Analyzing the Regulatory Response: Cryptoassets and Digital Assets

Keith Bear is a Fellow at the Cambridge Centre for Alternative Finance, part of the Judge Business School at Cambridge University. Previously, he served as IBM Fintech Head.

_____

Over the last 2 years we have witnessed multiple trends in the world of digital assets, with the rise and fall of ICO’s, the roller coaster of Cryptoasset prices, the emergence of decentralized finance, and the announcement of Libra. It is perhaps not surprising that the response from regulators has been fragmented and slow to react by crypto-world standards–though maybe relatively quickly by traditional financial services standards.

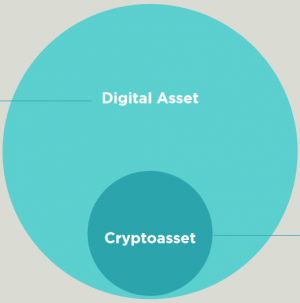

To examine the current state of play and future outlook, it is probably beneficial to first clarify the distinction between Cryptoassets and digital assets. At the Cambridge Centre for Alternative Digital Finance (CCAF) (as discussed in our 2019 Cryptoasset Regulatory Landscape Study) we view Cryptoassets as a subset of digital assets – tied to an open/permissionless network where their presence is a fundamental part of the network’s operation, and for which there is no formal issuer, as shown below.

Digital Asset: A digital unit of data in a shared system jointly maintained and updated by multiple parties that (i) can be directly controlled by the asset holder via cryptographic keys, and (ii) may represent a set of rights.

Digital assets are: (i) expressive, (ii) controllable via cryptographic keys, and (iii) compatible.

Cryptoasset: A digital token that (i) has no formal issuer, (ii) is exclusively issued and transferred via open, permissionless DLT (distributed ledger technology) systems, and (iii) plays an indispensible role in the economic incentive design of the underlying distributed ledger or application such that separating the asset from the underlying network would impair the system as a whole.

So, given the onslaught of innovation, change and a certain number of nefarious practices, how have regulators around the world reacted?

The reaction so far

The regulatory response has been varied to say the least. Regulatory clarity has been impacted by both a lack of consistent terminology and a tendency to conflate the nature of an asset (bond, equity, etc) and the form it takes (be it a token, ledger entry, or physical certificate).

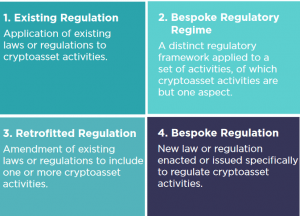

Having said that, we have seen multiple responses by regulators worldwide, which can be broken down into four categories:

- Using existing regulations (such as Korea’s Financial Investment and Capital Markets Act)

- Developing a new bespoke regulatory framework (such as Thailand’s Emergency Decree)

- Retrofitting existing regulations (such as in Japan, Switzerland and Estonia)

- Developing a broader bespoke regulatory regime which cover cryptoassets and other activities (as in Mexico).

It is interesting to note that retrofitting of current regulation is a much more likely path in those jurisdictions with a high level of Cryptoasset activities (just under half doing so in our 2019 survey).

Looking forward

It is clear that the significance and impact of digital assets is increasingly recognized by regulators globally, if only through the wake-up moment facilitated by Facebook’s Libra announcement.

So, what might we see over the next couple of years? Will the variety of regulatory reactions seen to date consolidate into a smaller number of approaches with a focus on international collaboration and best practice? Whilst in many ways it is too early to say, there are a number of developments which should give us hope:

1. Anecdotally, greater consistency in definitions and treatments should gradually emerge. In our experience many regulators are taking note of the digital asset regulatory pioneers such as Liechtenstein, Wyoming, Switzerland and the UK Justice Task Force efforts; to ensure that they learn from these initiatives and apply relevant elements in their own jurisdictions.

In addition, the number of international central bank DLT and digital asset collaborations (BoJ/ECB’s Project Stella, Bank of Thailand/HKMA’s Lionrock-Inthanon, MAS/Bank of Canada’s UBIN/Jasper) also point to a more consistent future with greater clarity in the role that digital assets can play in the broader economy.

2. Emerging standards: examples such as the Token Taxonomy Initiative with some big-name backers (including Accenture, Microsoft, R3 and IBM) given hope of standards that aid interoperability across token-based networks.

3. And of course, the work in fostering collaboration and best practices across the industry as led by organizations such as Global Digital Finance.

In summary, from a position of fragmented and inconsistent responses from regulators around the world, it appears that we are past the point of recognition of the importance of the role that Cryptoassets and more generally digital assets will play in the broader economy. The indicators from industry initiatives, collaboration across regulators and central banks, and the lessons learned from pioneering regulatory regimes all point to a more homogenous approach to the regulation of the expanding role of digital assets.

___

This article first appeared in the annual report of Global Digital Finance.