The Future of Money and the Payment System

This is a lecture by Agustín Carstens, General Manager of the Bank for International Settlements, held at Princeton University, Princeton, New Jersey, USA, on December 5, 2019.

Main highlights:

(Read the whole text below)

- Theoretically speaking, money is a social convention, hence anything could serve as money provided that everyone buys in. But this definition is not enough to predict how a particular version of money will perform in the payment system.

- The institutional details matter when it comes to how durable and how efficient any economic arrangement can be.

- Three developments have propelled money and the payment system to the top of the policy agenda in the last few years, raising questions about their basic architecture: 1) the rise and subsequent fall of Bitcoin (BTC) and altcoins; 2) the entry of big tech firms into financial services; 3) the intense debates concerning Libra and other stablecoins.

- Authorities and central banks realize they need to address the issues related to technological innovation and its impact on money and payments in a far more proactive way.

- Policymakers need to harness the best technology that is grounded on a solid foundation.

- The monetary system is founded on trust in the currency, which is something only the central banks can provide, but they need to embrace innovation.

- At the same time, their traditional functions are tailor-made for the many innovations on the horizon, including central bank digital currencies (CBDCs).

- Making the distinction between token-based money and account-based money: the tokens themselves may be intrinsically worthless, but people accept them as payment in the expectation that everyone else will accept them too, while account-based money uses an intermediary.

- Nowadays, anyone with a bank account holds currency in digital form, but the architecture of account-based money remains the same for hundreds of years.

- One notable aspect of Bitcoin was that it harked back to the earlier, token-based definition of money, one that does not rely on intermediaries such as banks.

- The particular given formulation of the consensus mechanism fails two basic tests: scalability and finality of payments.

- This is where the central bank comes into its own, playing four key roles, with the modern payment system being comprised of two tiers where the central bank serves as the banker to commercial banks – thus underpinning the public’s trust in money.

- In case of BTC, if a sufficiently large group of bookkeepers collude to rewrite the history of the distributed ledger, payments that were made far in the past could be made null and void.

- Throughout history, private moneys have come and gone, the critical issue being how the value of a particular form of money is underpinned.

- As long as the foundation of trust provided by central banks is in place, many forms of monetary arrangements can be built on top, using any number of different technologies.

- Technological advances have opened the door to a more fundamental shift away from conventional account-based money, but the technology by itself does not confer a stable value on CBDCs.

- What ensures their stability is that only CBDCs are redeemable in central bank money and are supported by the central bank public goods.

- CBDCs can be classified into wholesale CBDCs and retail CBDCs.

- For wholesale payments, settlement liquidity is particularly important. Account-based CBDCs used by regulated financial institutions have long existed in the form of conventional central bank deposits held by commercial banks.

- The introduction of retail CBDCs would represent a complete sea-change by opening up new possibilities, though they also raise a host of questions and issues.

- Arguably, the most effective way to improve the retail payment system is to build out the current account based, two-tier system to accommodate faster payments. This would be based on a level playing field with room for both traditional banks and innovative non-bank payment service providers (PSPs).

- Innovators include emerging economies and others who are unhampered by legacy technologies or resistance from vested interests. Central bank public goods need to move with the times, but the technology is secondary to the underlying economics.

___________________

The future of money and the payment system: what role for central banks?

Introduction

The economics of money is back in the limelight. Even five years ago, I cannot imagine that a lecture on money and the payment system could have been a subject for an event like today’s.

Theoretically speaking, money is a social convention. People accept money in the expectation that everyone else will do the same. According to this bare-bones definition, anything could serve as money provided that everyone, as it were, buys in. In economic parlance, this equilibrium analysis gives rise to a theoretical notion of a currency area consisting of users in a community, as shown in a recent paper by our host Markus Brunnermeier and his co-authors.[1]

In giving further texture to the analysis of money as a convention, economists and central bankers have learned over the years that the institutional details matter when it comes to how durable and how efficient any economic arrangement can be. To define money as a self-sustaining convention is not the same as nailing down the nitty-gritty details of the monetary system’s architecture.

Central bank public goods

Three developments have propelled money and the payment system to the top of the policy agenda in the last few years, seizing the attention of observers and commentators. The first was the rise (and subsequent fall) of Bitcoin and its cryptocurrency cousins; the second was the entry of big tech firms into financial services, and third and most recently, came the intense debates concerning Libra and other stablecoins. We have followed these developments in various BIS publications.[2]

Each of these developments, in its own way, has raised questions about the basic architecture of money and payment systems. So far, the existing structures have weathered the intellectual onslaught, yet the resulting debate over the future of money and the payment systems has only just started. And the message has certainly been received by authorities in general, and central banks in particular, that they need to address the issues related to technological innovation and its impact on money and payments in a far more proactive way.

Thus, more than ever, we need to keep a clear mind when setting the policy direction. As policymakers, we need to harness the best technology, but also to keep in mind that innovation needs to be grounded on a solid foundation if it is to serve the system well.

A gleaming skyscraper is an awesome sight. But when we admire one, we often overlook its foundations. These are out of sight, below ground level. But just because they are not visible, it does not mean that they don’t matter. On the contrary, they matter a lot.

I tend to think of the monetary and financial system in the same way. The monetary and financial architecture needs solid foundations, just as a skyscraper does. And it is the central bank’s role to establish these foundations. Just as in the case of a building’s foundations, the central bank’s role may not be overly visible, but it is definitely there, supporting the edifice.

The monetary system is founded on trust in the currency. This is something that only the central bank can provide. Like the legal system and other public goods, the trust underpinned by the central bank has the attributes of a public good.[3] To coin a phrase, I would like to refer to “central bank public goods”.

Central bank public goods improve the functioning of the monetary system. They do this by giving the private sector greater scope to innovate, for everyone’s benefit. Central banks amplify the efforts of private sector innovators, by giving them a solid base to build on.

This is where central banks need to focus their efforts. Today’s technological advances can certainly help to build a more efficient and more inclusive financial system, and central banks need to embrace that innovation. At the same time, their traditional functions are tailor-made for the many innovations on the horizon, including central bank digital currencies (CBDCs).

Let me go back to the three ground-breaking developments I mentioned at the outset – Bitcoin, big techs and Libra – and go into somewhat more detail. What we are learning from them is that the bare definition of money as a social convention is not enough to predict how a particular version of money will perform in the payment system. How the institutional arrangements are structured is critical if a given monetary arrangement is to work as intended.

To explain this thought, it is useful to make the distinction between token-based money and account-based money.

Throughout history, various physical tokens have been used as money, the most recent manifestation being notes and coins. In most cases, the tokens themselves may be intrinsically worthless, but people accept them as payment in the expectation that everyone else will accept them too. The more that others trust in monetary exchange, the more willing I am to accept it. In game theory terms, money is an equilibrium in a coordination game.

Account-based money marked a big step forwards in monetary history. This uses an intermediary, typically a bank that accepts deposits. The sender and the receiver of a payment both have deposit accounts at the bank, and a payment is executed when the bank debits the account of the payer and credits the account of the receiver.

Account-based money started to take off when deposit banks became widespread in 17th century Europe. Nowadays, anyone with a bank account holds currency in digital form. Your bank balance is a digital currency in the sense that it is an electronic entry in a ledger maintained by the bank where you hold your account. Yet the basic architecture of account-based money has remained constant for hundreds of years, even if electronic payments have hugely increased the speed and convenience of payments. This is true whether we are talking about conventional bank deposits or the forms of account-based money on innovative payment apps from non-bank payment service providers, such as Venmo or Stripe.

One notable aspect of Bitcoin was that it harked back to the earlier, token-based definition of money, one that does not rely on intermediaries such as banks. But, rather than exchanging physical tokens, a digital token would play the role of money. The token takes the form of an entry in a distributed or shared ledger that is maintained and updated in a decentralised way.

At the BIS, we have covered these issues in detail before,[4] so I won’t go into why this particular formulation of token-based money is flawed. But as we described, the particular formulation of the consensus mechanism fails two basic tests. The first is the test of scalability – where the more users there are, the more users flock to use it. The second test is finality of payments, where a payment is deemed to be final and irrevocable, so that individuals and businesses can make payments in full confidence.

This is where the central bank comes into its own. The modern payment system has two tiers, with the central bank serving as the banker to commercial banks. This two-tier system is the epitome of the account-based monetary system. The central bank grants accounts to commercial banks and other payment service providers (PSPs), so that domestic payments are settled on the central bank’s balance sheet.

Why arrange the system in this way? Crucial to the two-tier system is the unique position of the central bank, which plays four key supporting roles.

The first is to provide the unit of account in the monetary system. When you look at a dollar bill, it represents the promise of the Federal Reserve to provide the bearer with one dollar. From that basic promise, all other promises in the economy follow.

The second is to provide the finality of payments by using its own balance sheet as the settlement vehicle. Established in law, the central bank is the trusted intermediary that makes good on debiting the payer’s account and crediting the receiver’s account. Once the accounts are debited and credited through the accounts of the central bank, the payment is final and irrevocable.

Contrast this with Bitcoin. There, everything works by decentralised consensus, and what is deemed to be true is what the consensus says. In such a system, if a sufficiently large group of bookkeepers collude to rewrite the history of the distributed ledger, payments that were made far in the past could be made null and void. You may think that you received a payment from a customer in the past, and had planned to serve other customers relying on the funds from that payment. But you might wake up one morning to find that the money you thought you had is no longer there.

This simply cannot happen when the central bank is the final guarantor of finality. Once the payment is settled on the central bank balance sheet, that is it. It is final. The only way to reverse such a transaction is to conduct a new transaction that goes the other way.

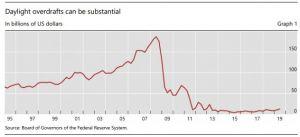

The third role of the central bank is to allow the payment system to work smoothly by providing enough liquidity for settlement to ensure that no logjams occur. At times of stress, the central bank’s role in providing liquidity takes on a sharper form as the lender of last resort. In today’s large-value payment systems where the value of payments is high relative to cash balances maintained by individual system participants, gridlock could easily result if payments have to wait for one another.[5] When the central bank can extend credit directly on its wholesale accounts, in the form of daylight overdrafts, it can help to resolve the congestion. These overdrafts can at times be substantial, as shown for the United States in Graph 1. In the years leading up to the Great Financial Crisis (GFC), the Fed injected up to $180 billion into the system every day, or roughly 5% of the total volume of daily payments. After the GFC, daylight overdrafts have fallen back, but this reflects the much larger reserve balances maintained by commercial banks at the Federal Reserve. The general point stands: settlement liquidity can be met only with central bank support – or else the participants would need very large cash balances. And in times of stress, the lender of last resort role of central banks remains central to the financial system’s safety.

The fourth role is their oversight of payment systems to ensure their safety and efficiency, by setting out requirements and enforcing them.[6]

These four roles set the foundations under the modern two-tier payment system. By performing these functions, the central bank underpins the public’s trust in money, a core public good that sustains the financial system. After all, the monetary system is a critical public infrastructure that everyone depends on, and should be run in the interests of the public, not those of private stakeholders. When I refer to “central bank public goods”, this is what I have in mind.

The governance of money

Throughout history, private moneys have come and gone. Some have lasted longer than others. The critical issue has always been how the value of a particular form of money is underpinned. In private money experiments, the starting point is always a strong commitment to backing the value of issued money, both by pledging assets and establishing “binding” rules for its issuance. But history tell us that eventually the temptation to maximise profits starts eroding the issuer’s commitment to the currency’s value, which ultimately succumbs to governance failures. At first, such a currency may attract a sizeable fan club, but decline comes at first “gradually and then suddenly”, as Ernest Hemingway memorably said about bankruptcy.[7] This cycle may play out quickly, but it can also take years.

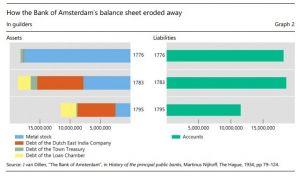

In the case of the Bank of Amsterdam (1609–1820), it took more than a century. Yet its governance failed it in the end. The Bank of Amsterdam was set up as a deposit and payment bank that provided account-based money for its depositors. Merchants paid gold coins into the bank and the bank issued deposits backed by the coins. In turn, the deposits could be used to make payments and settle financial claims.

In the way that the account-based money was created and managed, the Bank of Amsterdam bears more than a passing resemblance to the “stablecoins” that have captured headlines since the launch of Libra in June. The value of deposits is maintained by an asset backing, so that account-based money can serve not only as a unit of account and the means of payment, but also as a store of value.

For 170 years, the highly successful Bank of Amsterdam boasted a copper-bottomed balance sheet, with liabilities almost entirely backed by metal stock (see Graph 2, top bars). Its excellent reputation allowed the Bank to depart from its charter from time to time when providing liquidity assistance to market participants through overdrafts. However, in the late 1770s, it veered further away from its charter by lending more and more to its largest customer, the Dutch East India Company. As its creditworthiness seeped away, together with the quality of its backing (see Graph 2, middle bars), so did public trust in its account-based money. The resulting run in 1795 led to the bank’s collapse (see lower bars in Graph 2).[8]

The history of the Bank of Amsterdam resonates strongly in the current debate about stablecoins. The lesson is that good governance is critical. Governance is not just about the letter of the charter, but must be robust enough to resist forces that might undermine the charter. Even if a stablecoin is run by a non-profit entity, its long-term sustainability is still limited by the credibility and scope of its governance arrangements, particularly regarding its asset backing. Clarity on legal aspects, counterparty risks and who will provide liquidity and assistance in case of need are also key elements for the sustainability of stablecoins. Ultimately, it would be reasonable to say that only a publicly accountable institution could supply these elements. In this respect, the trust accorded to central banks as accountable public institutions is crucial to their ability to provide foundational public goods.[9]

Central bank digital currencies (CBDCs)

Let me jump back to a very topical issue: that of central bank digital currencies (CBDCs). I introduced the distinction earlier between the technology of the monetary system and its architecture. As long as the foundation of trust provided by central banks is in place, many forms of monetary arrangements can be built on top, using any number of different technologies. The conventional two-tier banking system and the real-time gross settlement (RTGS) payment system is one form. But other arrangements are also possible, including ones involving digital currencies issued by central banks. Using the architectural analogy, where different kinds of structure can be built on top of sound foundations, the superstructure of the payment system can take many forms, provided that the underlying foundations are sound.

Technological advances have opened the door to a more fundamental shift away from conventional account-based money. Digital tokens that can be transferred within a decentralised network of participants allow peer-to-peer payments. Once membership of the network is determined and procedures to transfer and settle tokens are clear, payments can be made and settled bilaterally, no matter how far apart the sender and receiver are located. Where conventional account-based payment systems need a chain of interlinked intermediaries to proceed, token-based systems would only need to find the recipient of the funds (or its bank) on the membership list. The transfer itself could take place using distributed ledger technology (DLT). This kind of system harks back to the classical analysis of money in terms of a historical ledger of all transactions.[10] Indeed, the emergence of token-based money makes practical what was formerly a purely theoretical notion in monetary economics.

However, the technology by itself does not confer a stable value on CBDCs. Token-based digital currencies share outward similarities in their technology, such as the use of DLT. This is so whether the digital token is issued by the central bank, by a private entity, or by a protocol as in Bitcoin. The key features that distinguish CBDCs from the rest is that only CBDCs are redeemable in central bank money and are supported by the above-mentioned central bank public goods. It is these features which ensure that the value of CBDCs remains stable.

CBDCs can be classified into wholesale CBDCs, where the network participants are financial institutions that already have access to the central bank balance sheet, and retail CBDCs, which are also available to general users such as businesses and consumers.

As for wholesale CBDCs, we should remember that account-based CBDCs used by regulated financial institutions have long existed in the form of conventional central bank deposits held by commercial banks. Tokenised wholesale CBDCs are under development for specific applications involving large-value payment systems, such as the settlement of large securities trades. For example the Bank of Canada and the Monetary Authority of Singapore have tested the use of token-based CBDCs for crossborder wholesale settlements. The private sector has also proposed wholesale stablecoins, for example, JPMorgan Coin and Utility Settlement Coin.

For wholesale payments, settlement liquidity is particularly important. For large-value payment systems that transact in real time, where the value of payments is large relative to cash balances, settlement liquidity is a key source of potential inefficiency. As already described, central banks could provide overdrafts to payment system participants to allow more immediate payments with less prefunded liquidity. CBDC token technology by itself does not remove settlement liquidity requirements, and adopting a tokenised CBDC technology does not obviate the need for central banks to provide daylight overdrafts. But, CBDCs could be made compatible with the provision of central bank settlement liquidity. The technology is tangential to the underlying economics.

Because wholesale CBDCs would be restricted largely to the same firms that currently use central bank deposits, wholesale CBDCs do not raise the difficult commercial footprint issues associated with widely available retail CBDCs, as outlined below.

The introduction of retail CBDCs would represent a complete sea-change. As noted in some of our reports, these would open up new possibilities when it comes to the 24/7 availability of payments, different degrees of anonymity, peer-to-peer transfers, or scope for applying an interest rate to a currency.[11] But they also raise a host of questions, starting with who takes responsibility for the enforcement of know your customer/anti-money laundering regulation.[12]

Most importantly, retail CBDCs would raise issues similar to those that would arise if ordinary citizens were to gain access to the central bank’s balance sheet. Imagine if anybody could open an account at the central bank, and have a debit card for that account. If this were to become widespread, the central bank’s footprint on the payment system and the wider economy would widen. In extreme cases, the central bank could become the one-stop banker for almost everybody in the economy. As I noted earlier this year,[13] the risks and operational costs for the central bank could be daunting. If the central bank becomes everybody’s deposit-taker, it may find itself becoming everybody’s lender too. The question of whether the central bank should provide access to its balance sheet via accounts or by issuing retail CBDCs is secondary. Either way, the central bank could crowd out private intermediaries. This again throws into sharp relief the distinction between the monetary system’s technology and the architecture underlying it.

The bottom line is this: provided there is a basis for central bank support, all types of payment system are possible, from RTGS to CBDCs. The technology is secondary to the underlying economics. But all possible solutions depend on the public goods associated with the central bank’s provision of the unit of account, finality of settlement, lender of last resort function and regulatory oversight.

Improving the current account-based payment systems

Arguably, the most effective way to improve the retail payment system is to build out the current accountbased, two-tier system to accommodate faster payments. This would be based on a level playing field with room for both traditional banks and innovative non-bank payment service providers (PSPs).

Central banks can promote competition by giving new non-bank PSPs access to central bank settlement accounts. Some already have: the Bank of England has adjusted its settlement accounts policies to allow access by non-banks. Another example is Switzerland, where licensed fintech firms are allowed access to accounts at the Swiss National Bank.[14] To ensure a level playing field and respect the principle of proportionality, light regulation must go hand in hand with reduced access to central bank services. Lightly regulated PSPs should, for example, have access to central bank settlement accounts only on a prefunded basis. In other words, they should not qualify for overdrafts or other central bank liquidity assistance.

New questions arise when large technology companies venture into payments. Their business model rests on enabling direct interactions among a large number of users via online platforms (social networks, e-commerce platforms and search engines). An essential by-product is the large stock of user data, which serves as an input for services that exploit natural network effects, generating yet further user activity. Increased user activity then completes the circle, as it generates yet more data. Because of this data-network-activity feedback loop, the entry of these big techs into the provision of payment services raises serious market power and data privacy issues.[15]

The People’s Bank of China has recently adopted a two-tier system reform that allows big techs to be fully integrated into the central bank payment system. First, the reform imposes a 100% reserve requirement on customer balances in the payment accounts of big techs. This is intended to strictly limit the potential risks from big techs investing these funds in interest-bearing assets within the banking system, or from venturing into shadow banking by extending credit to customers on their credit platforms. Second, big techs are required to clear payments on a newly created state-owned clearing house, NetsUnion Clearing.[16] The clearing of payments through a common, public platform enhances transparency by replacing the complex and opaque bilateral relationships between third-party payment platforms and banks.

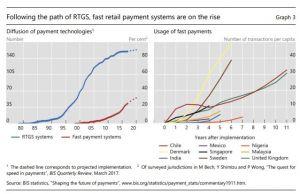

Within the two-tier, bank-based payment system, fast retail payment systems are gaining ground. Currently, 45 jurisdictions have fast payment systems, and this is expected to rise towards 60 soon.[17] As is documented in Graph 3, the adoption of fast retail payments is following the path of real-time gross settlement (RTGS) systems, which took off slowly but then spread quickly and are currently used by most central banks.

Innovators in this field include emerging economies and others who are unhampered by legacy technologies or resistance from vested interests. In some respects, the United States is one of the few advanced economies where fast payments are not widely available. It is only this year that the Federal Reserve Board of Governors has announced that the Fed’s own fast payment system, FedNow, will go live in 2023 or 2024.[18]

The common element in current initiatives to improve the existing system is the central bank’s provision of the core infrastructure in terms of settlement accounts on its balance sheet, combined with customer-facing services provided by the private sector. The dividing line differs depending on the particular application. In the case of Sweden’s Swish, for instance, the platform is private, provided by a consortium of commercial banks. The banks maintain pre-funded accounts which pay out settlement funds. Ultimately, however, commercial banks settle any outstanding net payments on the settlement accounts at the central bank, the Riksbank. In terms of user experience, or the “look and feel”, mobile phone apps like Swish already provide the convenience that is the selling point of mobile wallets such as Calibra that bypass the central bank altogether. The difference is that innovations based on central bank public goods have been proven to work. They benefit from the trust in the monetary system that is backed by the central bank.

The private sector will always have an important role to play in payments. The question is how to divide the work appropriately between the private and public sectors. There is no one-size-fits-all answer to this question, and the practice in different countries varies widely. Compare the Swish system with India’s Universal Payment Interface (UPI). Unlike Sweden’s privately operated platform, India’s platform is run by the National Payment Corporation of India (NPCI), a utility partly owned by the central bank. [19]

The private sector excels at customer-facing activity, using its ingenuity and creativity to serve customers better. However, there are good arguments for involving the public sector when setting standards or ensuring a competitive level playing field. Once the basis is in place, there is more scope for others to build.

The internet is a good example. It originated in projects to link military computer networks, but received a big boost in the 1980s with a project to connect academic computer networks. In fact, the modern internet was made possible by adopting common standards to govern the way computers talk to each other. You might remember things like the TCP/IP protocol, and the convention governing email addresses. These are now so commonplace that we forget them in everyday use. But in thinking about improving the payment system, they are important precedents to consider.

You could think of these standards as part of the core, or foundational infrastructures that are best set up with the public interest in mind – as opposed to closed or segregated systems configured for the benefit of private interests. The equivalent for payment systems would be a core infrastructure providing common addressing standards for individual accounts in the payment system, together with messaging standards that allow account holders to locate each other.

To bring the discussion closer to what is happening around the world, take the case of digital ID systems. Many countries have national ID numbers, but not all have digitised them for widespread use or to provide financial services. In many countries, private institutions, such as industry associations of commercial banks, have taken the lead in digitising national ID numbers. This is an example of the private provision of a public good.

Another layer is a uniform address format for all account holders in the payment system, even when they are customers of different banks or PSPs (including big techs). This is rather like the address format which allows emails to find their way to users wherever they are. These common addressing formats could then be combined with open application programming interfaces (open APIs) that let banking apps talk to each other – making them interoperable. In this way, the users of one bank’s app could easily send payments to or receive them from accounts held by other banks or payment service providers.

The combination of uniform address formats and open APIs eliminates closed or segregated networks where users are trapped within the network of one provider. These closed networks are like “walled gardens” that hinder any wider communication. Open APIs open up the payment system so that users and providers can all communicate on one platform. Among other things, this levels the competitive playing field and allows smaller players to compete on an equal footing.

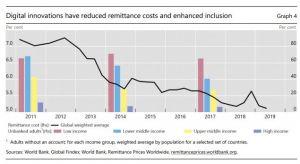

Of course, payment systems should also work globally. Central banks can support more efficient cross-border payments. Although the cost of such payments is already coming down everywhere (see Graph 4), more can be done. Policymakers are exploring various paths, for example, to support bilateral cross-border corridors for remittances. But such arrangements could only be in implemented if a crossborder solution is found to address anti-money laundering and financing of terrorism arrangements.

When embarking on these projects, protecting privacy is very important. A data permission layer needs to be included. We also need safeguards on how the data are stored and retrieved. And strong cybersecurity defences are paramount.

Building central bank public goods will also be vital in creating a level playing field. The entry of big techs into financial services makes it even more urgent to level out the playing field. When big techs provide payment services that bundle other digital services, using their existing businesses in e-commerce, social media, or search engines, the data generated could result in a data-network-activities loop (DNA) loop that entrenches a dominant service provider.[20] When the central bank provides the core infrastructure, big techs can be integrated into the two-tier system by mandating a reserve requirement.[21] Policies aimed at competition and data privacy can address the economic impact of market power and safeguard private data.

Concluding remarks

Central banks find themselves at the heart of developments that are transforming the financial sector and the wider economy, the nature of money, the payment system and financial regulation. In this respect, we have a responsibility to be at the cutting edge of the debate. In fact, there is really no choice but to do so, as otherwise events will overtake us.

To return to where I started today: central bank public goods need to move with the times. Establishing the BIS Innovation Hub is part of a medium-term strategy to do exactly this. This is vital if the BIS is to continue providing relevant and timely knowledge and services to central banks. The Innovation Hub will bring together expertise from many different sources. By doing so, our aim is to foster international collaboration on innovative financial technology within the central banking community, and also to contribute to the dialogue between the public and the private sectors. As the recent debate on global stablecoins has shown, it is vitally important for the public sector to identify issues well in advance and address them with the private sector in a timely fashion.

Let me conclude by reiterating the importance of the central banks’ role. We should all embrace innovation. What is important is how innovation is encouraged and applied. I have argued for central bank public goods as a means of achieving better payment systems. Central banks provide core services that are unique to them, such as providing the unit of account, settlement finality, liquidity provision and regulatory oversight. Provided that the central bank can underpin the core of the payment system, all types of payment solution are feasible. The technology is secondary to the underlying economics. Irrespective of technology, all solutions ultimately rely on central bank public goods. Whether you build a cabin, a house or a skyscraper, the building will stand only if it has sound foundations.

__________

[1] See M Brunnermeier, H James and J-P Landau, “The digitalization of money”, NBER Working Papers, no 26300, September 2019.

[2] The BIS’s Annual Economic Report and its other publications have tracked these debates. In our 2018 Annual Economic Report, we looked at the economics of Bitcoin and this year’s report dedicated an entire chapter to the role of large technology firms (“big techs”) in finance. Work on stablecoins is now in progress. See G7 Working Group on Stablecoins, “Investigating the impact of global stablecoins”, October 2019.

[3] For a discussion of the concept of public goods, see G Mankiw, Principles of Economics, seventh edition, Cengage Learning, 2011; P Samuelson, “The pure theory of public expenditure”, Review of Economics and Statistics, vol 36, no 4, 1954, pp 387–9. One can distinguish between “pure” public goods which are non-rival and non-excludable, versus “impure” public goods. For example, “club goods” are non-rival but excludable, and “common goods” are non-excludable but rival.

[4] See A Carstens, “Money in the digital age: what role for central banks?“, lecture at the House of Finance, Goethe University, Frankfurt, 6 February 2018. See also BIS, Annual Economic Report, 2018, Chapter V, and R Auer, “Beyond the doomsday economics of ‘Proof-of-work’ in cryptocurrencies”, BIS Working Papers, no 765, January 2019.

[5] See M Bech and K Soramäki, “Liquidity, gridlocks and bank failures in large value payment systems” in E-Money and Payment Systems Review, Central Banking Publications, 2002.

[6] An additional role of many central banks is to supervise commercial banks as the core participants in payment systems. Prudential bank supervision reinforces the role of central banks as overseers of payment systems, to ensure their smooth functioning.

[7] E Hemingway, The Sun also Rises, New York: Scribner’s, 1926.

[8] See J Frost, H S Shin and P Wierts, “An early stablecoin? The Bank of Amsterdam and the governance of money”, BIS Working Papers, 2019 (forthcoming).

[9] Indeed, clarity on legal aspects and good governance are the first and second principles for financial market infrastructure; see Committee on Payments and Market Infrastructures and International Organization of Securities Commissions, Principles for financial market infrastructures, April, 2012.

[10] See N Kocherlakota, “Money is memory”, Journal of Economic Theory, vol 81, no 2, August 1998, pp 232–51.

[11] For an in-depth discussion, see Committee on Payments and Market Infrastructures (CPMI) and Markets Committee (MC), “Central bank digital currencies”, March 2019. For results of a survey of central banks on CBDCs, see C Barontini and H Holden, “Proceeding with caution: a survey on central bank digital currency”, BIS Papers, no 101, January 2019.

[12] J Powell, “Letter to congressman French Hill”, 19 November 2019.

[13] A Carstens, “The future of money and payments”, speech by the General Manager of the BIS at the Central Bank of Ireland, Whitaker Lecture, Dublin, 22 March 2019.

[14] The Hong Kong Monetary Authority has granted “virtual banking” licenses to a number of new fintech companies. As licensed banks, these must join the RTGS system and open settlement accounts with the HKMA.

[15] A Carstens, “Data, technology and policy coordination”, speech by the General Manager of the BIS at the 55th SEACEN Governors’ Conference and High-level Seminar on “Data and technology: embracing innovation”, Singapore, 14 November 2019.

[16] The major stakeholders of NetsUnion Clearing are the People’s Bank of China and associated governmental institutes (40%), Tencent (9.6%), Alipay (9.6%) and other third-party payment platforms (40.8%). Clearing is also possible via China Union Pay, a state-owned clearing network for bank card payments.

[17] M Bech and C Boar, “Shaping the future of payments”, Commentary on the CPMI “Red Book” statistics, November 2019.

[18] L Brainard, “Delivering fast payments for all”, speech at the Federal Reserve Bank of Kansas City Town Hall, Kansas City, 5 August 2019, and “Digital currencies, stablecoins, and the evolving payments landscape”, speech at The Future of Money in the Digital Age conference sponsored by the Peterson Institute for International Economics and the Princeton University Bendheim Center for Finance, Washington DC, 16 October 2019.

[19] A Carstens, “Central banking and innovation: partners in the quest for financial inclusion”, speech at the Reserve Bank of India, C D Deshmukh Memorial Lecture, Mumbai, 25 April 2019.

[20] Bank for International Settlements, Annual Economic Report, June 2019, Chapter III, “Big tech in finance: opportunities and risks”.

[21] See A Carstens, “Big tech in finance and new challenges for public policy”, keynote address at the FT Banking Summit London, 4 December 2018, and also BIS (2019), see footnote above.