do a ratio. However since Bitcoin at its essence is a payments and store of value network, we can look to the money flowing through its network as a proxy to company earnings.”

“[…] The value transmitted on the Bitcoin blockchain is closely tied to its network valuation. The idea that we can use the money flowing through the network as a proxy for network valuation is valid. We can express this as a ratio. I call it NTV Ratio, short for Network Value to Transactions Ratio,” Woo concluded.

How you can use the Network Value to Transactions Ratio

The Network Value to Transactions Ratio can be used to compare the value of different cryptocurrencies to determine which ones are undervalued and which ones are overvalued per unit of on-chain transaction volume at any point in time.

For example, a high NVT ratio for bitcoin would suggest that bitcoin’s market capitalization is outstripping the value that is being processed as payments on the Bitcoin network. This could suggest that either the network is in a high-growth phase and crypto asset investors are expecting the value of the asset to increase or that the asset is in bubble territory as the volume of payments it processed is much lower than its current network value.

That means when investors see a high bitcoin Network Value to Transactions Ratio, they could consider putting on short positions to benefit from a potential price correction that may be just around the corner.

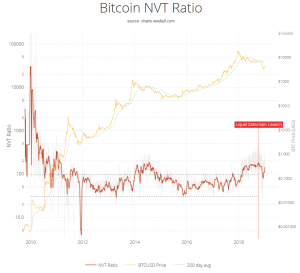

When looking at the chart above, we can see that bitcoin’s Network Value to Transactions Ratio (as shown by the red line) spiked into overvalued levels at the start of 2018 and remained high through the most of the year, only dropping more significantly in November. This overvaluation of bitcoin – as we know – was met with a collapse in price so NVT acted as a good price indicator.

A similar scenario was also visible after bitcoin’s first rally to USD 1,000 in late 2013. At the start of 2014, the price of bitcoin corrected from USD 770 to USD 370 in mid-April and closed the year at around USD 270. Throughout the first half of 2014, the NVT was showing clear signs of overvaluation up until bitcoin’s network value dropped to a level where it was merited in relation to its transaction volumes.

Kalichkin’s “Refined” Network Value to Transactions Ratio

Researchers at Cryptolab Capital, a mixed strategy cryptoasset investment fund, have analysed Woo’s NVT Ratio and have found that it can be improved to give a more accurate indication of whether a crypto asset is overvalued or undervalued.

In a blog post, Crytolab Capital Chief Research Officer, Dmitry Kalichkin, highlights what he and his research team do not like about the NVT Ratio. He argues that “spikes in NVT follow bubbles with a considerable lag of a few months.”

“Peak NVT coincides with the middle of a correction period. NVT is [therefore] neither predictive (doesn’t precede the overvaluation), nor descriptive (doesn’t coincide with it). You can only detect the bubble a few months after it bursts,” Kalichkin adds.

Therefore, for the NVT Ratio to be used to detect bubbles, it needs to be augmented. Kalichkin suggests that investors should use a 90-day Moving Average for transaction volumes instead of the original NVT Ratio’s 28-day Moving Average. This change in the ratio computation eradicates the time lag issue mentioned above.

Kalichkin believes that “this refined NVT ratio is a better descriptive metric of bitcoin bubbles. […] A longer smoothing period helps to get rid of the reflexivity effects […] — spikes in transaction volume that follow sharp price increase. These irregularities are speculation-driven and are bad descriptors of fundamental intrinsic utility of the network. When we remove these irregularities, we end up with a better proxy for fundamental value in NVT denominator, and, as a result, the new NVT ratio becomes a better descriptor of price level.”

While Kalichkin believes that his team’s version of the NVT is a superior measure for finding overvalued and undervalued levels, he acknowledges that the NVT’s main drawback is that it only takes on-chain transactions into consideration and thus does not take the entirety of a crypto asset’s activity into account.

Nonetheless, if you are looking for technical indicators to help you with your investment decisions, looking at the Network Value to Transactions Ratio might be a good place to start.