Crypto for Beginners: Which Trading Strategies Work Best?

Some experts believe that all trading strategies are just as applicable to crypto as they are to other assets. As with all things in crypto and non-crypto trading, there is sadly never any guarantee of profit.

Given the erratic, unpredictable behavior the cryptocurrency market can sometimes exhibit, people moving to crypto-trading for the very first time may be forgiven for thinking that no conventional trading strategy is particularly effective.

However, this assumption is mistaken: even though cryptocurrencies are generally more volatile than many other financial assets, experienced traders affirm that certain strategies are indeed applicable to crypto.

And in fact, some experts even believe that all trading strategies are just as applicable to crypto as they are to other assets, which aren’t as different from Bitcoin and other coins as beginners might initially suppose.

Modern portfolio theory

“I believe in something called ‘portfolio science,'” Lou Kerner – a founding partner at venture capital firm CryptoOracle – tells Cryptonews.com. “[This] says you allocate a percentage of your assets to crypto, and then buy a basket of market weighted assets, on a regular basis (monthly, quarterly), and not worry about prices. Over the long run, that’s how you maximize returns.”

Kerner is referring here to modern portfolio theory (MPT), which originated from a 1952 essay by American economist Harry Markowitz.

In its simplest form, MPT involves investing in a range of assets whose price movements are uncorrelated. Because they’re uncorrelated they tend not to fall and rise together, thereby lowering the investor’s exposure to individual asset risk and saving him or her from making an overall loss.

And as Kerner suggests, if the investor chooses their spread of assets (including cryptocurrencies) carefully, they may enjoy stronger returns over the long term.

For example, a 2017 study conducted by researchers at Bocconi University in Italy suggests that MPT is the optimal strategy for crypto-trading, at least when compared to a ‘Bitcoin-only’ strategy and one which weights a number of different coins equally (i.e. that includes an equal amount/value of each coin).

However, the key point to make here is that the use of MPT cannot generally be confined solely to the crypto-market.

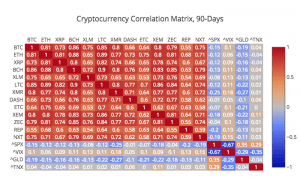

That’s because cryptocurrencies are too highly correlated with each other at the moment, as can be shown by the table below. When one slips so do the vast majority of the others, thereby exposing investors to greater risk.

Breakouts

As crypto-trading analyst Alex Krüger tells Cryptonews.com, there is one promising trading strategy for those who want to stick solely to cryptocurrencies.

“Breakouts,” he affirms. “Cryptos are very directional. Breakouts work much more consistently than for other asset classes.”

The breakout trading strategy rests on the assumption that, when the price of a cryptocurrency (or any other asset) ‘breaks’ through its usual support or resistance level, it has most likely begun a new price trend.

For those unfamiliar with these terms, the ‘support’ level is the price which, in the past, an asset generally hasn’t fallen below. Conversely, the ‘resistance’ level is the price above which an asset tends not to rise, since historically traders have usually wanted to sell at such a level.

If a cryptocurrency drops or rises above one of these levels, then it may be a good idea to go short on it (in the case of drops), or to go long (in the case of rises). In other words, it might be profitable to invest in it before this emerging trend hits new support or resistance levels.

Of course, while the tendency of cryptocurrencies to ‘breakout’ of support/resistance levels potentially makes them ripe for this strategy, cryptocurrency trends have been noticeably short-lived. For example, Bitcoin broke through the ‘resistance’ level of USD 8,000 on July 24, only to fall below this level on July 31, undermining the notion that it had really begun a new trend.

Since breakouts are happening all the time in the crypto-market, they tend to unfold and end more quickly than with other assets, implying that traders should be very quick on their feet if they want to take advantage of them.

Other strategies?

While MPT and breakouts are perhaps the two most popular trading strategies for crypto, many crypto-analysts believe that most or all conventional strategies are still relevant.

“No. Everything is applicable,” says Alex Krüger, when quizzed on whether there are any strategies that aren’t applicable to cryptocurrencies. This may seem like an overly optimistic response, but he argues that the crypto-market isn’t fundamentally different from other, more ‘conventional’ markets.

“Trading cryptos is what trading commodities used to be in the 70s and early 80s,” he says, and in this respect his sentiments are echoed by Lou Kerner.

“As an asset, crypto isn’t different, it’s new,” he says. “New comes along all the time. Junk bonds used to be new. It was really volatile then. Most investment banks said it was a scam and they would never trade junk bonds. Forty years later, it trades just like everything else. That’s crypto in forty years too.”

What this means is that other common strategies may also be fruitful for crypto. This is includes day trading, which involves buying and selling assets within a single day. It includes position trading, which involves using price charts and other data to determine the longer term trend of a market, and usually requires investors to HODL onto coins for longer. And it also includes scalping (i.e. arbitrage), which involves profiting from the difference between maximum bid and ask prices for certain assets, so that investors can buy low and sell high.

These strategies (and others) are open to new and more advanced traders alike, but as with all things in crypto and non-crypto trading, there is sadly never any guarantee of profit.