Crypto Market Sentiment Improved For The Third Week in A Row

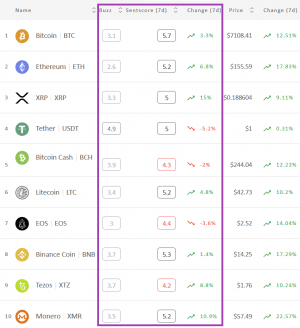

The market sentiment is on the rise. While the week starting with March 16, which followed the market plunge, saw a six-month low of 4.21, we’re now seeing the market sentiment go up for the third week. The combined moving average 7-day market sentiment measure, sentscore, for the top 10 coins, is now 4.95, compared to last Monday’s 4.73/10, as calculated by crypto market sentiment analysis service Omenics.

Though three out of the top ten coins are red today, unlike the all-green picture we saw a week ago, the improvements are still noticeable. Seven out of the ten are also graded 5 or above, and while we still don’t have any coins in the positive zone, we no longer have any in the negative zone either, as Tezos (XTZ) entered the neutral zone as well. World’s number one coin, Bitcoin (BTC), also went up, from a score of 5.5 to that of 5.7.

The 24-hour picture looks promising as we’re finally seeing Bitcoin back in the positive zone again, with a sentscore of 6.2. The coins above 5 went further up, but so did the three with the grade of 4. Besides BTC, XRP is also showing a significant difference between its 7-day score of 5 and the 24-score of 5.7. The total sentscore for the top 10 coins in the 24 hour period is 5.3/10.

Sentiment change among the top 10 coins in the past week*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive

Identifying winners and losers is easy this week. Among the green seven, there are two with a double digit rise: XRP with 15% and Monero (XMR) with 10.9%. XRP’s strongest aspects are news (5.9) and social (5.5), followed by technicals (4.7) and fundamentals (4.4), while its weakest aspect is buzz (3.3). Similarly, Monero’s highest score is the positive 7 that the coin got in news, while its lowest is the negative 3.5 it got in buzz. Between these two, it got 5 in technicals, while its fundamentals and social are rated 4.6 each.

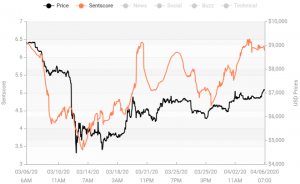

Daily Bitcoin sentscore change in the past month:

Meanwhile, the three red coins are this week’s losers by default. These are Tether (USDT), EOS, and Bitcoin Cash (BCH), respectively. Tether has a high score of 7.4/10 in news, but its other scores are much lower. These are: 4.9 in social and buzz, 4.5 in technicals, and 3.4 in fundamentals. The second-placed EOS has a positive score in news (6.7), neutral scores in social and technicals (4.2 and 4.1, respectively), as well as negative scores in buzz and fundamentals (3 and 2.9, respectively). Lastly, BCH has scores closer to each other. It received 5.6 in news, as well as 4.5 in technicals, closely followed by 4.4 in social, and it also has two negative scores: 3.9 in buzz and 2.8 in fundamentals.

Zooming out to observe the seven-day performance of the other 29 coins tracked by Omenics, majority of them are green, and though eleven are red compared to last week’s four, five coins have sentscores above 5 compared to last week’s one, and five are in the negative zone compared to last week’s seven.

___

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 39 cryptocurrencies.