How To Buy Bitcoin In Australia – A Comprehensive Guide

An estimated one-quarter of Australians now own at least one cryptocurrency; most opt for Bitcoin. According to some analysts, now could be a great time to invest, as Bitcoin is still heavily undervalued.

In this guide, we help beginners buy Bitcoin in Australia. We explain the best places to invest in 2024, what risks to consider, and what the future holds for this high-growth industry.

The Best Ways to Buy Bitcoin in Australia

Let’s start with the best ways to buy Bitcoin in Australia:

- Crypto Exchange: The overall best way to buy Bitcoin as a beginner, exchanges allow you to invest with convenient payment methods and low fees

- Crypto Wallet: Great option for buying Bitcoin anonymously, but you’ll need another cryptocurrency to pay for your purchase

- Crypto ATM: Hundreds of crypto ATMs enable Australians to buy Bitcoin with cash, although fees are often high

- Banking Methods: Although banks in Australia don’t sell Bitcoin, you can usually use a debit/credit card with an exchange

- P2P Exchange: Popular option for Australians who want to buy Bitcoin directly from a local seller, rather than going through third parties

We discuss the above methods in a lot more detail further down. Read on to choose the best option for you.

Buy Bitcoin in Australia Through a Crypto Exchange

The best way to buy Bitcoin in Australia is through a reputable crypto exchange. In most cases, it takes just five minutes to complete your investment.

This covers the account opening process, depositing funds, and placing a Bitcoin order. You can then withdraw your Bitcoins to a private wallet for safekeeping.

A Step-by-Step Guide to Buying BTC From an Exchange

Still asking the question – “How do I buy Bitcoin in Australia with an online exchange?”

The process is very straightforward once you know where to start.

We’ll now walk you through the step-by-step requirements. We’re using the popular exchange MEXC for this tutorial, but the steps are the same for most Bitcoin platforms.

Step 1: Choose a Bitcoin Exchange and Register an Account

First, you’ll need to choose a suitable Bitcoin exchange. The most important metrics to consider include safety, security, reputation, fees, customer service, accepted payment methods, and account minimums.

It’s also worth choosing a Bitcoin exchange that supports other cryptocurrencies. This will enable you to build a diversified portfolio, rather than going all-in on Bitcoin.

Once you’ve selected the right Bitcoin exchange, open an account. Most exchanges will ask for an email address and password. You’ll then need to verify the email address provided.

Step 2: Choose a Payment Method and an Investment Amount

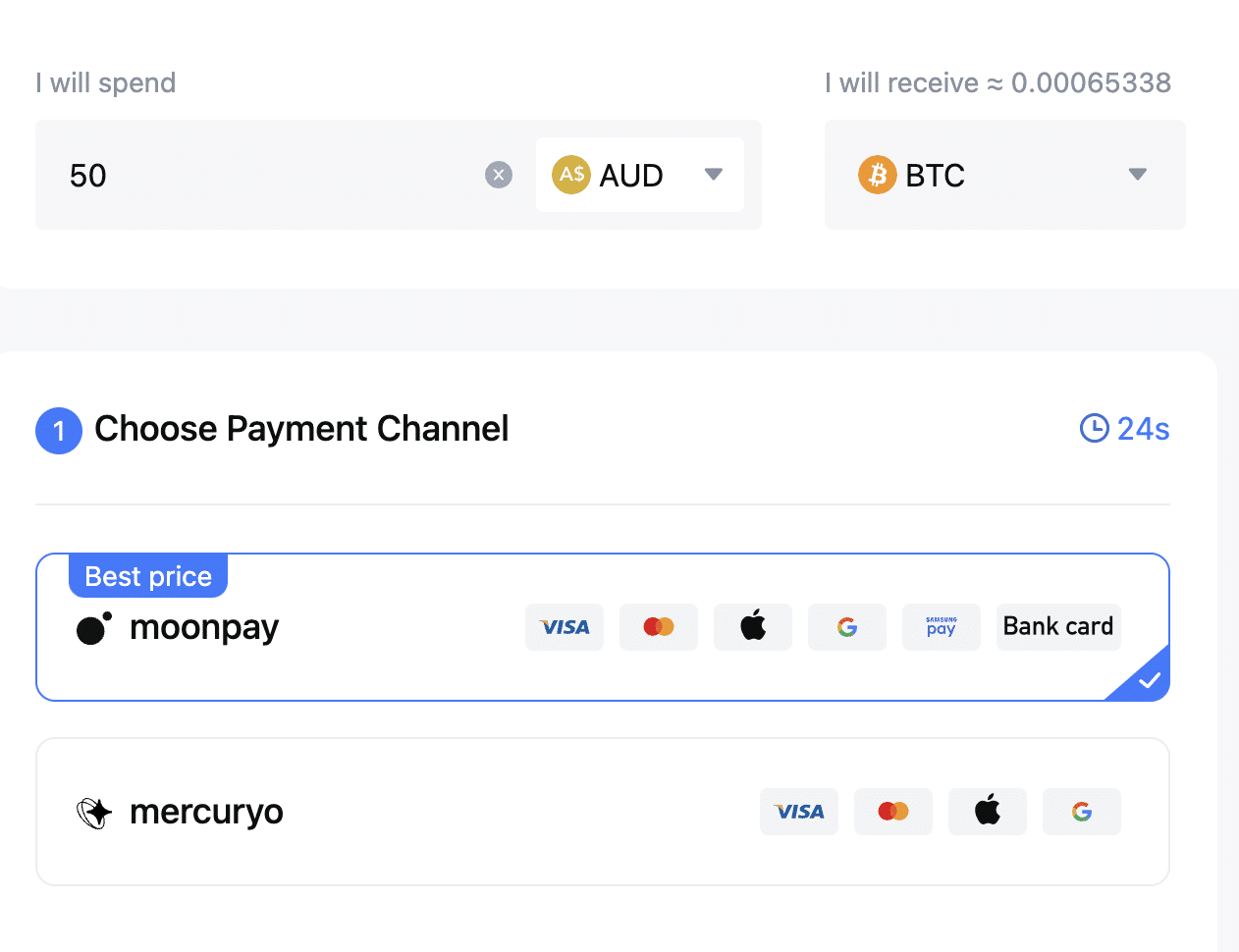

Reputable exchanges like MEXC allow users to buy Bitcoin with Australian dollars.

Hover your mouse over the ‘Buy Crypto’ button and click ‘Debit/Credit Card’. Select ‘AUD’ in the currency field. In the purchase currency, choose ‘BTC’.

You can then type in the amount of Bitcoin you want to buy. The minimum purchase requirement on MEXC is $50.

Like many crypto exchanges, MEXC uses third-party payment processors. It automatically selects the best provider based on fees and real-time exchange rates.

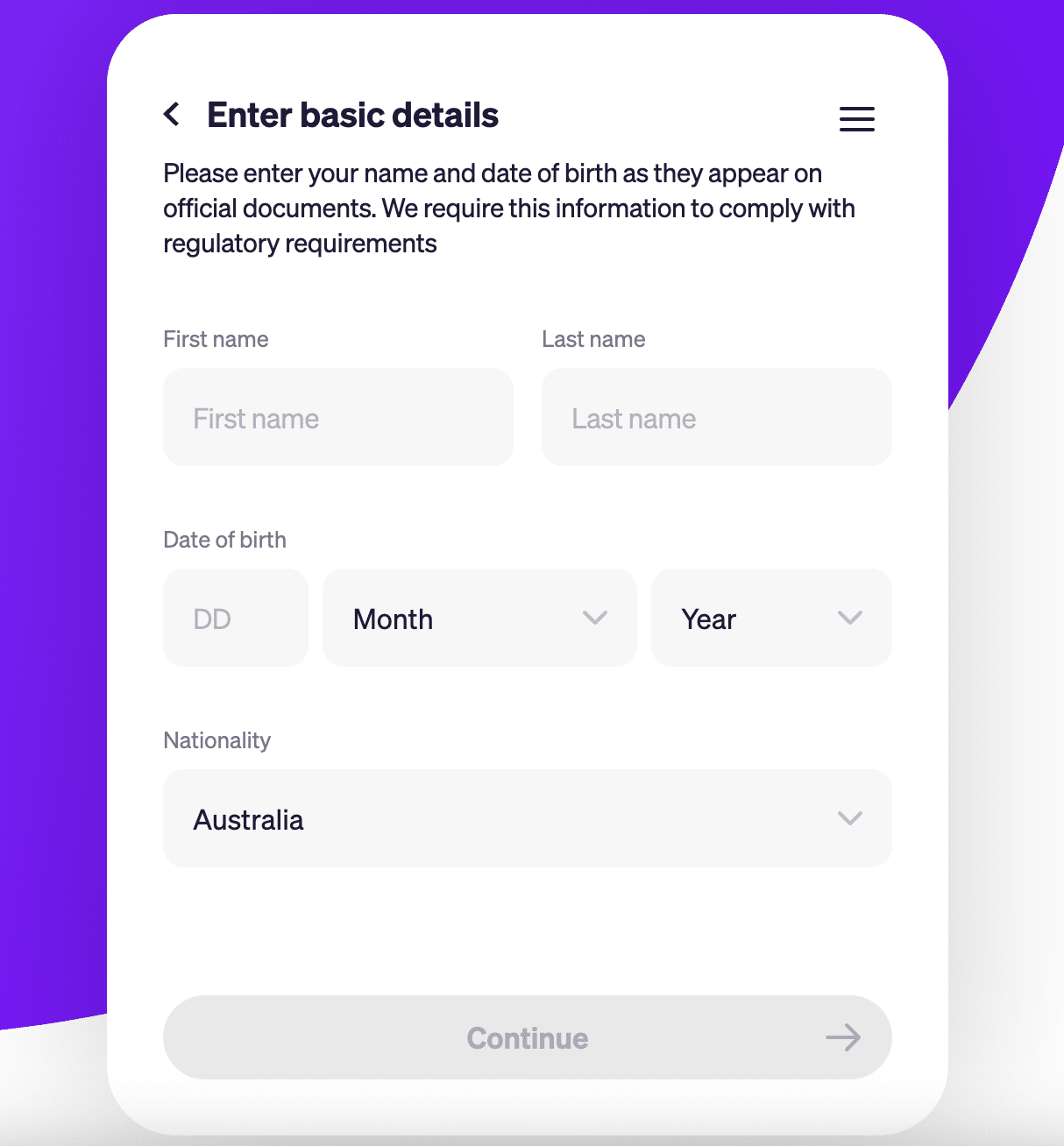

Step 3: Complete the KYC Process

Buying Bitcoin with Australian dollars requires a KYC (Know Your Customer) process. This is because of anti-money laundering laws. The KYC process will be conducted by the third-party processor and shouldn’t take more than a couple of minutes.

First, type in your email address and confirm the verification code. Next, type in your first and last name, date of birth, and nationality. You’ll then be asked to upload a copy of your passport or driver’s license.

You’ll also need to hold your ID next to your face. This requires a device that has an in-built camera. Within a few seconds, the documents will be verified. This means you’ve completed the KYC procedure.

Step 4: Enter Payment Details and Buy Bitcoin

You’ll now be asked to enter your payment details. Depending on the payment provider, options include Visa, MasterCard, Apple Pay, and Google Pay. MEXC uses encrypted servers, so your payment information is handled securely.

Finally, confirm the Bitcoin purchase. The Bitcoins will then be added to your MEXC account.

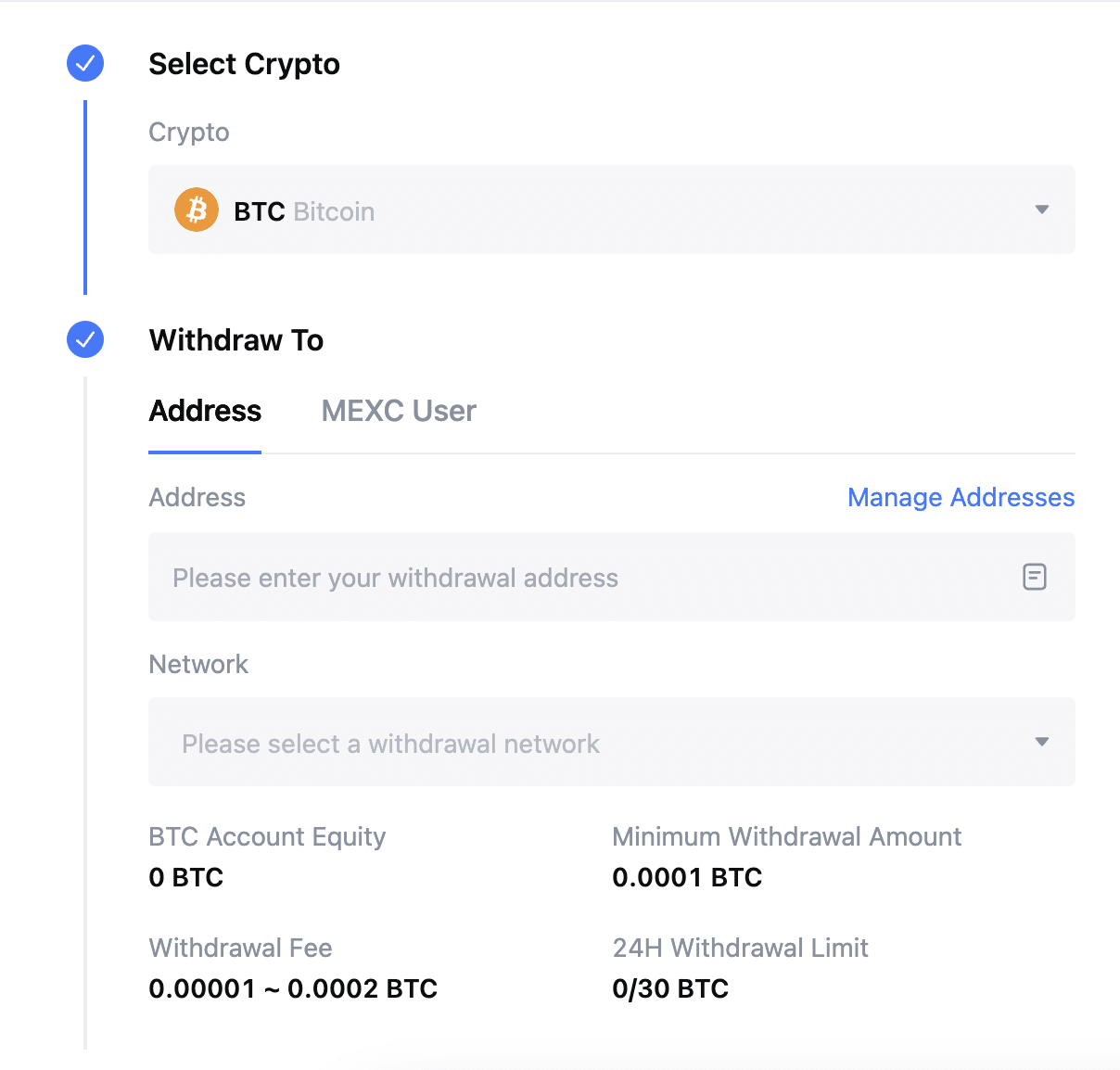

Step 5: Withdraw Bitcoin to a Private Wallet

Although MEXC offers secure wallet storage, it’s never a good idea to keep cryptocurrencies on an exchange. We’d suggest withdrawing your Bitcoins to a private wallet with self-custody storage.

This means you’ll own the private keys; so you’re the only person who can access the wallet. Some of the best crypto wallets to consider include Best Wallet, Electrum, MetaMask, Trust Wallet, and Exodus.

You’ll need to provide MEXC with your unique wallet address. After confirming the withdrawal, MEXC will transfer the Bitcoins to your wallet.

Pros and Cons of Using a Crypto Exchange

Although crypto exchanges are the best option when buying Bitcoin in Australia, you’ll need to consider the following pros and cons:

Pros

- Buy Bitcoin with Australian dollars

- Use Visa, MasterCard, Google/Apple Pay, and other convenient payment methods

- The end-to-end process takes under five minutes

- Account minimums are low

- Exchange commissions average 0.1%

- Diversify your portfolio by purchasing other popular cryptocurrencies

- Deposit your Bitcoins into a savings account to earn interest

Cons

- Not all crypto exchanges are safe and regulated

- Fiat money deposits often come with high fees

- You’ll need to complete KYC before using Australian dollars

- Keeping your Bitcoins on an exchange is risky

Best Crypto Exchanges Australia

We’ll now reveal the three best crypto exchanges to invest in Bitcoin.

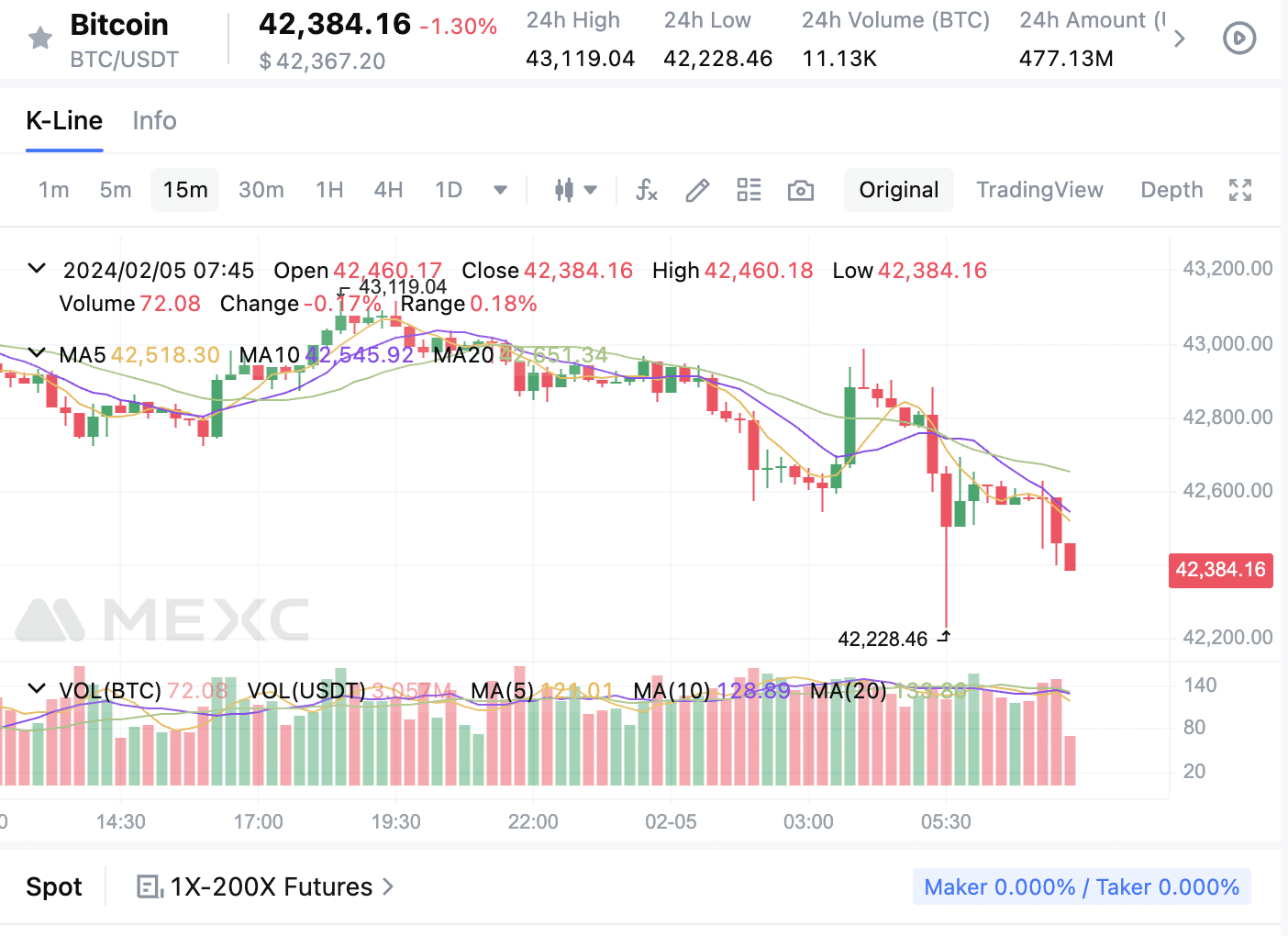

1. MEXC – Overall Best Site to Buy Bitcoin in Australia

We found that MEXC is the best crypto exchange in Australia. As we highlighted in our step-by-step walkthrough, the investment process takes just five minutes. After opening an account, MEXC enables you to buy Bitcoin with a debit/credit card or e-wallet. The minimum investment requirement is just $50.

This will appeal to first-time investors who don’t want to risk too much money. Moreover, MEXC offers competitive trading fees. For instance, Bitcoin can be traded at just 0.1% per slide. That’s a $1 commission for every $1,000 traded. That said, MEXC uses third-party payment processors, so keep an eye on deposit fees.

Nonetheless, we also like MEXC for its Bitcoin savings accounts. You’ll earn interest of up to 1.8% with flexible withdrawal terms. MEXC is also great for building a diversified portfolio. It supports hundreds of other cryptocurrencies, including Ethereum, Shiba Inu, Solana, Cardano, and Dogecoin. MEXC also offers a mobile app for iOS and Android.

Pros

- In our view, the overall best place to buy Bitcoin in Australia

- Minimum investment requirement of $50

- Supports debit/credit cards and selected e-wallets

- Bitcoin trading commissions of 0.1%

- Earn interest of up to 1.8% on flexible savings accounts

- Lots of trading tools and charting features

Cons

- Doesn’t accept local bank transfers

- AUD payments are handled by third-party processors

| Exchange | Best For? | Bitcoin Trading Fee |

| MEXC | Investors buying Bitcoin in Australia for the first time | 0.10% per slide |

2. OKX – Deposit AUD via Local P2P Sellers

While OKX no longer directly accepts AUD payments, it does offer peer-to-peer (P2P) options. This enables Australians to deposit funds with a variety of convenient payment methods. This includes local bank transfers, OSKO, Revolut, Wise, and Skrill. After selecting a method and completing the payment, the seller will transfer Tether to your OKX wallet.

You can then swap Tether for Bitcoin instantly on the OKX exchange. This will cost you just 0.1% in trading commissions. OKX doesn’t charge any fees on P2P purchases, but sellers set their own exchange rates. This can be above or below the spot price, so make sure you check this before proceeding.

OKX is also a great option for earning interest on your Bitcoin investments. Flexible Bitcoin savings accounts pay APYs of 5%. High-risk investors might consider the dual investment feature, which offers APYs of up to 105.76%. OKX is also ideal for buying other popular cryptocurrencies; hundreds of altcoins are supported.

Pros

- Low Bitcoin trading commissions of 0.1%

- Earn 5% on flexible Bitcoin savings accounts

- Supports hundreds of the best altcoins

- Offers a decentralized wallet app for iOS and Android

- Withdrawals are processed quickly

Cons

- Australians need to use the P2p feature – which only supports Tether

- Charting features will be intimidating for beginners

| Exchange | Best For? | Bitcoin Trading Fee |

| OKX | Australians wanting to use a local payment method like bank transfers and OSKO | 0.10% |

3. KuCoin – Instant Bitcoin Purchases With Visa and MasterCard

Another option for Australians is KuCoin, a popular exchange with over 30 million global customers. KuCoin allows users to buy Bitcoin instantly with Visa or MasterCard. The minimum purchase requirement is just $15, which is ideal for beginners. After you’ve completed KYC and added your payment details, the Bitcoins will be added to your account straight away.

We also like KuCoin for its competitive fee structure. You’ll never pay more than 0.1% in trading commissions. This is reduced when you meet minimum trading milestones or pay fees in KCS, which is KuCoin’s native token. KuCoin also offers Bitcoin earning products. However, APYs aren’t as competitive as other exchanges.

For instance, flexible Bitcoin savings accounts pay just 0.06%. In terms of storage, KuCoin offers a web wallet for beginners. It also offers a decentralized wallet with self-custody storage. This comes as a mobile app for iOS and Android, plus a Google Chrome extension. In addition to Bitcoin, KuCoin supports over 700 other cryptocurrencies.

Pros

- Supports instant Bitcoin purchases with Visa and MasterCard

- Minimum Bitcoin investment of $15

- Super-fast KYC procedures

- Lists over 700 other cryptocurrencies

- Offers a decentralized wallet app and browser extension

Cons

- Bitcoin savings accounts pay APYs of just 0.06%

- Not all KuCoin features are available to Australians

| Exchange | Best For? | Bitcoin Trading Fee |

| KuCoin | Australians wanting to buy Bitcoin instantly with Visa or MasterCard | 0.10% |

Other Popular Bitcoin Exchanges to Consider

Here’s a list of other popular exchanges that enable you to buy Bitcoin in Australia:

- Binance

- Coinbase

- Kraken

- CoinSpot

- CoinJar

Buy Bitcoin through a Crypto Wallet

Some crypto wallets allow you to buy Bitcoin. This removes the need to use an exchange. What’s more, after completing your investment, the Bitcoins will automatically be added to your wallet.

A good option here is Best Wallet, which comes as a secure and user-friendly app.

The step-by-step process is summarized below:

- Step 1: Download the Best Wallet App: The first step is to download the Best Wallet app for iOS or Android. Open the app and choose a PIN. Write down the backup passphrase provided. Keep this somewhere safe, the passphrase provides remote access to the wallet. You’ll also need this if you lose your mobile device or forget the PIN.

- Step 2: Set up Bitcoin Purchase: Next, you’ll need to set up a Bitcoin order. Select AUD and choose your preferred payment method. Best Wallet uses third-party payment processors, so options include Visa, MasterCard, and selected e-wallets. Type in the amount of Bitcoin you want to buy.

- Step 3: Complete KYC: Although Best Wallet is a decentralized wallet, KYC is still required when using fiat money. This needs to be completed with the respective payment provider. You’ll need to provide some personal information and a government-issued ID. A selfie is also needed, with the ID held next to your face.

- Step 4: Buy Bitcoin: Finally, type in your payment details and confirm the Bitcoin purchase. The Bitcoins will be added to your wallet automatically.

You can now leave the Bitcoins in Best Wallet. This is a self-custody wallet, so only you have access to the private keys. This means you don’t need to trust your Bitcoins with a third-party exchange.

Pros and Cons of Using a Crypto Wallet

Using a crypto wallet to buy Bitcoin comes with the following pros and cons:

Pros

- Buy Bitcoin without leaving the crypto wallet interface

- The Bitcoins are instantly added to your wallet

- Self-custody storage ensures you own your Bitcoins 100%

- No requirement to trust a crypto exchange

- Store other cryptocurrencies in the same wallet

Cons

- You’ll need to use a third-party payment processor

- Fiat payment fees are often high

- KYC processes are triggered when using AUD

- Not all wallets are user-friendly

Best App to Buy Bitcoin in Australia

We’ll now reveal the three best wallet apps supporting Bitcoin purchases in 2024:

1. Best Wallet – Overall Best Wallet App to Buy Bitcoin

Our top pick is Best Wallet, a decentralized wallet app offering self-custody storage. This is an all-in-one solution allowing you to buy and store Bitcoins securely. Best Wallet comes as a user-friendly app for iOS and Android. Your wallet is secured by a PIN, biometric security, and a backup passphrase.

Not even Best Wallet has access to your private keys, ensuring complete ownership of your Bitcoins. Although Best Wallet offers an anonymous trading experience, this won’t be possible when using fiat money. You’ll need to provide personal information, upload a copy of your ID, and take a selfie holding the document.

After that, you can buy Bitcoin instantly with a debit/credit card and selected e-wallets. In addition, Best Wallet supports all ERC-20 and BEP-20 tokens. This means you can swap Bitcoin for other cryptocurrencies without leaving the wallet. Best Wallet has just completed phase two of its roadmap, meaning some features are still being developed.

Pros

- Store and buy Bitcoin in one safe place

- Swap crypto without leaving the wallet app

- Secured by a PIN and biometrics

- Available for iOS and Android devices

- Also accessible via desktop browsers

Cons

- Using fiat means you can’t trade anonymously

- Some features are still being developed

| Wallet | Best For? | Fee to Buy Bitcoin |

| Best Wallet | The overall best wallet app for Australian investors | Determined by the third-party processor |

2. Zengo – Secure Bitcoin Wallet With 3-Factor Authentication

We found that Zengo is another popular wallet that enables you to buy Bitcoin. This is a mobile wallet for iOS and Android devices. It’s a self-custody wallet, so you’ll have full control of your Bitcoins. Moreover, Zengo offers superb security features, including Multi-Party Computation (MPC) technology.

This removes private key vulnerabilities, as there’s no single point of failure. Small segments of the private key are hosted on multiple servers. So, even if a hacker obtained part of the key, this would be useless without the rest. Zengo also offers 3-factor authentication. Recovery methods include email, facial recognition, and a unique file stored on the cloud.

Zengo has partnered with MoonPay, Coinmama, and Banxa to provide fiat facilities. Payment types include Visa, MasterCard, Apple/Google Pay, and bank wires. Fees are determined by the chosen payment provider. The minimum Bitcoin purchase is $50 and KYC is required. Zengo also supports other cryptocurrencies, including ApeCoin, Ethereum, and Maker.

Pros

- Secure Bitcoin wallet app for iOS and Android

- Leverages MPC technology for watertight security

- Recover the wallet through 3-factor authentication

- Supports some of the best cryptocurrencies to buy

- Payment methods include Visa, MasterCard, and bank wires

Cons

- Can’t be accessed on desktop devices

- High fees are charged by its partnered payment providers

| Wallet | Best For? | Fee to Buy Bitcoin |

| Zengo | Investors who want the perfect balance between security and convenience | Determined by the third-party processor |

3. YouHodler – Buy Bitcoin and Earn Interest of up to 7%

Long-term investors might consider YouHodler. This is a multi-product platform that offers a wallet, exchange services, and fiat facilities. YouHodler also specializes in crypto interest accounts. Bitcoin, for example, comes with a competitive APY of 7%. This is much higher than the industry average.

Altcoins pay even more, with Litecoin, Solana, and USD Coin yielding 15%, 13%, and 12% respectively. However, yields will vary depending on the chosen term. For instance, flexible accounts will pay much less than fixed plans. The YouHodler wallet comes as a mobile app for iOS and Android. It offers a user-friendly experience and robust security features.

What’s more, the YouHolder wallet has an ‘Excellent’ rating on TrustPilot. In terms of buying Bitcoin, YouHodler supports multiple payment methods. This includes bank wires, debit/credit cards, and Apple Pay. Fees range from 0% to 4.5% depending on the payment type. You can also convert Bitcoin to fiat, but YouHodler charges a 4% commission.

Pros

- User-friendly wallet app for iOS and Android

- Accepts debit/credit cards, Apple Pay, and bank wires

- Competitive deposit fees starting from 0%

- Earn up to 7% on Bitcoin savings accounts

- Great ratings in the public domain

Cons

- Charges 4% when selling Bitcoin for fiat

- The highest interest rates come with fixed terms

| Wallet | Best For? | Fee to Buy Bitcoin |

| YouHodler | Long-term investors who want to buy Bitcoin and earn high-interest rates | 0% to 4.5% depending on the payment type |

Other Popular Bitcoin Wallets to Consider

Investors might also consider the crypto wallets listed below, which enable you to buy Bitcoin:

- Trust Wallet

- Exodus

- Ledger Nano

- Trezor

- Blockchain.com

Buy Bitcoin from an ATM

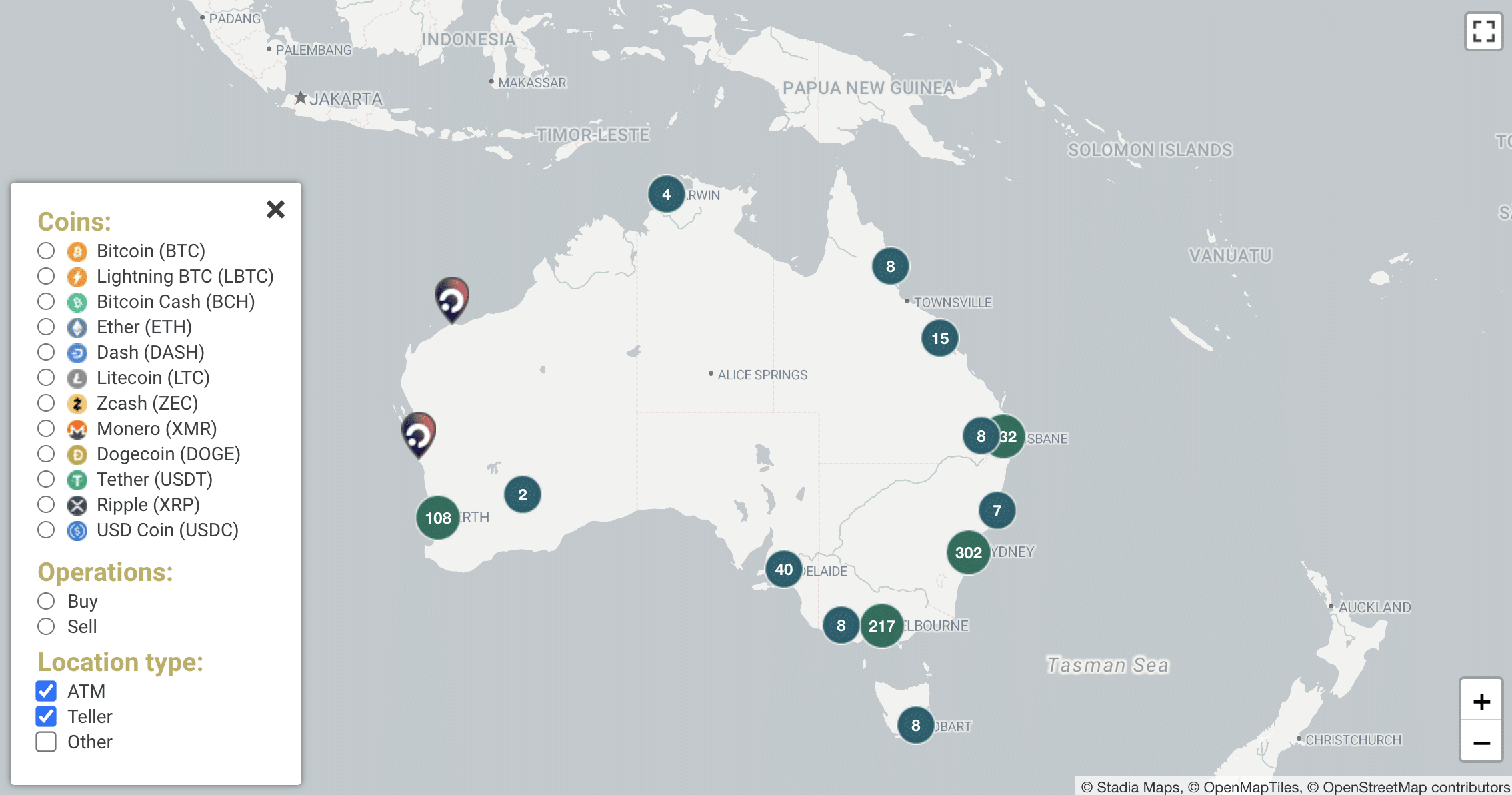

According to CoinATMRadar, there are more than 800 Bitcoin ATMs in Australia. This includes locations in Brisbane, Sydney, Melbourne, Darwin, and Perth.

Here’s how to buy crypto in Australia from a Bitcoin ATM:

- Step 1: Locate a Bitcoin ATM: First, you’ll need to locate a Bitcoin ATM. Although you might be tempted to choose the nearest ATM, you should also consider fees.

- Step 2: Choose Purchase Amount: Once you’re at the ATM location, type in the amount of Bitcoin you want to buy. Each ATM will come with a minimum purchase amount, often around $50.

- Step 3: Insert Cash: Next, you’ll be asked to insert cash to pay for the Bitcoin purchase. This needs to be AUD notes, as Bitcoin ATMs don’t accept coins.

- Step 4: Claim Bitcoin: Some Bitcoin ATMs will ask for your wallet address. In this instance, you’d need a mobile wallet with a QR code feature. That said, some ATMs print a receipt that explains how to claim the Bitcoins from any wallet.

You might also be asked for some ID when using a Bitcoin ATM. This will likely depend on the investment size.

Pros and Cons of Using a Bitcoin ATM

The pros and cons of buying Bitcoin from a crypto ATM are summarized below:

Pros

- Buy Bitcoin with cash

- More than 800 Bitcoin ATMs throughout Australia

- The investment process takes under two minutes

- Bitcoin ATMs usually support other popular cryptocurrencies

- Small investment amounts might not require ID

Cons

- Bitcoin ATM fees are huge – often at least 10-20%

- You’ll need a wallet to claim the Bitcoins

- KYC might be required on larger purchases

- You can only use cash – debit/credit cards aren’t accepted

- Getting hold of customer support can be challenging

How to Find a Crypto ATM in Australia

CoinATMRadar is the easiest way to find Bitcoin ATMs in Australia.

First, choose your preferred city. For instance, selecting Melbourne brings up 181 different ATM locations. Next, type in the desired investment amount. This will remove ATMs that aren’t suitable.

You can then click on the ‘Details’ button for additional information about each Bitcoin ATM. Importantly, you’ll be able to see what fees are charged and how the Bitcoins are delivered.

Just remember, while Bitcoin ATMs are usually located inside stores, they’re provided by third parties. This means the store location won’t be able to assist if you have any issues. Instead, you’d need to call the Bitcoin ATM provider yourself.

Buy Bitcoin Through Your Bank

Buying Bitcoin through traditional banking methods is the easiest way to enter the market. However, not all Australian banks are crypto-friendly. What’s more, you’ll need to consider fees, safety, and account minimums.

Read on to find out what your options are.

Are Australian Banks Crypto-Friendly?

There are an increasing number of reports about Australian retail banks blocking cryptocurrency transactions.

For example, CommonWealth Bank announced in mid-2023 that it would block transactions to ‘high-risk exchanges’. Similarly, Westpac has since banned transactions with Binance – the world’s largest exchange for trading volume. Even when transactions are approved, some Australians report waiting times of several days.

Nonetheless, we found that Revolut is a crypto-friendly option. After all, Revolut allows users to buy and sell crypto directly on its app. However, Revolut isn’t regulated in the same way as traditional banks, so you won’t get the same consumer protections.

Buy Bitcoin with Credit Card in Australia

Most crypto exchanges support credit card purchases. This will either be facilitated directly by the exchange or through third-party processors. Either way, you’ll need to complete a KYC process before you can use a credit card. This shouldn’t take you more than a few minutes to complete, as KYC procedures are typically automated.

That said, you’ll need to consider fees when buying Bitcoin with a credit card. For a start, Bitcoin exchanges usually charge a 3-5% fee on card purchases. Moreover, credit card companies often classify crypto purchases as ‘cash advances’. This means you’ll pay an extra 3-5%, and interest kicks in immediately.

Australians should also consider the added risks of buying Bitcoin with a credit card.

- For example, suppose you buy $2,000 worth of Bitcoin when it’s worth $60,000.

- You receive your credit card statement a month later. Bitcoin is now worth just $30,000, a decline of 50%.

- This means you’ll need to pay the full $2,000, even though the value of your Bitcoin investment has dropped to $1,000.

Alternatively, if you don’t pay the statement balance in full, you’ll begin paying interest on your Bitcoin investment. This is in addition to the cash advance fee and trading commissions we mentioned above.

Buy Bitcoin with Debit Card in Australia

A more sensible option is to use a debit card to buy Bitcoin. This is because you’ll be using your own money to invest. Irrespective of what happens to the Bitcoin price, you won’t owe money to a credit card company.

Furthermore, you’ll avoid paying cash advance fees, let alone interest payments. Most Bitcoin exchanges accept debit cards issued by Visa and MasterCard.

Buy Bitcoin with PayPal in Australia

PayPal is another option when exploring where to buy Bitcoin in Australia. While PayPal itself doesn’t offer its Bitcoin services to Australian traders, some online exchanges accept PayPal deposits and withdrawals. This offers a fast and secure way to fund your Bitcoin investments.

Pros and Cons of Using Banking Methods

Consider the following benefits and drawbacks before using banking methods to buy Bitcoin in Australia:

Pros

- Typically one of the fastest ways to buy Bitcoin

- Once approved, the payment should be processed instantly

- Some exchanges directly support AUD – so no FX fees

- Ideal for making recurring Bitcoin investments

- Bitcoin profits can be withdrawn to your bank account

Cons

- Some Australian banks block crypto-related transactions

- Increased reports of long approval times when using crypto exchanges

- Credit card purchases attract cash advance fees and interest

- Exchanges charge an average fee of 3-5% on debit/credit cards

- KYC will be required before you can make a purchase

Buy Bitcoin Through a P2P Exchange

Peer-to-peer (P2P) exchanges are increasingly becoming popular with Australian investors. This is especially the case now that some Australian banks are restricting crypto-related activities.

P2P exchanges allow you to buy Bitcoin directly from a seller that’s based in Australia. Not only does this mean you can use AUD but you can choose from a range of local payment methods. This often includes instant bank transfers and e-wallets.

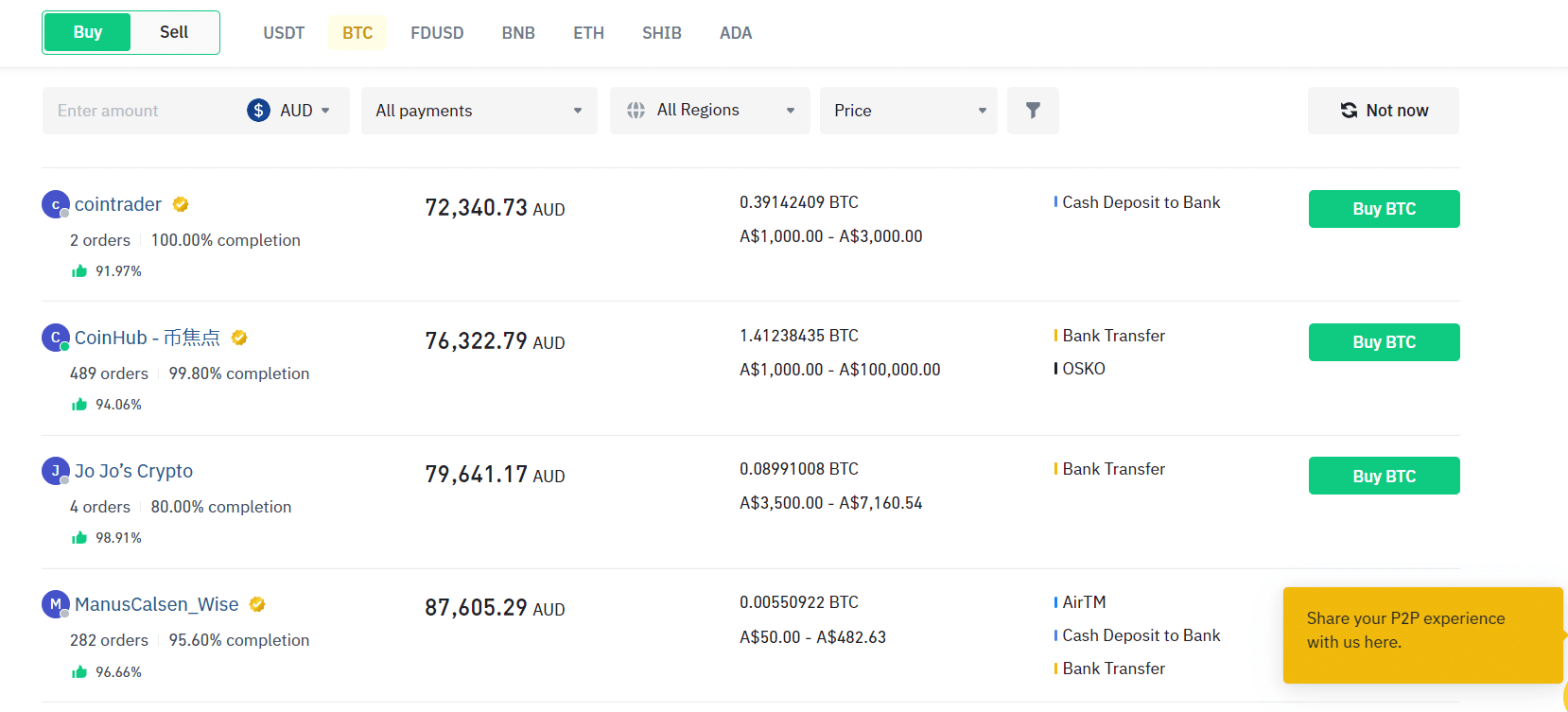

The best P2P crypto exchanges use an escrow system to keep buyers and sellers safe. After confirming a deal, the seller transfers their Bitcoins into the exchange’s escrow wallet. They remain there until the buyer completes the payment. The Bitcoins are only released once the seller confirms the received the funds.

P2P trades are usually completed in minutes. After all, if sellers take too long to confirm payments, they’ll receive a negative rating.

Here’s how to buy Bitcoin in Australia with a P2P exchange. We’re using Binance for this tutorial, but many other options exist.

- Step 1: Open a Binance Account: You’ll need an account with Binance before accessing its P2P exchange. This requires an email address, cell phone number, and password.

- Step 2: Complete KYC: All P2P traders are required to have a verified Binance account. This ensures that buyers and sellers can trade safely. Upload a government-issued ID to complete the KYC process.

- Step 3: Set P2P Parameters: Next, hover your mouse over ‘Trade’ and click on ‘P2P’. Make sure ‘Buy’ is selected. Choose ‘Bitcoin’ as the investment coin. Select ‘AUD’ as the payment currency. Type in the amount of Bitcoin you want to buy. If you have a preferred payment method in mind, select this from the drop-down list.

- Step 4: Review P2P Sellers: Binance will now display a list of sellers that meet your requirements. Not only in terms of payment methods but the investment amount. Sellers are listed based on the exchange rate available. This is set individually by each seller. Not only do you want the best-priced seller but also one with a good reputation. This means an extended track record, positive feedback, and fast release times.

- Step 5: Complete Payment: Once you’ve chosen a seller, a new deal will open. The seller will send a message with their payment details. Don’t transfer the money until Binance confirms the Bitcoins have been added to its escrow wallet. If you need more information from the seller, send a message. Mark the payment as complete once you’ve made the transfer. It’s also worth sending a copy of the payment. slip.

- Step 6: Receive Bitcoin: After the seller confirms the payment has been received, Binance will release the Bitcoins from the escrow wallet. You’ll then find them in your Binance account.

We’d suggest withdrawing the Bitcoins to a private wallet, rather than leaving them on Binance. This will give you full control of your Bitcoins.

Pros and Cons of Using P2P Exchanges

P2P exchanges come with several pros and cons, which we’ve summarized below:

Pros

- Buy Bitcoin directly from sellers in Australia

- Sellers need to deposit Bitcoin into an escrow wallet for safety

- P2P trades can be completed in under five minutes

- Choose from a range of convenient payment methods

- Your bank won’t know the transfer is related to crypto

Cons

- Many P2P sellers set unfavorable exchange rates

- The Bitcoins won’t be released until the payment is confirmed by the seller

- Payment disputes can take several weeks to resolve

- The seller might ask for additional KYC documents

How We Chose Australia’s Best Places to Buy Bitcoin

We employed a strict methodology when choosing the best places to buy Bitcoin in Australia. The most important metrics we focused on are detailed below:

- Safety and Security: We initially assessed Bitcoin providers based on safety levels. Factors included licensing, reputation in the public domain, and account security. We looked for safety features like biometrics, 2 or 3-factor authentication, MPC technology, and SSL encryption. Ultimately, safety is the most important part of the methodology.

- Fees: We also assessed fees for each Bitcoin investment method. This included deposit fees when using fiat money, trading commissions, and withdrawals. We found that crypto exchanges offer the lowest fees. In contrast, Bitcoin ATMs were the most expensive option.

- Supported Coins: Some investors like to buy Bitcoin and other cryptocurrencies. Therefore, we evaluated what other coins were supported by each investment method. MEXC, for example, offers hundreds of other cryptocurrencies. P2P exchanges, however, typically only support Bitcoin, Ethereum, and Tether.

- Interest Potential: Another important metric is the ability to earn interest on a Bitcoin investment. We prioritized providers that offer Bitcoin savings accounts with competitive APYs. However, this isn’t always an option, especially when using a Bitcoin ATM or a P2P exchange.

- Payment Methods: First-time investors need to buy Bitcoin with fiat money. We covered providers supporting a range of methods, including debit/credit cards, bank transfers, and e-wallets. Bitcoin ATMs were included to cover investors who prefer using cash.

What Australians Need to Know Before Buying BTC

Australians should make the following considerations before investing in Bitcoin:

- Volatility: While Bitcoin has produced huge returns since launching in 2009, it’s a volatile asset. Prices can rise and fall sharply – often without any justification. Since its inception, Bitcoin has moved in extended bull and bear cycles. Seasoned investors will hold onto their Bitcoins long-term, subsequently ignoring short-term pricing trends.

- Financial Risks: Put simply, you could lose some or even all your investment when buying Bitcoin. Nobody knows what the future holds; Bitcoin is still an emerging asset class. Risk-averse investors should avoid investing more than 5-10% of their portfolio into cryptocurrencies.

- Operational Risks: Operational risks should also be considered. Avoid using an unregulated Bitcoin exchange or an unknown wallet provider. Make sure you keep your private keys and backup passphrases safe when storing Bitcoin. Your Bitcoins will be compromised if these details get into the wrong hands.

- Crypto Tax: Similar to other assets, Australians must pay tax on realized crypto profits. It’s best to hold for at least 12 months; you’ll get a 50% discount on capital gains tax. Moreover, any income made on Bitcoin – such as savings accounts, will be taxed as income. Always keep your crypto taxes in order; penalties can be implemented if you fail to pay what’s owed on time.

- Regulatory Developments: It’s crucial to stay abreast of key market developments. Not only in Australia but globally. Just like other trading markets, news can impact the price of Bitcoin. Always be informed so that you can act accordingly.

Next Steps After Buying Bitcoin

After you’ve bought Bitcoin, you’ll need to think about the next steps. For a start, you should avoid keeping your Bitcoins on an exchange. This removes the third-party risk associated with hacks and internal malpractice. Keeping your Bitcoins in a private wallet is the best option. Go with a self-custody wallet; only you will have control of the Bitcoins.

This means you can store and transfer funds without needing permission from a third party. That said, make sure you understand how private keys and backup passphrases work. These should be stored safely. You can remove the threat of being hacked by writing your wallet credentials on a sheet of paper, and keeping it in a private and secure location.

At some stage, you might want to cash out your Bitcoin investment. This can be done 24 hours per day, 7 days per week. Use an online exchange that supports AUD payments. You can transfer the Bitcoins to the exchange, swap them for AUD, and then make a withdrawal to your bank account. Another option is to sell the Bitcoins to a local seller on a P2P platform.

Conclusion – Why Should Australians Buy Bitcoin?

While a lot riskier than traditional investments, Bitcoin remains one of the best-performing assets. Consider that the ASX 200 has increased by just 25% in the prior five years. Over the same period, Bitcoin increased by more than 1,200%.

There are many ways for beginners to enter this high-growth market. The easiest and most cost-effective option is to use a reputable Bitcoin exchange like MEXC. In doing so, you can buy Bitcoin in Australia instantly with a Visa or MasterCard.

References

- https://www.theguardian.com/technology/2023/oct/16/crypto-currency-reforms-australia-treasurer-jim-chalmers-cryptocurrency

- https://www.austrac.gov.au/business/legislation/amlctf-act

- https://www.oaic.gov.au/privacy/privacy-legislation/related-legislation/anti-money-laundering

- https://www.bloomberg.com/news/articles/2023-07-17/australian-lender-nab-blocks-some-payments-to-high-risk-crypto-exchanges

- https://www.afr.com/technology/cba-bans-crypto-payments-as-us-led-crackdown-spreads-20230608-p5df0w

- https://www.theguardian.com/business/2023/may/18/westpac-bans-transfers-to-worlds-largest-crypto-exchange-binance

- https://www.ato.gov.au/individuals-and-families/investments-and-assets/capital-gains-tax/calculating-your-cgt

Buy Bitcoin Australia 2024 FAQs

What is the cheapest way to buy Bitcoin in Australia?

The cheapest way to buy Bitcoin in Australia is by using a crypto exchange. Reputable exchanges like MEXC and OKX charge Bitcoin trading commissions of just 0.1%.

How much Bitcoin should I buy to start?

Bitcoin remains a risky and speculative asset, so only invest what you can afford to lose. Most exchanges allow you to buy Bitcoin from just $50 – sometimes less.

How much will I get if I put AU$1 into Bitcoin?

Based on current prices, an AU$1 investment in Bitcoin would get you 0.000015 BTC.

Is it still worth putting money into Bitcoin?

Bitcoin is still an emerging asset with huge growth potential. If you’re yet to gain exposure to Bitcoin, you’re not too late.

How do you cash out Bitcoin?

You can cash out a Bitcoin investment with a crypto exchange that supports AUD. Transfer your Bitcoins to the exchange and cash out via a bank transfer.

Is it safe to invest in Bitcoin?

In general, it’s safe to invest in Bitcoin. However, make sure you’re using a reputable exchange and a secure wallet, and that you’re aware of the financial risks.

What can I buy with Bitcoin in Australia?

Bitcoin adoption is yet to reach day-to-day spending in Australia. That said, Australians can use Bitcoin at many online retailers, including Microsoft, Ralph Lauren, and Adidas.

How to buy Bitcoin in Australia with Commonwealth Bank?

Commonwealth Bank has previously stated it blocks crypto transactions from ‘high-risk exchanges’. That said, you should be able to use your card with regulated exchanges that are approved in Australia.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman