10 Ways to Earn Free Crypto in 2024

Whoever said there’s no such thing as a free lunch hadn’t discovered crypto yet. From crypto faucets to crypto airdrops, there are free crypto tokens falling out of the sky. Some ways to get free crypto may involve a bit of work, though. Others may require some risk capital. In this guide, we’ll detail the 10 best ways to earn free crypto and how you can get in on the action.

We’ll also compare the pros and cons of each free-crypto strategy as well as how much you can earn and how much effort is required to earn free cryptocurrency. Let’s learn how to earn free crypto in 2024.

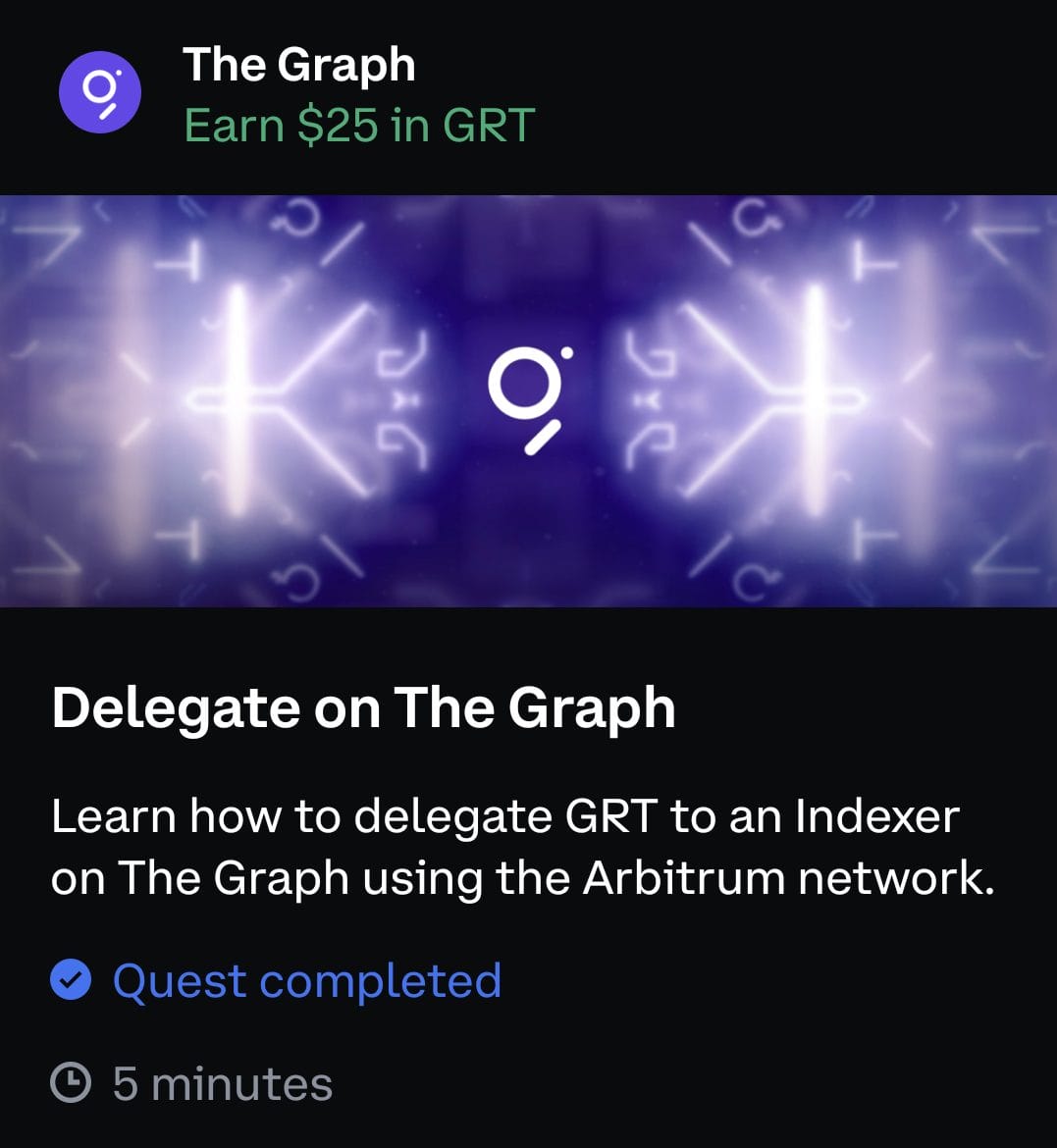

1) Learn and Earn Free Crypto

Get paid to learn about new cryptocurrencies (including other digital assets like NFTs) or protocols. Pass a quiz and earn free crypto. If you don’t pass, you can keep trying until you do. For example, Coinbase offers a Learn and Earn program and also offers Learn and Earn through Coinbase Wallet “quests” on occasion.

Some rewards are worth only a few dollars, while others can be worth up to $25 or more. The example below shows a Learn and Earn opportunity available through Coinbase Wallet. This gives users the opportunity to earn cryptocurrency rewards via staking.

- Earning potential: Limited. Learn and Earn offers like those from Coinbase are promotional. They help create awareness of new chains or protocols, and new Learn and Earn opportunities occur sporadically.

- How often can you earn: Every few months, on average. Most Learn and Earn tokens only give one-time rewards, but a different offer may become available in a month or two.

- Return on Investment: No investment is needed. Read a few paragraphs and pass a quiz to earn crypto.

- Risk Level: None. There’s nothing to lose because you’re not investing money. However, “quests” may require on-chain transactions that require network fees.

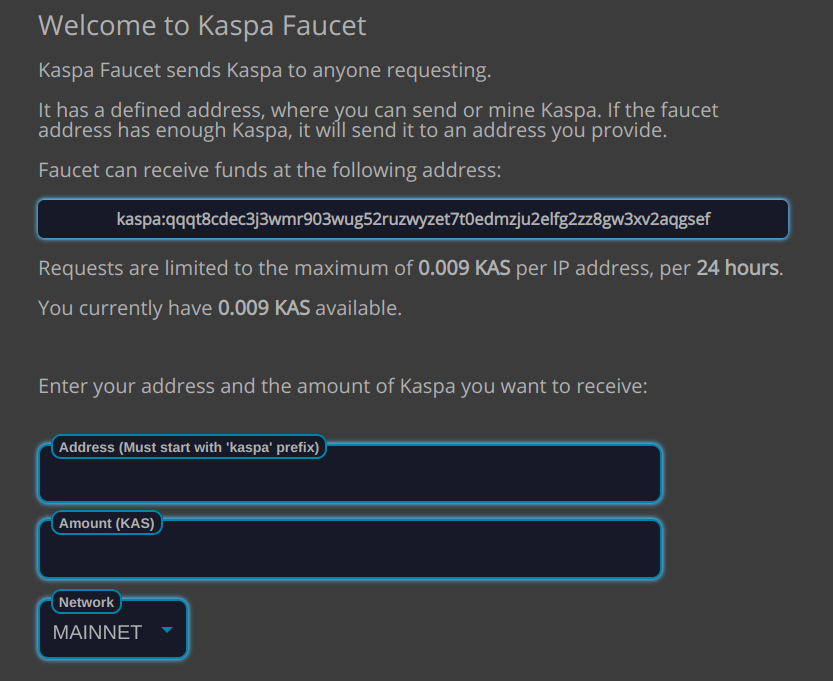

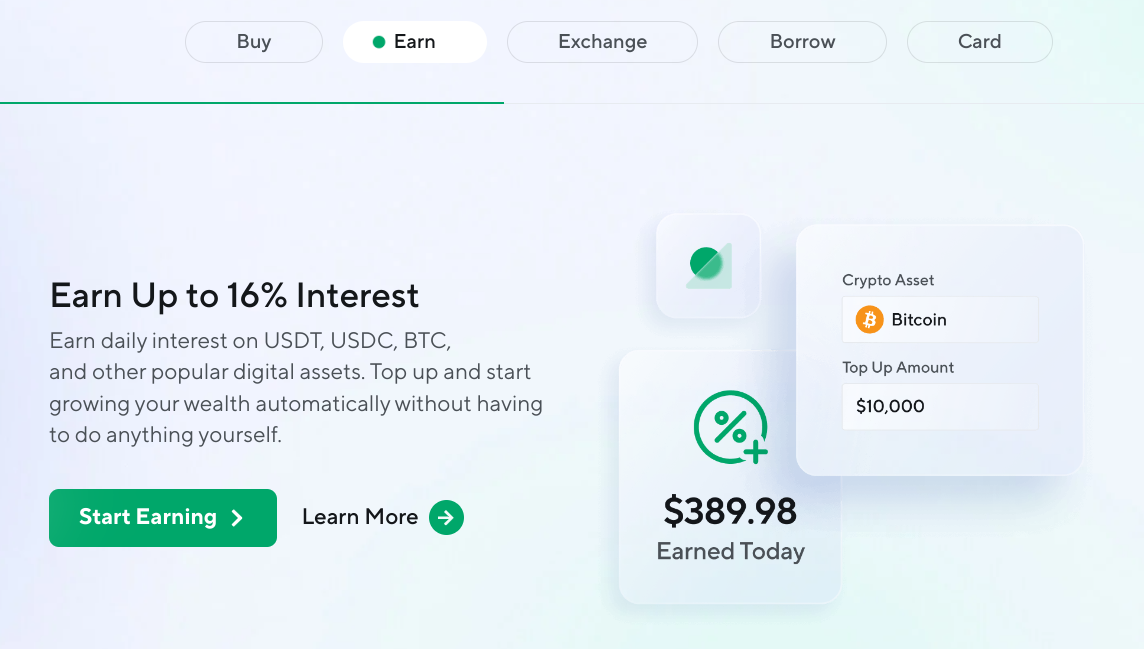

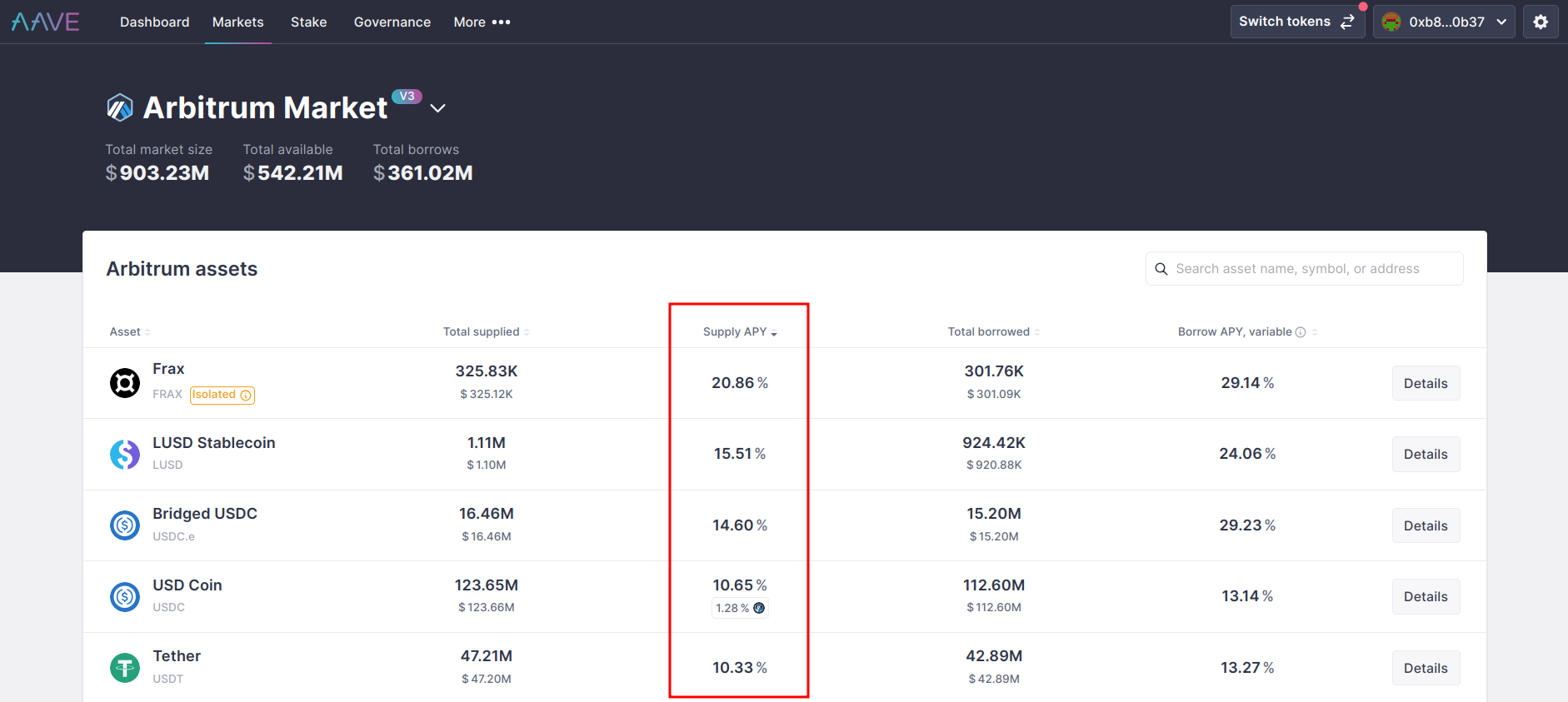

Pros Cons Airdrops are another promotional tool used by crypto projects to generate buzz and awareness. However, this one often requires a bit more work and some capital. Qualifying for crypto airdrops typically requires on-chain activity, such as using DeFi protocols or staking. In March 2023, the Arbitrum blockchain airdropped $120 million worth of ARB tokens to active users on the blockchain. Qualified wallet addresses could then claim the airdropped tokens through a portal. Many qualified for activities they were doing anyway. Pros Cons Staking, in this sense, refers to using your crypto as a form of collateral to help ensure proper validation of blockchain transactions. By locking your crypto in a staking contract, you earn staking rewards paid in the same cryptocurrency. Crypto staking platforms like Binance make this easy, but you need some capital to get started. Typical staking yields run in the 3% to 5% range, although some blockchains offer higher yields. Pros Cons Crypto faucets are portals where you can get free crypto. Think of a leaky faucet that drips one drop at a time. Crypto faucets work in a similar way, giving just a drop, but all those drops can add up over time. In some cases, you may have to complete simple tasks, such as the Learn and Earn programs we discussed earlier. In other cases, you have to wait a certain amount of time to be eligible for the next free crypto drop. Pros Cons Arguably, Axie Infinity (AXS) brought play-to-earn games to the forefront. But the genre has evolved, and now you can earn crypto and NFTs on more advanced platforms like Star Atlas (ATLAS) and Gods Unchained (GODS). By playing these games, you can earn tokens or NFTs while you progress through the game. Some play-to-earn games even have in-game economies where you can provide services to earn crypto. Pros Cons Much like traditional savings accounts, crypto savings accounts pay a yield on deposits. In many cases, these yields come from lending, which we’ll cover in more detail later. The distinction here is that crypto savings accounts are easier to use. You deposit your crypto, and the platform pays a yield. Often, this yield is paid in the same crypto you deposit. However, platforms like Nexo, shown below, may pay higher yields if you choose to take your payment in the platform token. Pros Cons Crypto exchanges want your business, so much so that they’re willing to pay you to join. There’s a catch, though. Often, you’ll have to deposit a trade a certain amount to qualify for the spiff. Payouts can also vary. For example, crypto exchange Coinbase advertises up to $200 for new users. To participate, sign up, verify your identity, and then “spin the wheel,” much like a game show. In other cases, exchanges might offer a simpler sign-up bonus with a fixed amount of free cryptocurrency for each new account. Pros Cons Earlier, we discussed crypto savings accounts, which often use lending to earn free crypto. However, you can venture further into lending with decentralized finance (DeFi) lending platforms. In this case, you’re not depositing funds with an exchange. Instead, deposit funds into a lending pool using smart contracts. DeFi lending platforms like Aave connect lenders and borrowers with stablecoins (valued at $1) often paying the highest yields. Finding 100% plus yields isn’t difficult, but you may need to use less-proven crypto lending platforms. Pros Cons Refer a friend, your social media followers, or website visitors to earn free crypto. As a caveat, some programs pay in traditional fiat currencies. However, you can use the USD, GBP, or AUD they pay to buy (free) crypto. Referral programs may be simple, in which you use a special link to invite others and then collect a referral reward. They can also be more complex, requiring verified follower counts or website traffic. Either way, there are plenty of crypto referral and affiliate programs available. Pros Cons Much like rewards credit cards, a few platforms offer rewards in the shape of crypto rewards cards. Earn free crypto for everyday purchases. This one has a catch as well but comes with an easy workaround. In many jurisdictions, paying with crypto is a taxable event. The IRS treats it as the disposal of an asset. Simply put, you probably don’t want to buy a pack of gum with your bitcoins just to earn rewards. Instead, you can fund your account cash and earn crypto rewards everywhere you use your card. For example, Coinbase pays up to 3% in free crypto rewards and lets you choose a new reward each month. Pros Cons However, strategies like play-to-earn and airdrop hunting can require much more effort and do not guarantee a meaningful return. However, if things go your way, the payouts can be much larger compared to passive strategies. Consider how much time and effort (and money) you want to commit before you choose a strategy to earn free crypto. Airdrops provide the most profit potential but can require a lot of work and speculative investment. By comparison, DeFi lending and crypto savings accounts offer steady passive income. However, the crypto space brings risks as well. Do your research before investing any money or providing any information online.

Crypto referral rewards offer one way to earn free crypto without making an investment. Alternatively, a crypto rewards debit card pays crypto rewards for everyday purchases with no additional investment required. You can consider crypto referral bonuses as rewards. As you build your balance over time, you can use those rewards to explore other profitable strategies like crypto lending or airdrop hunting that require some seed money. The easiest and likely the safest to earn free crypto is with a crypto rewards debit card. With a provider like Coinbase, you can fund your card in USD, then transfer crypto, limiting your risk to the amount you’ve used to fund your card. Coinbase offers four ways to earn free crypto rewards. New users can earn up to $200 in cash or Bitcoin to sign up. Coinbase’s Learn and Earn provides crypto rewards for passing simple quizzes about crypto projects. Coinbase also offers a crypto rewards debit card. Lastly, Coinbase provides a crypto staking service to earn a yield for staking assets like ETH.

2) Claim Airdrops

3) Crypto Staking

4) Crypto Faucets

5) Play-to-Earn Games

6) Crypto Savings Accounts

7) Exchange Sign-Up Offers

8) Crypto Lending

9) Referrals

10) Crypto Credit Card Rewards

How to Avoid Free Crypto Scams

Crypto has its share of shady characters and outright scams, but there are ways to avoid scams and reduce risks.

Is Earning Free Crypto Worth The Effort?

Learning how to earn free crypto isn’t difficult, but depending on which method you choose, you might have some work ahead of you such as preparing for added income tax or completing multiple tasks to become eligible for airdrops. Easier methods include debit card rewards, crypto lending, and crypto staking. With debit card rewards, you usually just need to fund your account and choose a reward. Lending and staking usually just require a few clicks, although you need to buy some crypto to get started.Conclusion

We just covered ten ways to earn free crypto, some of which are easy and some that require a bit more effort. Paydays for free crypto range from a few cents at a time up to hundreds or even thousands of dollars.FAQs

How do you earn cryptocurrency without investment?

How do you make money in crypto without money?

What is the best way to earn crypto for free?

How do you earn free crypto like on Coinbase?

References

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell