Has Zimbabwe Made U-turn on Bitcoin? Cryptopreneurs Still Skeptical

Despite the Reserve Bank of Zimbabwe (RBZ) said that it will create a regulatory sandbox for crypto entrepreneurs, local industry players warned not to get too excited and urged to wait for results.

In March, the bank announced that it has started drafting a policy framework.

“The framework, which is a regulatory sandbox, will be assessing the cryptocurrency companies as to how they are going to operate,” Chronicle reported back then, citing Josephat Mutepfa, Deputy Director of Financial Markets and National Payment Systems at the RBZ.

Also in March, American company Apollo Fintech signed a memorandum of agreement with government-owned CBZ to “develop and operate 3 national solutions” and one of them is a gold-backed stablecoin.

However, some local crypto industry players are still skeptical about these plans.

“It’s not something to celebrate too early because it has been two years now and they are saying the same thing over and over again at conferences,” Confidence Nyirenda, Director of crypto exchange BitPaya and a former blockchain developer at Smartcash and Golix, told Cryptonews.com.

He added that the RBZ has ignored solutions offered by local startups and now the central bank is inviting developers from foreign countries. Nyirenda is concerned that the market regulator will create a harsh regulatory environment for local startups, while only big players might benefit from the new regulations.

“Therefore, besides this being good news to the crypto and blockchain world, it might be a setback for local startups that helped create the community and the industry,” he opined.

Meanwhile, Terrence Zimwara, Africa Curator in Chief at Africa Blockchain Media, thinks that the RBZ will only work with those companies it can control.

“You need to understand that the RBZ, just like other central banks on the continent, is not a big fan of privately issued digital currencies,” Zimwara said, suggesting to wait and see what actions will follow the recent positive statements.

He also stressed that with the Zimbabwean Dollar (ZWL) headed for another collapse, the RBZ needs to bring a monetary alternative if it wants to restore confidence, and by working with the local crypto community it has greater chances to find better solutions.

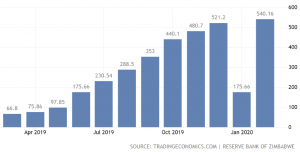

The annual inflation rate in Zimbabwe was 540% in February this year.

Bitcoin finds its way

Meanwhile, according to local players, crypto awareness is growing in the country.

Local crypto entrepreneurs told Cryptonews.com that they believe that crypto payments would help increase liquidity in the market and “would have a really good impact on financial inclusion and would make payments cheaper.” Moreover, even local tourist guides warn that it’s difficult to get ZWL in cash.

Also, as more and more local people know about crypto and are using it, the RBZ even banned local banks from dealing with businesses involved in crypto in order to avoid capital flight.

However, Zimbabweans are still finding peer-to-peer ways to trade crypto.

“Nothing is done via banks. There are WhatsApp groups where people buy and sell crypto,” an operator of such groups told Cryptonews.com.

He claims he “interacts with about 2,000 people on the various groups that buy and sell bitcoin (BTC) on a daily basis.”

“Five years ago, when I got involved with cryptocurrency, 1 out of 100,000 understood what it was. Now, it’s probably 1 out of 1,000,” he concluded.

The RBZ did not respond to our requests for comment.