How to Mine Bitcoin at Home in 2024 – 5 Things You Need

Every 10 minutes, 6.25 new Bitcoins are mined, valued at more than $320,000. If you’re looking to mine Bitcoin in 2024, there’s a lot to consider. You’ll need some ASIC devices, mining software, and a lot of energy consumption.

Read on, we explain how to mine Bitcoin at home in simple terms. We also explore some Bitcoin mining alternatives that are suitable for beginners.

How Does Bitcoin Mining Work?

BTC is still one of the best cryptos to mine in 2024 but it’s pretty costly to say the least. Bitcoin mining keeps the network decentralized and secure. Miners connect specialist hardware to a desktop device, run Bitcoin mining software, and hope to be the first person to solve the mining reward. If successful, the miner will earn 6.25 BTC. This process happens every 10 minutes.

Within the 10-minute cycle, Bitcoin miners verify a block of transactions. The only way to do this is to solve a complex equation created by cryptography. The equation is so complex it takes 10 minutes to solve. Anyone can become a miner, as per the inclusive nature of Bitcoin. However, the process now requires vast resources.

No longer are CPUs or GPUs powerful enough to mine Bitcoin. You’ll need multiple ASIC devices, each costing thousands of dollars. As the Bitcoin difficulty has increased in recent years, so has the amount of electricity required. This means Bitcoin mining is an expensive market to enter.

Fortunately, there are some Bitcoin mining alternatives for beginners. Cloud mining, for example, enables users to mine Bitcoin from home without owning any hardware. However, you’d need to rely on a centralized provider – many cloud mining sites are scams. We discuss some more alternatives later in this guide.

What You Need to Start Mining Bitcoin at Home

Can you still mine Bitcoin? While not impossible, mining Bitcoin from home is very challenging. As noted, you’ll need some expensive ASIC devices and vast amounts of energy consumption. You’ll also need some Bitcoin mining software and cooling devices. The latter ensures that your Bitcoin mining rig doesn’t overheat.

Read on for more information on how to mine Bitcoin at home 2024.

Bitcoin Mining Hardware Essentials

If you want to mine Bitcoin directly, you’ll need some mining hardware. When Bitcoin first launched in 2009, people were mining at home with basic CPUs. As more miners entered the market, the Bitcoin difficulty increased. This meant that CPUs were no longer capable of solving mining equations. Instead, miners had to upgrade to GPUs.

Fast forward to 2024 – neither CPUs nor GPUs will enable you to mine Bitcoin at home. They’re simply not powerful enough, meaning they won’t realistically compete against other miners. Today, you’ll need to buy an Application-Specific Integrated Circuit or an ASIC.

And not just one ASIC – you’ll need multiple.

- The more ASICs you have, the more hashing power you can generate simultaneously.

- More hashing power enables you to generate more potential answers to the mining equation.

- This means you have a greater chance of being the first miner to solve the equation.

- Hence you would win the 6.25 BTC mining reward.

Now, there are some drawbacks to consider. For a start, the latest and most powerful ASIC devices are often developed by large mining organizations. This means that they use the best ASICs for themselves exclusively, meaning they have a huge advantage in the market.

After several months of usage, the ASICs might then be sold to the public. At this stage, the mining organization will likely have developed a newer ASIC, meaning it retains its edge over other miners. In addition, ASIC devices are expensive.

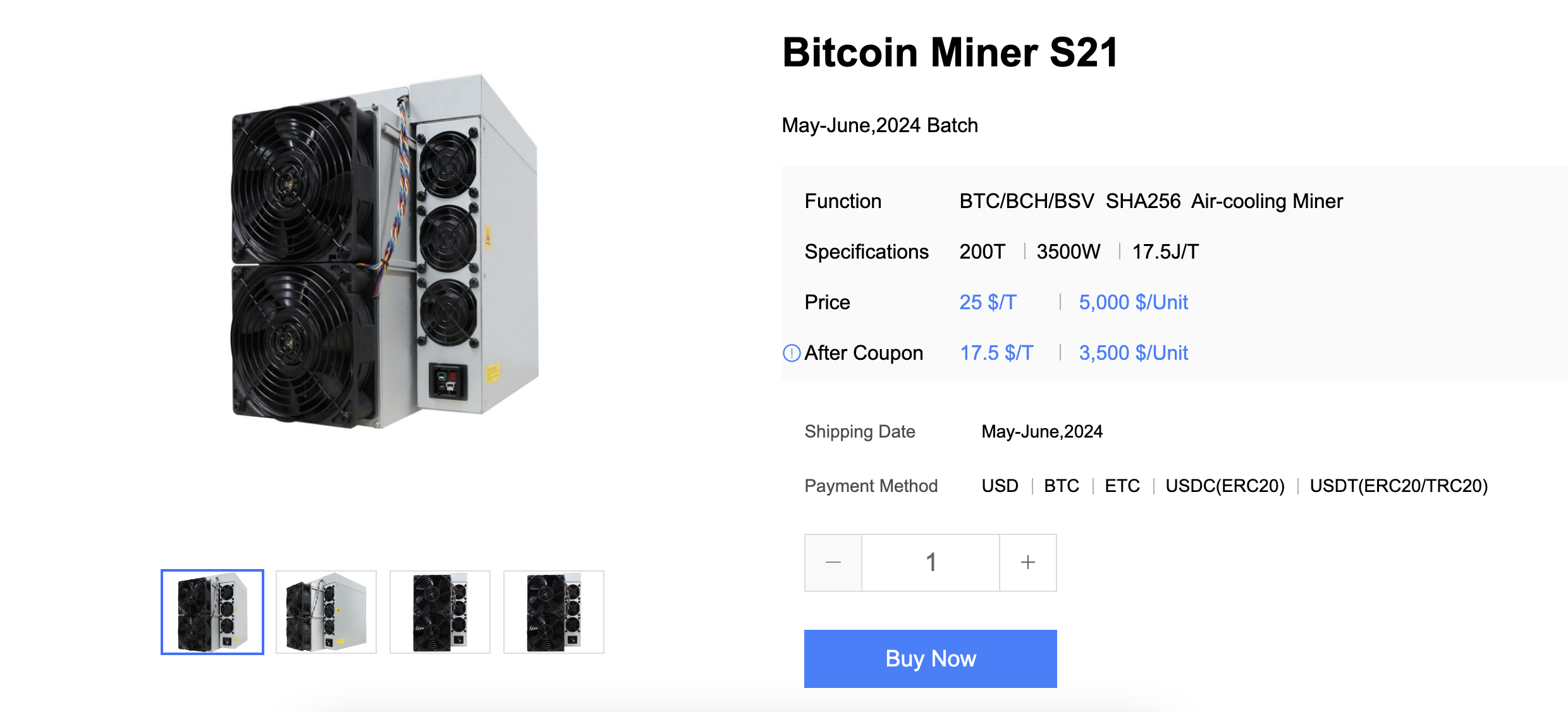

For example, one of the best ASICs is the Bitcoin Miner S21. This can generate a hash rate of 200 TH/s, with a power efficiency of 17.5 J/TH. The cost? $5,000. As noted, one ASIC won’t be enough – you’ll need an entire farm of devices to stand a chance of competing.

Bitcoin Mining Software

Once you’ve sourced some suitable ASICs, the next step is to install Bitcoin mining software on your desktop device. This sits between your ASIC and the Bitcoin network, allowing you to mine from home. There are several types of Bitcoin mining software – the one you need will depend on various factors.

For example, the type of operating system you’re running and the specific hardware device you’re connecting.

- If you’re purchasing ASICs, then CGMiner is a great option. Not only is it compatible with the latest ASIC devices but it’s free to use.

- Another option is BFGMiner, which is also ideal for running ASICs around the clock.

That said, some ASIC manufacturers release their own mining software. This means that third-party software won’t be compatible. Always check this with the manufacturer before making a purchase.

Reliable Electricity and Power Supply

When you mine Bitcoin at home, you’ll be using a significant amount of electricity. As reported by the Independent, Bitcoin mining consumes as much energy as the entire Argentinian population. This is why Bitcoin is considered bad for the environment.

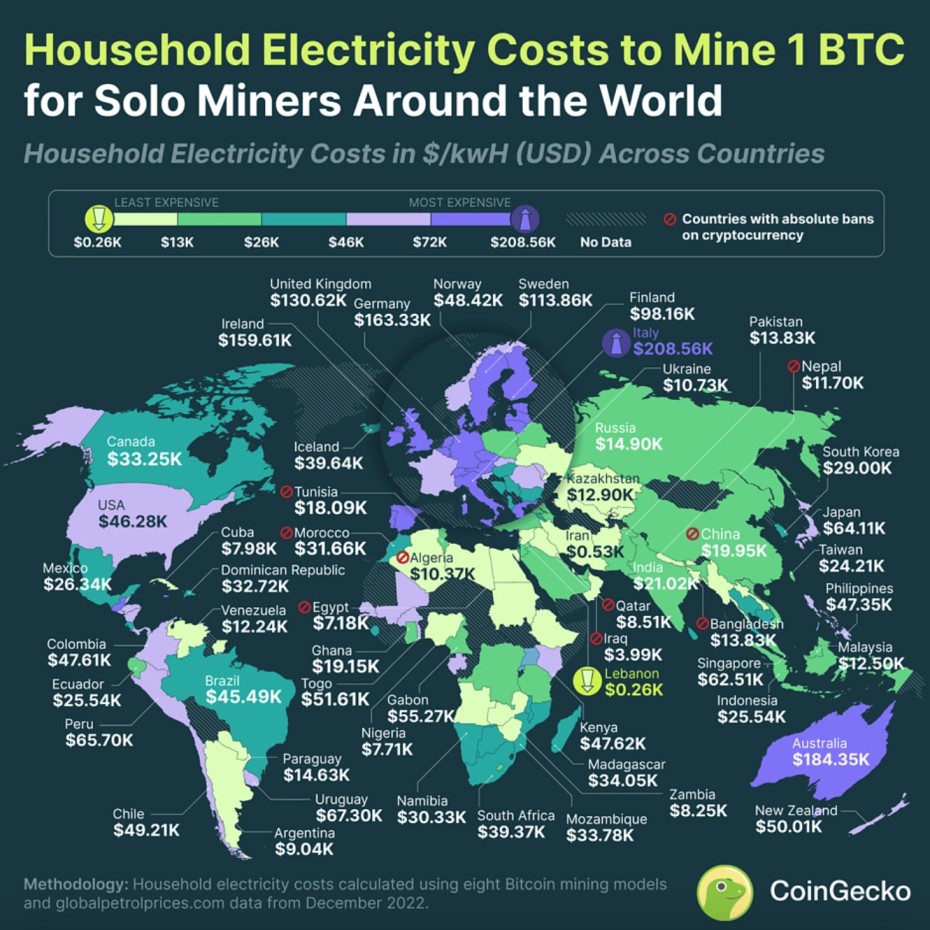

The amount of energy you’ll require when mining Bitcoin will depend on how many ASICs you’re running. More ASICs mean more electricity. Additionally, the cost to mine 1 Bitcoin will depend on where you live.

- For example, a CoinGecko study shows that it costs over $46,000 to mine Bitcoin in the US.

- In Russia, however, it would cost just $14,000.

- In Argentina, you’d require $9,000 worth of electricity to mine one Bitcoin.

Not only do you need to consider the cost of mining Bitcoin at home but also reliability. After all, you’ll need to run your ASIC devices 24 hours per day, 7 days per week to stand a chance of winning mining rewards. This means you’ll need uninterrupted power supplies without any downtime.

It’s best to speak with your energy supplier before you start mining Bitcoin. Your usage will increase by unparalleled amounts, which could force the supplier to turn off your power.

Cooling System

So far, we’ve established that you’ll need multiple ASIC devices with advanced power capabilities. Consequently, your ASICs will consume vast amounts of energy around the clock. The result? Your stay-at-home mining rig will generate significant power. This means your ASIC devices will overheat, resulting in downtime, maintenance fees, and lost earnings.

Therefore, you’ll also need to invest in adequate cooling systems. That being said, some of the best ASIC devices – especially those manufactured by Bitmain, come with internal cooling features. This means that the ASICs monitor and regulate their own temperature levels. This feature is rarely included with older ASICs, so make sure you check this before proceeding.

Bitcoin Wallet to Collect Earnings

Before activating your mining set-up, you’ll need to make sure you have a suitable Bitcoin wallet. This must connect to your Bitcoin mining software. If you successfully mine a Bitcoin block, the 6.25 BTC reward will be transferred to the stated Bitcoin wallet address.

Considering the value of 6.25 BTC, we’d suggest buying a hardware wallet. One of the best crypto hardware wallets is Trezor. Its basic model costs just $59 – which is more than sufficient for safeguarding your Bitcoins. Your private key is stored within the Trezor device, which is never connected to the internet. This protects you from remote hacking attempts.

Other popular hardware wallets include Ledger Nano, Safepal, KeepKey, and SecuX. Once you’ve chosen a wallet and set it up, you’ll need to copy the unique deposit address. Paste this into the Bitcoin mining software.

Setting Up Your Mining Rig

A mining rig includes your entire setup, such as ASICs, cooling devices, software, and a reliable energy supply. You’ll need to set everything up before you can mine Bitcoin from home.

Here’s a general overview of the required process:

- Select and Purchase Hardware: First, you’ll need to purchase some Bitcoin mining hardware. Only ASIC devices will suffice. Do some research on the most powerful ASICs in the market. Consider the maximum hash rate, efficiency levels, and core features like anti-cooling. Make sure you purchase the ASIC(s) directly from the manufacturer’s website.

- Connect ASICs to Desktop Device: When you receive the ASIC device, unbox it. The most recent ASICs offer a plug-and-play process. This means you won’t need any technical know-how. Simply follow the instructions provided to connect the ASIC to your desktop device.

- Set up Cooling Devices: Depending on the model, you might need additional cooling devices. This will ensure your ASICs avoid overheating, which will result in downtime. That said, some ASICs come with in-built cooling systems.

- Install Mining Software: Next, you’ll need to install Bitcoin mining software onto the same desktop device. Popular options include CGMiner and BFGMiner. Make sure the mining software is compatible with your ASICs.

- Configure Software Settings: You’ll need to configure your mining software settings before proceeding. This means adjusting the operating times and frequency settings. You’ll also need to enter your Bitcoin wallet address. This is the wallet address to receive your Bitcoin mining rewards.

- Speak With Energy Supplier: To avoid operational downtime, we strongly suggest you let your energy supplier know that you’ll be mining Bitcoin from home. This is because your energy consumption will increase considerably. You might also be able to negotiate more favorable rates.

- Activate Mining Software: Finally, you’ll need to activate the Bitcoin mining software. Your ASICs will then go to work. It’s crucial to monitor your progress, especially when it comes to energy consumption.

Joining a Mining Pool

When exploring how to mine Bitcoin profitably, you’ll likely find the process is challenging. This is because you’ll be competing with large mining operations. These operations have hundreds of powerful ASIC devices running around the clock. They invest millions of dollars in energy consumption every month.

Even then, they’re not guaranteed to successfully mine Bitcoin. Crucially, unless you’re also prepared to invest significant amounts, you’ll need to consider an alternative option.

For example, you could join a ‘mining pool’. This means you’ll combine with Bitcoin hash rate with other solo miners. Pooling your resources together will give you a solid chance of successfully mining Bitcoin. Moreover, Bitcoin mining pools are a lot more budget-friendly.

For instance, your energy costs will be reduced, as you won’t need to own dozens of ASICs. And, you’ll be able to switch your mining devices off at any time. This means your ASICs won’t need to run 24/7.

There are many Bitcoin mining pools in the market. Here’s what to consider when selecting a provider:

- Pool Size: It’s best to focus on large mining pools. This will give you the best chance of generating mining income. You can dip into and out of the mining network at any time, without it impacting your earning ability.

- Stability: Make sure you’re chosen mining pool has a proven track record, meaning little to no downtime. This will ensure you can mine Bitcoin from home without interruptions.

- Payout Schemes: Each mining pool will have its own distribution model. This determines how and when you get paid. Some of the most common methods are pay-per-share and pay-per-last-N-shares. Do some research to determine which model is best for you.

- Hardware Capabilities: You’ll also need to ensure the mining pool is compatible with your hardware device.

Pool Fees and Reward Structures

Although mining pools give casual users a chance to mine Bitcoin, you’ll need to pay fees. This isn’t required when mining Bitcoin solo. Fees will vary depending on the mining pool but average 1-3%. So, if you earned 0.5 BTC in mining rewards, you’d likely pay between 0.005 BTC and 0.015 BTC in fees.

In addition, you’ll need to choose the most suitable reward structure.

Here’s an overview of the two most common:

- Pay-Per-Share (PPS): This is based on a proportionate model, meaning your share of earnings depends on the contributed hash rate power. However, irrespective of how much is mined, you’ll receive a pre-agreed amount from the pool. This offers a steady, predictable income flow. However, expect to pay higher fees.

- Pay-Per-Last-N-Shares (PPLNS): This payout method is also based on proportionate contributions. However, you’ll only earn when the pool successfully mines a block. When it does, you’ll receive an equal share based on your contributed hashing power. You could earn more or less than the PPS model.

Setting up Pool Connection

Once you’ve found a suitable mining pool, you’ll need to register with the provider.

You’ll be provided with some unique credentials, which you can add to the Bitcoin mining software. This ensures you receive your fair share of Bitcoin mining rewards, based on the amount of hashing power provided.

Thereon, everything should be automated. You’ll receive your share of Bitcoin mining rewards as per the agreed payout framework. It’s important to monitor your progress to ensure you’re receiving what you should be.

Understanding Key Bitcoin Mining Terminology

When exploring how to mine Bitcoin from home, it’s crucial to understand key terminology. This will ensure you’re mining Bitcoin with your eyes wide open.

Key Bitcoin Mining Terminology

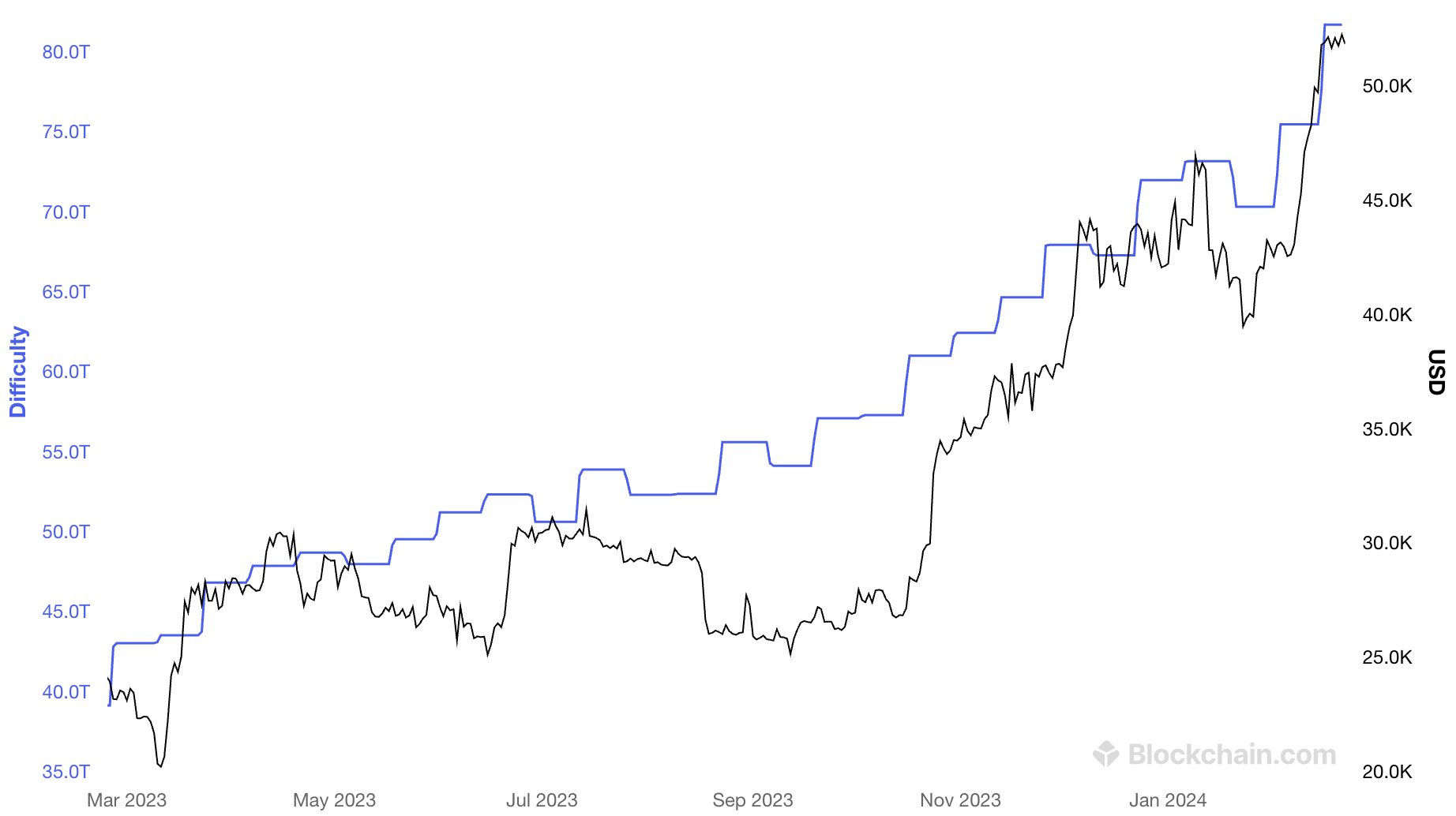

- Mining Difficulty: The Bitcoin ‘mining difficulty’ determines how difficult the cryptographic equation is. This is adjusted based on the number of active miners. As the difficulty increases so does the required hashing power.

- Hash Rate: The ‘hash rate’ is the amount of power a mining device generates at any given time. The more hash rate generated, the more chance the miner has of successfully mining the Bitcoin block.

- Bitcoin Halving: Approximately every four years, a ‘Bitcoin halving’ event will take place. This reduces the block mining reward by 50%. The next Bitcoin halving event is expected to occur in April 2024.

Mining Difficulty

Knowing how the mining difficulty works as a miner is crucial. This will determine whether or not you have a realistic chance of making money. In simple terms, the mining difficulty determines how easy or difficult the cryptographic equation is. This is the equation that miners must solve to win the mining reward.

The Bitcoin mining difficulty rises and falls based on how much hashing power is being contributed. This means in the early days of Bitcoin, the mining difficulty was very low. This is because very few people knew about Bitcoin. As such, you could have mined Bitcoin from home with a CPU or GPU.

Bitcoin is now a trillion-dollar asset. This means that Bitcoin mining is extremely competitive. In turn, the Bitcoin mining difficulty is significantly higher than it was a decade previously. This is why you need multiple ASICs to stand a chance of mining Bitcoin.

Hash Rate

The hash rate determines how much power an ASIC device can generate. It’s usually measured in terra hashes per second (TH/s). The more TH/s, the more powerful the mining device is.

Subsequently, more hash rate power means you’ll have a greater chance of mining the next block. This is why the most powerful ASICs are so expensive – they have an unparalleled TH/s.

Bitcoin Halving

Bitcoin reduces the mining reward approximately every four years. This increases Bitcoin’s scarcity, as over time fewer new coins are being issued. So, when Bitcoin first launched in 2009, the mining reward was 50 BTC. In 2012, it was reduced to 25 BTC. In 2016, it was reduced to 12.5 BTC.

In 2020, it was reduced to 6.25 BTC. The next Bitcoin halving is expected in April 2024. This will reduce the mining reward to 3.125 BTC. Nonetheless, based on current prices, this will value the block reward at over $165,000. Moreover, history suggests that Bitcoin halvings are the start of the next bull cycle. This means new all-time highs.

Bitcoin Minetrix: A New Solution to Bitcoin Mining

We mentioned that joining a Bitcoin mining pool is a solid option for beginners. However, we discovered an even better alternative – Bitcoin Minetrix. This is a new blockchain project that’s revolutionizing the Bitcoin mining industry. It allows users to mine Bitcoins from home without needing ASICs. In fact, no hardware is needed at all.

This is because of Bitcoin Minetrix’s ‘stake-to-mine’ initiative.

Here’s how it works:

- Users buy Bitcoin Minetrx’s native cryptocurrency, BTCMTX

- The BTCMTX tokens will then be staked. This means they’re temporarily locked.

- Users will generate credits while BTCMTC tokens are staked.

- Credits can be exchanged for Bitcoin mining power.

- This means Bitcoin can be mined remotely.

Bitcoin Minetrix not only saves users money but it decentralizes the mining process. As long as you hold BTCMTX tokens, you’ll have a say in how the ecosystem operates. What’s more, you won’t need to make a large upfront investment – Bitcoin Minetrix allows users to get started with any amount.

Bitcoin Minetrix is currently running on the best crypto presales of 2024. It has sold more than $11 million worth of BTCMTC tokens to early investors. Those investing in the presale get preferential pricing. This means you’ll get more BTCMTX tokens for your money, which will generate more Bitcoin mining credits.

However, just make sure you consider the risks before proceeding. BTCMTC will be one of the most volatile cryptocurrencies to trade once it’s listed on exchanges. There’s no guarantee its stake-to-mine concept will be a success either.

Calculating Profitability: Is Bitcoin Mining at Home Worth it?

Several variables will determine whether or not you can make a profit from Bitcoin mining. This includes the average electricity costs in your home country, the amount you invested in hardware, and the current price of Bitcoin.

Let’s explore these variables in more detail.

Evaluating Electricity Costs

Your biggest cost when mining Bitcoin from home will be electricity. Crucially, your powerful ASIC devices consume significant amounts of energy. This is because they’re constantly trying to solve cryptographic equations. And, as the Bitcoin mining difficulty continues to rise, so will the amount of electricity consumed.

That said, electricity costs will vary considerably depending on where you live. As you’ll see from the above CoinGecko study, a miner in Indonesia would consume over $25,000 worth of energy to mine one Bitcoin. In contrast, a miner in Malaysia would consume just $12,500.

In Canada, the cost to mine one Bitcoin is over $33,000. Based in the UK? You’re looking at over $130,000. Ultimately, if you’re based in a country with high electricity costs, Bitcoin mining likely won’t be viable.

Considering Hardware Investment

Another significant cost when mining Bitcoin from home is hardware. As we mentioned, you’ll need powerful ASIC devices to stand of chance of success. And not just one – you’ll need multiple ASICs. You’re going to need several thousand dollars per ASIC purchased. This is without any guarantees that you’ll make a profit – let alone cover your costs.

In addition, you’ll also need to consider cooling systems. There will also be costs associated with maintenance. This can be costly, as ASIC maintenance requires high-level expertise.

Keeping Track of Bitcoin’s Price

The Bitcoin price will have a substantial impact on your ability to make money from mining. After all, Bitcoin rewards are the only way you’ll generate revenue. You then need to factor in your variable costs, such as electricity and maintenance. Not to mention sunk costs from your ASIC devices.

For example, we mentioned above that it costs over $25,000 to mine one Bitcoin in Malaysia, based on electricity costs. This doesn’t include the cost of buying hardware devices, rigs, and cooling systems. What’s more, when the Bitcoin price is high, this encourages more miners to contribute hash rate power.

Not only does this make mining more competitive, but the Bitcoin difficulty will increase. This means increased hashing power and electricity consumption. Nonetheless, mining Bitcoin when its price is high is the optimal time for miners. This ensures there’s enough margin to cover costs and generate a sufficient profit.

How to Optimize Your Home Mining Operation

Buying and setting up a mining rig is just one part of the process. You’ll need to constantly monitor the performance of your mining efforts. This means keeping tabs on the Bitcoin difficulty, electricity costs, and the amount of mining rewards you’re generating. Crucially, you’ll need to optimize your setup frequently.

Energy Efficiency Best Practices

We’ve established that electricity will be your biggest cost when mining Bitcoin from home. Therefore you’ll want to follow some best practices to keep your costs down. For a start, make sure your mining hardware is energy efficient. This is determined by the Joules per Terahash (J/TH). The more efficient your mining hardware is the less energy is required to successfully mine Bitcoin.

It’s also important to ensure you’re getting the best deal possible. Speak with your energy supplier and let them know you’ll be mining Bitcoin. Explain that this will result in a significant increase in energy usage and that a discount would be appropriate. Considering switching to a more competitive energy supplier is needed.

Upgrading Hardware

Although ASICs are expensive, they have a shelf life. At some stage, you’ll need to consider upgrading to a more recent, powerful model. This means buying ASICs with a higher TH/s and a lower J/TH.

Put otherwise, you’ll want ASICs that generate more power in an energy-efficient way. Fortunately, your older ASICs don’t need to go to waste. You can use them to mine other cryptocurrencies.

How much Bitcoin is left to mine?

- According to CoinMarketCap data, more than 19.6 million BTC has been mined so far.

- This represents 93.5% of the maximum supply, which is 21 million BTC.

- This leaves approximately 1.4 million BTC left to mine.

- The final mining block reward is expected to be earned in 2140.

Risks of Mining Bitcoin at Home

Besides the financial risk, there are some additional drawbacks to consider when mining Bitcoin at home.

Hardware Failures

You’ll need your ASICs running 24/7 to effectively mine Bitcoin solo. Constant usage means an increased risk of hardware failure. If you don’t know how to fix ASICs yourself, you’ll need to consult with a third party.

This is likely to be costly. What’s more, there might not be anyone living locally that can help. This means your expensive ASICs could be left redundant.

Tightening Government Regulation

Nobody can predict the future of cryptocurrency regulations. This is especially the case with Bitcoin mining. After all, Bitcoin mining isn’t legal everywhere. For example, the Chinese government banned Bitcoin mining in 2021. Even so, Bitcoin mining is still huge in China. The ban has simply pushed mining operations ‘underground’.

Although the majority of Bitcoin mining operations are now based in the US, New York enacted a temporary ban in 2022. Bitcoin mining is also illegal in countries where cryptocurrency ownership is prohibited. This is a major risk to consider when exploring how to mine Bitcoin at home.

Security Risks

Bitcoin mining is big business. Successfully mining one block will secure 6.25 BTC – plus transaction fees. That’s more than $320,000 worth of Bitcoin based on current prices. With this in mind, Bitcoin miners are a target for scammers and thieves.

Best practices include keeping your Bitcoin mining activities private. What’s more, you should store your Bitcoins in a cold wallet. Some of the best cold wallets include Trezor and Ledger.

Conclusion

Mining Bitcoin at home is no longer profitable. You’ll need hundreds of ASICs running simultaneously to stand a chance. This would require a significant upfront investment, not to mention substantial energy costs.

A great workaround is Bitcoin Minetrix; a new blockchain project with a stake-to-mine solution. Simply stake BTCMTX tokens to earn mining credits, which can be converted into Bitcoin mining power. No hardware devices are required.

FAQs

How long does it take to mine 1 Bitcoin?

The minimum time to mine 1 BTC is 10 minutes. However, it can take many days, weeks, or months – depending on your Bitcoin mining setup.

Is it legal to mine Bitcoin at home?

Yes, in most countries it’s legal to mine Bitcoin at home. However, Bitcoin mining is banned in some locations, including China and New York.

Is it possible to mine Bitcoin yourself?

Mining Bitcoin at home will be challenging. You won’t be able to generate enough hash rate power to compete with large mining operations.

Is it still profitable to mine Bitcoin at home?

The only way to mine Bitcoin profitably at home is to join a mining pool. This means pooling your hash rate power with other miners and splitting mining rewards proportionately.

How much does Bitcoin mining cost?

According to a CoinGecko study, the electricity cost to mine one Bitcoin ranges from under $1,000 to over $208,000. This depends on the country. In addition, you’ll also need thousands of dollars to buy powerful ASIC devices.

How do you mine Bitcoin?

You’ll need to connect some powerful ASICs to your desktop device, before installing Bitcoin mining software. Once activated, your ASICs will attempt to mine Bitcoin on your behalf.

How to mine Bitcoin on a PC?

You won’t be able to generate enough hash rate power to mine Bitcoin on a PC. CPUs and GPUs are no longer viable, so you’ll need to invest in some ASICs.

How to mine Bitcoin on Android?

Mining Bitcoin on an Android is impossible. The only workaround is a stake-to-mine concept like Bitcoin Minetrix, which allows you to mine Bitcoin without owning any hardware.

References

- How Bad is Bitcoin Mining for the Environment? (The Independent)

- Household Electricity Costs to Mine 1 Bitcoin at Home, Around the World (CoinGecko)

- Cryptoverse: Bitcoin Miners Make Money Ahead of ‘Halving’ (Reuters)

- China Widens Ban on Crypto Transactions; Bitcoin Tumbles (Bloomberg)

- New York Enacts 2-Year Ban on Some Crypto-Mining Operations (NY Times)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman