Wirex CEO Says Money Mules Are a Massive Issue in FinTech and Crypto

In an insightful interview with Cryptonews, Pavel Matveev, CEO and co-founder of popular global digital payment platform Wirex, discussed what money mules are and how big of a problem they pose in the crypto and FinTech industries. The short answer is: big.

He further told us how these fraudsters sell real challenger banks’ accounts on the dark web, how Wirex finds them, and what a solution to this issue may be.

Matveev also briefly touched on the incoming bull market and Wirex’s plans for this year.

This is what he told us.

What’s a Money Mule in Crypto?

Money mules are a widespread issue in FinTech and banking. And Matveev told Cryptonews that this problem overlaps with crypto.

Money mules are usually young people, typically between 18 and 22. They have valid documents, including an ID and proof of residence.

Criminals who aim to commit money laundering hire these young individuals to commit fraud and/or cycle money through accounts open in FinTech companies.

Most of the time, money mules know what they’re doing. But they do it anyway:

“maybe because they’re young, or maybe because they need money, or maybe because they just don’t understand consequences.”

It rarely happens that they are unknowingly pulled into criminal activities, becoming victims themselves.

That said, challenger banks, such as Revolut, N26, and Wise, remain their main targets. However, Matveev said,

“We have reached a point in the industry where a lot of FinTech companies have crypto, in one form or another.”

Therefore, it’s unsurprising that money mules have made their way into this novel industry as well.

However, money mules can’t ‘do their business’ in crypto alone: there is always a connection with fiat. They need to exchange it at some point.

That said, Wirex’s CEO argued that this problem doesn’t get much attention in crypto.

“The crypto industry doesn’t really care much about money mules at this point of time [though] it’s an urgent issue in FinTech.”

Since Wirex is both a challenger bank and a crypto business, money mules are a pressing issue.

Scammers Sell Real Accounts on the Dark Web

Nobody knows how many money mules there are out there.

The major problem is that they are real people with real IDs. They provide all the necessary documentation and pass all the checks.

“That’s why it’s very difficult to catch them. They look like real customers with real intentions. So that’s one of the challenges for the industry.”

Wirex, on its side, employed several tools to research the dark web. This is where real accounts are offered for sale.

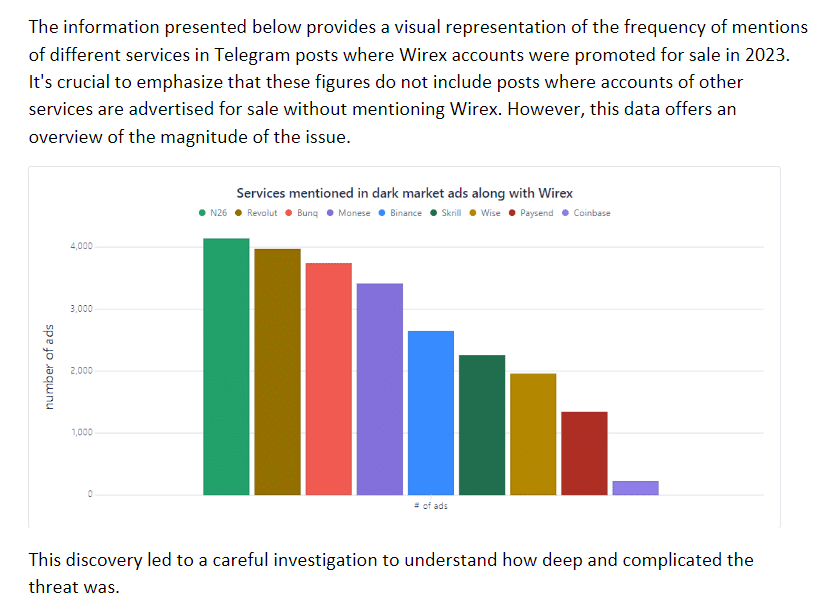

Wirex found accounts made with them, as well as with Revolut, Crypto.com, Coinbase, and others. They all have a high number of ads selling new accounts published on the dark web.

Therefore, scanning the dark web for Wirex mentions is one of the tools the company employs.

The team also conducted a few tests: they contacted sellers to buy accounts. This enabled them to examine the account, its origin, the user’s country, time of registration, and other details. These details allow them to look for similar risky accounts and patterns.

Meanwhile, users in the 18-22 age group are considered risky customers that require more checks.

Moreover, the company does transaction monitoring.

One Money Mule = Multiple Accounts on Multiple Platforms

Money mule movements are interconnected. They jump between different accounts on different platforms. This means that one person can create several accounts to be misused.

This is not one company’s problem but an industry-wide issue. Therefore, Meteev said,

“We, as an industry, need to fight money mules collectively.”

There is no way to control or censor the dark web, but it’s necessary to raise awareness about money mules and continue developing multiple tools to monitor the dark web activity.

Furthermore, tests are necessary to understand where these accounts are coming from.

Subsequently, companies should share the data they gather to prevent the same people from creating multiple accounts across multiple platforms.

It’s impossible to eliminate FinTech money mules completely, but “it will be good to develop an industry-wide approach and a framework.”

Response to COCA MPC Wallet & Card is ‘Very Positive’

In January this year, Wirex partnered with COCA to launch a Multi-Party Computation (MPC) wallet and a non-custodial debit card.

The product has a zero-fee policy. Asked how that approach is profitable, Wirex’s CEO said that COCA is a relatively young company and is currently focused on user growth rather than margin.

He opined that,

“At some point, they will probably find a way to monetize the client base, either through membership or maybe through selling additional services or something like that.”

It has been a month since the wallet and card were announced, and per Matveev, the response has been “very, very good” and “very positive.”

He stressed that the application is designed for non-crypto-native audiences and the mass market.

The main value proposition is that users control their money without counterparty risk.

“If something happens with your card, it gets lost, stolen, VISA or the card issuer disappears, you still own your money. You still control your money.”

Additionally, the wallet allows users to interact with dapps, trade on DEXes, buy NFTs, spend funds, and more.

Given that crypto still needs to be converted to fiat to be spent, the combination of wallet and card is attractive to the mass market.

Matveev told us that the integrated IBAN feature will be available by the end of the first quarter. It will enable FinTech users to conduct Euro transactions and access banking services.

Entering the Bull Market

Matveev noted that the recently approved spot Bitcoin exchange-traded funds (ETFs) were “a bit overhyped” and were already priced in. However, in the mid-to-long run, they will be “a great gateway for institutional money.” Ethereum ETFs will be the next big milestone.

Moreover, Matveev explained that we are entering another crypto bull market. Every four years, crypto sees a new cycle, “almost like the Olympics.”

We are seeing many altcoins’ prices increasing, and “it’s just the beginning.” Per Wirex’s CEO,

“That’s the best, the most exciting time in the industry.”

Wirex has “a lot of things” in the pipeline for this year. In terms of a product set, he said, the company is working on Wirex Business. Currently, the product is similar to a challenger bank for retail customers. But the company plans to expand the product set to businesses, including crypto companies, offering them access to Wirex’s banking and card infrastructure, as well as cryptocurrencies.

Any enterprise will be able to open an account on Wirex Business where they can issue cards for employees or subcontractors. The banking infrastructure and cards can be used to pay bills, invoices, and other expenses.