Bitcoin Outperformed by Ethereum But Still Has More Holders Profiting

Even though bitcoin (BTC) was outperformed by several major coins in the past year, including ethereum (ETH), there are still more BTC holders ‘in the money.’

This information is provided by the set of tools, developed by blockchain analytics firm Into The Block. Among the top 10 coins by market capitalization, it is available for seven coins: BTC, ETH, tether (USDT), bitcoin cash (BCH), chainlink (LINK), litecoin (LTC), and bitcoin SV (BSV).

One of the first things that can be noted in this top 10 category over the course of the past year is that three coins have outperformed BTC’s 41% increase – LINK with 350%, ETH with 125%, and binance coin (BNB) with 61% (at UTC 10:25). This list is a lot longer when we move in the top 20 and top 50 categories.

Out of these three BTC-outperformers, as noted above, the blockchain analysis tool is currently available for two of them – and bitcoin has more holders in the money than either LINK or ETH.

As a reminder, per Into The Block, holders that have a positive difference between the purchase price and current price are said to be “in the money,” when there is no difference, the holder is defined to be “at the money,” and the holders at a loss are “out of the money.”

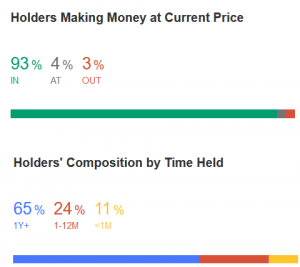

Bitcoin

At the time of writing, a whopping 93% of the wallet addresses on the network are making money, according to Into The Block’s tool, which shows that these addresses are in the green on their fiat balance. 4% are at the money, and only 3% are at a loss.

65% are holding their BTC more than a year, while 24% holds it between 1 and 12 months. Interestingly, 11% are newcomers, so to say, holding the coin less than a month. 10% of the holders are “large,” that is, they own more than 1% of all circulating coins.

At the time of writing, BTC’s price was USD 13,117. It appreciated 1% in a day and 14% in a week.

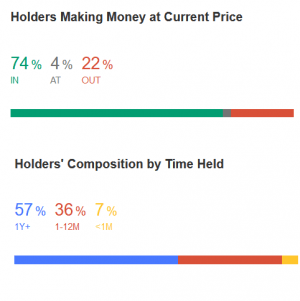

Ethereum

The second coin by market capitalization has 74% of the wallet addresses making money. Like BTC, 4% are at the money, and it has 22% at a loss.

57% are holding ETH more than a year, 36% between 1 and 12 months, and 7% less than a month. 41% of the holders own more than 1% of all circulating coins.

The price of ETH remained unchanged in a day, and it increased 8% in a week to the current price of USD 407.

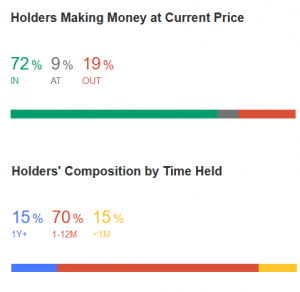

Chainlink

LINK is the second coin whose price has massively outperformed that of BTC. It has a high percentage of holders profiting at the moment, 72%, compared to the 19% of them who are not.

Large majority of the LINK holders have the coin in their wallets for less than a year, while the remaining 30% are evenly distributed between the time periods of more than a year and less than a month. Furthermore, LINK has the highest percentage of whales, with 82% being defined as large holders.

Its price has dropped 1.5% in a day and went up more than 12% in a week, reaching the current USD 12.1.

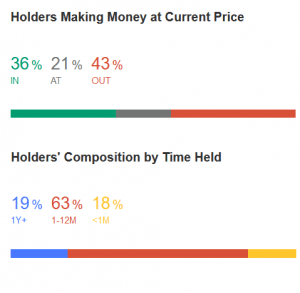

Tether

Moving to the only stablecoin on this list, we see that a larger percentage of its holders are actually at loss, according to the tool – 43%. Conversely, 36% are in the money, and 21% at the money.

Similarly to chainlink, larger majority of tether holders, 63% of them, have the coin in their hands for up to a year. The remaining holders are almost evenly divided between more than a year and less than a month. Still, the whale concentration is relatively larger, with 35% of the holders said to be “large.”

Bitcoin Cash

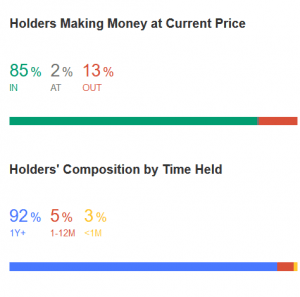

Like bitcoin from which it forked and, as we’ll see, like bitcoin SV which forked from it, bitcoin cash has a high percentage of holders currently in the green: 85%. Meanwhile, only 13% are standing at the opposite side.

Additionally, 92% have been holders for more than 12 months, while 30% of all holders are ‘large.’

BCH’s current price is USD 267. It dropped less than 1% in a day, and it appreciated more than 8% in a week.

Litecoin

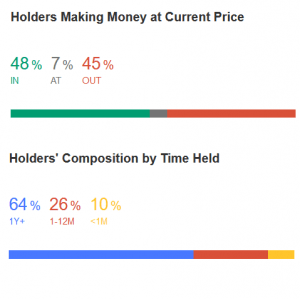

48% of litecoin holders are making money at current prices, according to the tool, but nearly that amount – 45% – are at a loss.

Most are holding their LTC for more than a year, making 64% of the total number. Furthermore, 48% are defined as large holders.

LTC is trading at the price of nearly USD 58, after it increased 1.5% in a day and 22.3% in a week.

Bitcoin SV

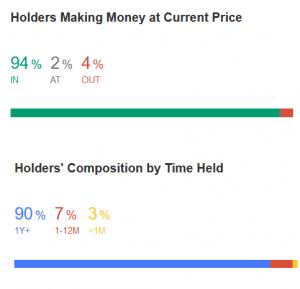

When it comes to the last coin on this list, a whopping 94% of the wallet addresses are making money. 2% are at the money, and only 4% are at a loss.

90% are said to be holding it for more than a year. Additionally, 28% of the holders are defined as whales.

BSV’s price is USD 180, having gone up 3.3% in a day and nearly 13% in a week.

__

Learn more:

Interest In Bitcoin Spikes as PayPal, JPMorgan, and Kanye West Praise BTC

The US Election: Pullback Possible, But Neither Trump Nor Biden Won’t Stop Bitcoin

‘Bitcoin on Track for USD 100,000 in 2025’ – Bloomberg Intelligence

Bitcoin Is Better Than Ethereum At These Four Things