P2P Bitcoin Trading: Bisq & Paxful Grow, LocalBitcoins Slips

In Spring 2019, we witnessed the end of the so-called “crypto winter” when the price of bitcoin rallied past the USD 5,000 mark in the first days of April to peak at over USD 13,000 in June. While the altcoin market is still struggling to recover, bitcoin (BTC) managed to put itself back on the map for profit-hungry investors, despite its retracement to sub-USD 10,000 in Q3/2019.

In this article, we analyze peer-to-peer (P2P) bitcoin trading activity to gain insight into how this segment of global bitcoin trade has performed in the past twelve months, when the total trading volume on crypto exchanges has increased.

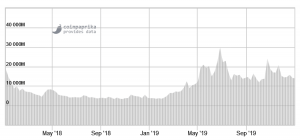

Daily bitcoin trading volume on exchanges: 2018-2019

Decentralized peer-to-peer trading has taken off in 2019

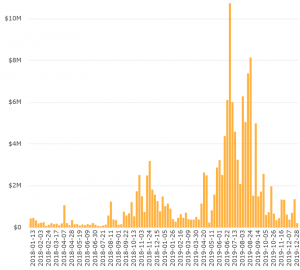

Bitcoin trading data provided by analytics platform Coin Dance for P2P trading platform Bisq suggests that an increasing amount of bitcoin traders prefer to trade on a private peer-to-peer basis.

Bisq is an open-source, decentralized peer-to-peer trading application that enables individuals across the globe to buy and sell bitcoin (and other cryptoassets). The key difference between Bisq and other leading P2P marketplaces is that the trading application does not require users to undergo an ID verification process nor does it store user’s funds. Moreover, Bisq is built on top of Tor to enhance transactional privacy for its users.

Judging by its global trading data, Bisq had its best year ever in 2019. While in the year prior, its highest volume week only saw around USD 3 million worth of BTC traded, its best week in 2019 saw over three times that amount. In total, Bisq trading volumes tripled in 2019 vs. 2018, amounting to over USD 112 million (c. BTC 15,500).

While Bisq has lower trading volumes than other P2P bitcoin exchanges, it has become an increasingly popular trading platform for individuals who cherish their privacy and financial sovereignty.

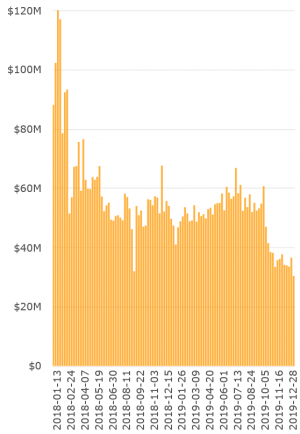

P2P trading is thriving in struggling economies on LocalBitcoins

Globally, trading volumes are down slightly on market-leading P2P trading platform LocalBitcoins in 2019 vs. 2018, which could be attributed to the introduction of mandatory KYC (know your customer) procedures and increasing competition in the P2P exchange market. However, LocalBitcoins still plays a fundamental role for bitcoin traders in emerging markets that are suffering from economic downturns and in those that are not home to reliable local exchanges.

LocalBitcoins has been experiencing record trading volumes in Argentina, Colombia, Egypt, India, Kazakhstan, Kenya, Mexico, Peru, South Africa, and Venezuela, most of which are countries that have been suffering from economic difficulties in 2019.

In total, LocalBitcoins saw over USD 2.5 billion (c. BTC 346,000) of bitcoin traded via its platform, despite the removal of its popular cash in-person payment option and the addition of more KYC measures.

This somewhat supports the theory that bitcoin can act as a store of value as well as a currency alternative in nations with weakening currencies and dire economic outlooks. Moreover, LocalBitcoins trading data suggests that emerging markets have been key drivers in the P2P bitcoin trading in the past twelve months are more and more individuals are opening up to bitcoin in these geographies.

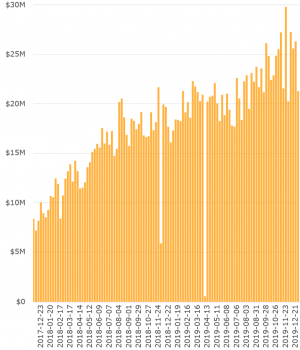

Paxful’s trading volumes are “mooning”

U.S.-based P2P bitcoin exchange Paxful had its best year – in terms of trading volumes – since its launch in 2015. According to trading volume data by Coin Dance, Paxful has experienced a steady increase in volumes through the past twelve months.

Similarly to LocalBitcoins, a substantial amount of the trading activity on the P2P marketplace has come from emerging markets, including China, India, Kenya, the Philippines, and the UAE. Moreover, the company has stated that Nigeria and Ghana are its two biggest markets.

However, it is important to note that Paxful’s trading volumes have also grown in developed markets such as Australia, Europe, UK, and in the U.S.

Globally, Paxful users traded over USD 1 billion (c. BTC 138,500) in digital currency over the course of the last twelve months, according to Coin Dance data.

Is P2P trading poised to increase in 2020?

In light of a tightening of crypto regulations in several jurisdictions that is leading to mandatory KYC for exchange users as well as a number of exchanges no longer servicing specific jurisdiction (including the U.S. in some cases), we could expect to see peer-to-peer bitcoin trading to continue to grow in the coming twelve months.

It comes as no surprise that peer-to-peer marketplaces have become go-to trading platforms in countries where local exchanges are unable to function effectively under the local regulatory framework. Moreover, in markets were bitcoin trading is either prohibited or within a grey area of the law, P2P trading platforms are empowering individuals to exercise their right of financial sovereignty.

As centralized bitcoin exchanges continue to tighten the KYC requirements forced upon them by lawmakers, we could see a move away from exchanges towards P2P marketplaces, like Bisq, with no or less stringent ID verification requirements from bitcoin traders who are more concerned about privacy. Given that privacy in the digital age is becoming an increasingly important issue, this trend could come to flourish in 2020.