Bitcoin On Course For Best Quarter Since Early 2021, Here’s What Q2 Could Hold for the BTC Price

Bitcoin, the world’s first and largest cryptocurrency by market capitalization, is about to close out its best quarter in exactly two years.

Assuming Bitcoin is able to close Friday’s session at or above current levels in the $28,200s, the cryptocurrency would have gained a massive 70% since the start of the year.

Back in Q1 2021, Bitcoin doubled in price from slightly above current levels to close to $59,000. Indeed, the end of Q1 2021 marked Bitcoin’s best-ever quarterly closing level.

Bitcoin’s sudden return to form in 2023 comes amid a more favorable macro backdrop.

Fed tightening bets have eased in recent weeks amid concerns about weakness in the bank sector, which has itself also spurred a safe-haven bid for “hard money” like precious metals and proven cryptocurrencies like Bitcoin (which many refer to as digital gold).

Bitcoin’s 2023 rally has also likely been driven by mean reversion and improvements in Bitcoin’s on-chain health – various technical and on-chain indicators have been flashing in the last few months that Bitcoin had become oversold last year and that the bear market bottom is now likely in.

Read More:

- Widely Followed Suite of Bitcoin On-chain Metrics Flash Bullish as BTC Price Holds Above $28,000 Post-Fed – Where Next?

- Bitcoin Adds Nearly 1 Million Non-Zero Addresses in Under 1 Month – What Positive On-chain Trends Mean for the BTC Price

- On-chain Indicators Scream Bitcoin Bull Market as the BTC Price Roars Back

With the world’s largest cryptocurrency having defied the bears in Q1 2023, investors are wondering what Q2 might hold for Bitcoin.

Things have been looking good for the medium-term technical outlook since Bitcoin’s hugely important bounce from its 200-Day Moving Average and Realised Price under $20,000 earlier this month, which also happened to coincide with another retest of the downtrend from the Q4 2021 and end-Q1 2022 highs.

All of Bitcoin’s major moving averages point higher and all have crossed each other in a bullish fashion – the 21DMA is above the 50DMA, which is above the 100DMA, which is above the 200DMA).

That means the door appears to be open for a rally above $30,000 in Q2 and a retest of the key $32,500-$33,000 resistance area.

But as all traders know, technicals aren’t everything in markets. A number of important fundamental themes are likely to have a big impact on Bitcoin’s price in Q2. Let’s take a look at the most important themes.

Will the Bank Crisis Worsen and Spur Fresh Safe-haven Demand for Bitcoin?

In wake of mini-bank runs as a result of concerns about poor balance sheet management, three crypto/tech/start-up friendly banks (Silvergate, SVB and Signature Bank) collapsed or were shuttered by regulators earlier this month.

This sparked concerns about a broader US (and global) bank crisis that could threaten the entire financial system.

For now, the response from policymakers has prevented a broader bank run on US financial institutions – authorities ensured that all depositors at these three banks didn’t lose any funds, reassuring deposits at other banks, going above and beyond the Federal Deposit Insurance Fund’s usual $250,000 per account protection pledge.

Moreover, authorities introduced new liquidity programs to ease balance sheet pressures being felt at other vulnerable banks, as well as bolstering USD liquidity swap programs with other major central banks.

Those liquidity programs mean that the Fed’s balance sheet has shot up from under $8.35 trillion in early March to nearly $8.75 trillion as of the end of March.

That’s approximately $400 million in liquidity injections, undoing the liquidity withdrawals of the last four months that saw the Fed allowing $95 billion per month in treasuries and mortgage-backed securities to roll of its balance sheet without reinvestment.

Elsewhere, a consortium of large US banks even came together to help rescue vulnerable bank First Republic, injecting it with $30 billion in deposits.

While concerns about a full-blown banking crisis have eased somewhat this week, helped also by an agreed buyout of SVB’s assets, the situation remains fragile and, for now, Bitcoin is retaining its “safe-haven” bid.

Bitcoin is viewed by its proponents and many investors as a secure alternative to fiat currency, which is not deemed as 100% safe stored at a bank thanks to the fractional reserve banking system.

If Q2 sees a resurfacing of bank crisis concerns, this should underpin the Bitcoin price, even if a proactive response from policymakers continues to keep a lid on things and fend off a full-blow financial crisis.

Will the Fed Keep Tightening and Could This Derail the Bitcoin Bulls?

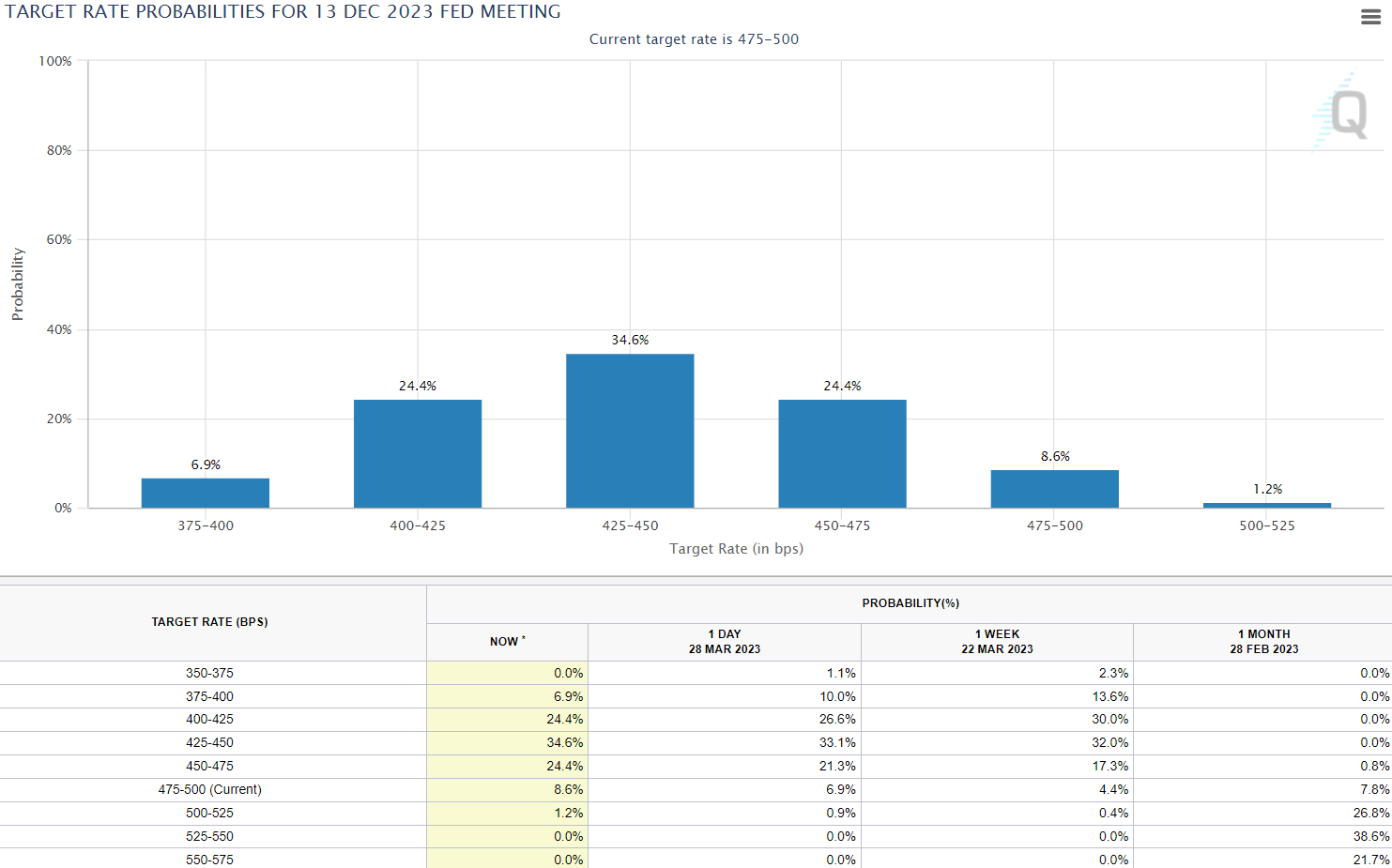

Less than one month ago, US money markets participants were pricing in a strong likelihood that the US Federal Reserve lifts interest rates to around or above 5.5% by the end of Q2.

In wake of the emergence of bank crisis concerns, those tightening expectations have seen a massive drop.

Alongside safe-haven demand for hard currency, easing tightening bets has been an important tailwind for Bitcoin, which tends to perform better when financial conditions ease.

According to the CME’s Fed Watch Tool, which provides implied probabilities as to where the Fed’s interest rate might be in the future based on money market pricing, the Fed’s tightening cycle is now most likely over.

What’s more, an aggressive tightening cycle is now being priced in, with money market’s betting rates will drop to the low-4.0% area by December, versus expectations one month ago that rates would still be in the mid-5.0% area.

The Fed last week lifted interest rates by 25 bps to a 4.75-5.0% range.

The narrative driving the aggressive repricing appears to be that 1) further tightening would increase the risk that the bank crisis worsens and 2) that the US will likely enter a recession later this year as banks pull back on lending and focus on strengthening their balance sheets.

Both of these are seen as strongly deflationary, meaning that markets appear to have come to the conclusion that US inflation (which remains well above the Fed’s target) will drop rapidly later this year, giving the Fed room to cut interest rates.

While money markets might well be right to bet on an aggressive incoming rate-cutting cycle, there is no guarantee things go down this way.

Various inflation metrics surprised to the upside in Q1 2023 and the US economy, particularly its labor market, remains remarkably resilient.

If that remains the case in Q2, money markets may have to pare their bets on Fed interest rate cuts.

That could be a headwind for Bitcoin and the broader crypto market.

Conversely, if the lagged effects of 2022’s aggressive tightening finally start to result in labor market weakness and inflation resumes its downward trend, this could further feed into rate-cut bets, adding further fuel to the Bitcoin bull market.

US Crypto Crackdown Broadens as SEC and CFTC Battle For Regulatory Authority

Crypto regulation in the US (and elsewhere) could be a key to price action in Q2. In the US, regulatory agencies including the US Securities and Exchange Commission (SEC) and Commodity Futures and Trading Commission (CFTC) have been going after major centralized crypto players.

Last week the SEC issued a Wells Notice to Coinbase warning the crypto exchange that it is facing a lawsuit over 1) its various staking programs (which the SEC thinks of as unregistered securities) and 2) its listing of tokens, some of which the SEC deemed to be securities, meaning Coinbase would then be an unregistered securities exchange.

Elsewhere, the SEC’s ongoing lawsuit versus Ripple, the creator of XRP and the XRP Ledger, may come to a head next quarter – XRP has been rallying recently on optimism that the SEC will lose its bid to label XRP as an unregistered security issued by Ripple.

Meanwhile, the CFTC announced this week that it is going after Binance over operating under-the-table as an unregistered US digital commodity exchange and having a sham AML/KYC compliance program.

Those are just a few of the highest-profile cases, but they demonstrate how, in 2023, US authorities are seeking to leave their mark on the crypto market via regulation via enforcement.

The two cases also highlight a clash of visions between the SEC and CFTC. The former has stated it views nearly all cryptocurrencies as securities.

The latter deems many as commodities. Indeed, in its latest lawsuit versus Binance, it named Bitcoin, Ether, Litecoin, Tether and Binance USD as commodities.

The SEC has labeled Binance USD as a security in a lawsuit against its issuer Paxos, and has hinted that it views other stablecoins and Ether as securities as well.

How the SEC vs CFTC Battle Could Impact Crypto/Bitcoin

In the crypto space, it is broadly viewed as positive if the CFTC’s viewpoint wins and broadly viewed as negative is the SEC’s vision wins, as the latter would mean a much more arduous regulatory regime, as well as a mountain of potential fines and penalties for industry players over past discretions.

More specifically, if the SEC’s argument of most cryptocurrencies being securities gains ground, this is seen as likely throttling the development of the crypto industry in the US.

It would likely also result in a big increase in barriers to investment in crypto for US-based retail traders and institutions.

That would be a catastrophe for cryptocurrencies labeled as a security, or at risk of being labeled. But the impact on Bitcoin is unclear.

Counterintuitively, it could benefit Bitcoin if there is a substantial flight to haven within the crypto space, with Bitcoin the only cryptocurrency the SEC has outright said it does not view as a security.

Traders will be closely monitoring an appearance by SEC Chair Gary Gensler before Congress on the 19th of April for any more guidance on the SEC’s regulatory plans for the crypto sector.

Can the Asia Adoption Narrative Gain Further Ground?

Other regulation-related themes to monitor include the policy pivot being seen in Hong Kong.

Earlier this quarter, Hong Kong announced that it would be making certain blue-chip cryptocurrencies legal to trade once again, and announced a new licensing regime for crypto firms.

Crypto investors viewed this as the China government, who directs policy in Hong Kong, “testing the waters” for a potential reintroduction of crypto in China.

Crypto was banned outright in China in September 2021 and legalization, even of only a small number of well-known cryptocurrencies, could spark huge investment inflows.

Further signs of China’s growing interest in a return to the global crypto market could thus provide a strong tailwind to Bitcoin in the coming quarter as traders front-run expected Chinese inflows.

Meanwhile, another regulatory story to watch is the progress of regulation in the UK and Europe. The UK has stated a desire to become a major global crypto hub, while lawmakers in the EU and currently debating the bloc’s Markets in Crypto Assets (MiCA) bill.