This is Why Dogecoin is Better than ‘Altcoins-Degenerators’

While large majority of the altcoins are being on a straight-down path, a coin that was made as a joke and seemingly has had no recent major development is proving store of value (SoV) properties.

Popular crypto researcher and analyst Willy Woo posted both on Twitter and website his opinion on the type of altcoins of interest to investors. Regardless how nuanced altcoins are, manifesting as protocol coins, utility tokens, security tokens, and non-fungible tokens, the only two types that are of relevance to an investor are: Oscillators and Degenerators.

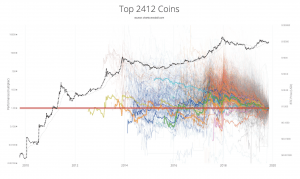

To show both types, Woo provided a chart of the market.

However, the great majority of all altcoins are Degenerators, says Woo. “Their price chart has a measurable half-life, like radioactive decay. Plotted on a log chart, it’s a straight line down,” he explains, providing Namecoin (NMC) as an example.

On the other hand, there are only a few Oscillators, and one of the most surprising examples is Dogecoin (DOGE), initially made as a joke and now ranked 30th by its market capitalization (USD 326 million). How is a coin an Oscillator, I hear you ask. Woo says that Oscillators are proving SoV properties. “To qualify,” he adds, the coins “need to keep up with Bitcoin (BTC)/USD gains.” In order to find oscillators, plot a coin’s BTC value. It must oscillate around a horizontal line, for at least one full bull-bear cycle, which is around four years, but more than one cycle is better, the analyst explains.

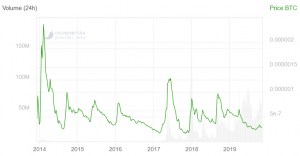

DOGE/BTC chart:

One doesn’t need innovation and cutting edge technology to build value in their coin, says Woo. “These are monetary instruments, they build value with economic network effects.” He finds Dogecoin as an example of an altcoin with no particularly significant technology or smart contracts, nor has it solved some of the major issues in the crypto and blockchain world. If we look at its GitHub, we see the last activity recorded 5 months ago.

However, the researcher believes that Dogecoin achieved SoV due to the Lindy Effect. The Lindy Effect is one of the more interesting things you’ll come across in your daily life wherever you turn. It basically means that future life expectancy of a non-perishable thing is proportional to its current age – its mortality rate decreases with time. So, if a technology is six years old, like DOGE is, it’s expected to last six more. Next year it’ll be seven years old, and if the effect persists, its life expectancy will be that much longer. “An oscillator can always breakdown. Due to Lindy Effect, it becomes harder the longer it stays an oscillator,” Woo writes.

Furthermore, DOGE is listed on nearly all exchanges, it’s supported by most wallets, and it has a liquid market, says Woo.

Top 10 DOGE markets:

Another example Woo gave is DCR/BTC, which he finds to be at a critical stage as it’s about to complete its first full bull-bear cycle. “It needs to emerge cleanly holding its horizontal oscillation against BTC. Only then can we say it’s achieving SoV properties.”

On a question if all this means that all stablecoins are Degens, which would lead to a conclusion that all Fiat currencies are too, Woo replied with “Correct.”

Finally, Woo offered advice on owning altcoins:

At pixel time (16:06 UTC), DOGE trades at c. USD 0.00267, and is up by 2% in the past 24 hours, by 1.5% in the past week and by almost 15% in the past month. The price is still 26% lower than a year ago.

On October 24th, cryptocurrency exchange Binance.US started trading for DOGE, while Binance listed it back in July, which was followed by a price explosion.

{no_ads}