A New Era For Crypto Tracking of Crypto Assets

Michael Soussan is Marketing & Communication Manager at Blox, a crypto asset tracking, management and bookkeeping platform.

______

Blockchain and cryptocurrency technology has rapidly expanded its global presence, creating conflict and excitement within the financial and technology industries. This rapid growth of investors, new coins, stablecoins, currencies, companies, businesses, miners and the entire ecosystem is a complex and dizzying puzzle of moving parts.

In the beginning, the industry faced challenges such as difficult onboarding for new users, speed and scalability, nefarious scandals, security breaches and a major lack in government regulations. However many of these challenges have been solved with solutions such as the Lightning Network for speed, KYC process for easy and verified new crypto investors and a lot more regulation from the IRS and government regulatory bodies.

Now while these new solutions have paved a path for crypto to penetrate a more mainstream audience and acceptance, for users, investors and businesses they face the daunting task of crypto tracking and asset management.

The most difficult challenges for today’s crypto investors and businesses:

Early birds don’t know how to catch the worm

When most new cryptocurrency investors begin to get involved it is usually with the help of a more experienced friend or organization that helps to guide them along the process. Yet, the guidance abruptly ends at the most crucial point. New investors may now have their first bitcoin that is stored in their crypto wallet – but where do they go from there? How can they begin tracking the value of their assets?

The onboard process into crypto is not deemed simple, and once inside, there is still a distinct learning curve for these rookie investors. However, these can be anyone from young teens, to highly intelligent but less tech-savvy individuals. Both require easier means to access, track and manage their new crypto assets. Now as these investors begin to buy more coins, from more places, this problem only compounds into more complex webs of crypto assets, coins, portfolios, wallets and more. A conundrum in need of technological solutions.

We will save this for later, but most of these early or new investors may not even realize that the most important component of successfully tracking your cryptocurrencies is the ability to be prepared when it comes to tax season, as those who neglect to pay, will start to face the wrath of the IRS.

More crypto coins, more crypto problems

According to CoinMarketCap there are over 1,600 different crypto coins in existence. Moreover, there are over 300 cryptocurrency exchanges worldwide for buying, selling or trading crypto. Without including crypto wallets, crypto ATMs, crypto mining operations and dozens of other verticals, it’s easy to understand the sheer volume and range of digital crypto assets that people can own.

While the allure of owning a deluxe crypto portfolio is nice, it can also create intricate crypto accounting and tax challenges, especially for new or inexperienced investors. For businesses, they too face the same challenges but with an even larger burden and cost to account for. The volatile swings of value based on speculation mean prices rise and fall all the time – but when you need to track your assets or calculate your profit & loss, that deluxe portfolio for an investor is a nightmare for their accountant or tax practitioner.

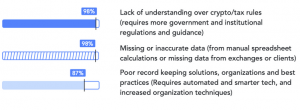

To better understand, the Blox Crypto Accounting Report found that most CPA’s were suffering to effectively do their job due to lack of completed reports, historical records, and a wild web of crypto activity, transactions, and asset movement.

To eliminate future headaches, employing the use of smart crypto-asset tracking services and tools will not only help you but your financial professionals as well. Staying on top of your assets and protecting your financial well being derives from your ability to understand your complete financial picture.

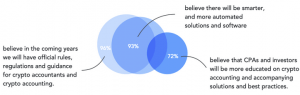

The illustration below articulates how U.S-based CPA’s feel about the future of cryptocurrency tax and accounting. This highlights an important and growing need for technology and smart software to be leveraged not only by professionals but before, with their clients. When investors and clients begin to use software at the onset of their cryptocurrency journey, they will only benefit from their prudence and proactivity – worthy traits in the eyes of the all-seeing IRS.

For the new investors out there or for those that simply are unaware, they will begin to see growing urgency to keeping records, tracking and reporting their crypto activity and earnings, especially with the unwavering scrutiny of government and tax regulatory institutions, most notably, the IRS.

The grace within ignorance is bliss is a fading excuse for new and experienced investors. More than ever, business decision-makers and crypto investors alike are beginning to integrate the best tools and platforms available to help them as the world enters the new era of crypto tracking, management, and taxation for cryptocurrency assets.

____

Learn more: Top 8 Crypto Tax Platforms