How to Launch a Bitcoin ATM Business

The Bitcoin ATM market is “mooning.” When the first Bitcoin ATM was installed in Vancouver, Canada in 2013, Bitcoin was still a largely unknown phenomenon. Fast forward to 2019, Bitcoin and Bitcoin ATMs are seemingly everywhere.

Today, there are over 5,000 Bitcoin ATMs across the globe, according to Coin ATM Radar. From New York to Hong Kong, Moscow to London, and Buenos Aires to Sydney, you will find Bitcoin ATMs. Even the small African nation of Djibouti is home to a Bitcoin teller machine. The more bitcoin awareness and adoption grows, the more entrepreneurs are installing Bitcoin ATMs in an attempt to benefit from the ”bitcoin gold rush.”

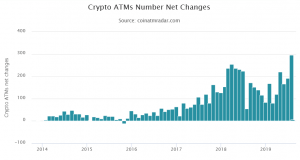

The chart below shows net change of cryptocurrency machines number installed and removed monthly:

In this guide, you will learn how you can launch a Bitcoin ATM business to jump onto this business opportunity, which is still risky as any other business idea.

Review regulations and laws

First and foremost, you will need to check what the legal and regulatory situation is in the country or state you want to run your operation. The legal framework for operating a bitcoin teller machine can differ significantly from jurisdiction to jurisdiction and not complying with laws when it comes to cryptocurrencies is a surefire way to suffer serious legal consequences.

Therefore, it is highly advisable to consult with a lawyer before launching a bitcoin business to ensure you will not end up on the wrong end of the law.

Find Bitcoin-friendly banking partners

Regardless of whether the Bitcoin ATMs you will install are one-way or two-way, you will need to handle cash as part of your day-to-day business operations. Therefore, you will need a business bank account at a bank that is willing to provide its services to a bitcoin business.

Due to the threat that Bitcoin poses to the legacy banking systems, the majority of banks have been reluctant to bank Bitcoin startups. However, in most countries, you should be able to find a lender or a mobile-only banking provider that is willing to open an account for you.

To play it safe, it would be advisable to set up more than one banking relationship due to the ever-changing regulatory landscape and to have a backup in case one institution changes its policy about servicing Bitcoin businesses.

The setup costs

The setup costs for a Bitcoin ATM business can vary greatly, depending on what types and how many ATMs you decide to purchase to launch your venture.

The prices of Bitcoin ATM range from USD 775 for a BitTeller BTM to USD 14,500 for a two-way Genesis Coin Genesis1 model. Delivery costs, installation costs, taxes, and import duties also need to be included in the setup costs as well as potential upfront rental charges for your chosen Bitcoin ATM location(s).

Exchange integration is another important aspect of setting up a Bitcoin ATM (unless you want to use your own company/personal cryptocurrency wallets). However, exchanges generally do not charge an upfront fee as they receive execution fees on each trade.

The purchase price of the machine(s) will be the largest portion of the setup costs while the remaining expenditure will range from a few hundred dollars to several thousand. Marketing expenses should also be taken into consideration as you will need to attract users to your ATM.

Provided you choose one of the more affordable Bitcoin ATM models, your set-up costs could be as low as USD 5,000. On the high end, you could look at USD 20,000 to USD 25,000.

Day-to-day management

The day-to-day management of a Bitcoin ATM business involves providing customer service to users who are having issues with the machine, doing cash runs to either restock the machine or to bring cash to the bank, ensuring everything runs smoothly with the exchange integration, prices feeds remain operational, and that the machine is running without glitches.

A Bitcoin ATM business is, therefore, not one that can easily be run remotely. Either you or a trusted staff member will need to be on the ground to check on the machine(s), conduct maintenance if/when necessary, and conduct the cash management.

How much can you expect to earn?

The amount of profit you can generate per Bitcoin ATM will depend on factors such as the location, public interest, the level of customer support, the machine’s availability, and whether bitcoin is in bull or bear market.

To get an idea of how much you can expect to earn, you can use the CoinATMRadar Bitcoin ATM ROI Calculator. The calculator enables you to input your known business costs, the ATM specifications, and your expected transaction volumes to compute an estimated ROI (Return on Investment) per machine.

Let’s assume you purchase a General Bytes BATMTwo Classic for USD 3,249, and you expect your machine to process 300 transactions with an average transaction volume of USD 250 per month. You charge a 7% transaction fee, and the linked exchange charges a 0.2% trade execution fee. Finally, you pay USD 250 a month rental cost for the location of the ATM (in a café, restaurant or a shop, for example) and you had one-off costs to start the business of USD 2,500.

In this instance, you would generate USD 5,250 in revenue per month, which would equate to USD 4,850 in monthly profits and a payback period of only one month.

This example shows that Bitcoin ATM businesses can be highly profitable if the right location is found, and enough users can be attracted. While this is only a theoretical example, the above returns mirror anecdotal evidence of Bitcoin ATM profitability found online.

If you have the funds to launch such a venture and are located in a bitcoin-friendly jurisdiction, a Bitcoin ATM business may be an excellent entrance into the Bitcoin economy for entrepreneurs who are willing to take risks and, as a result, potentially receive a high monetary payoff. However, as with every business, there can be no guarantees.

______

Read more: How To Build Your Own Crypto Exchange Business